Record Exports & Strong Crush, But Trade Eyes U.S. Acres

Market Analysis

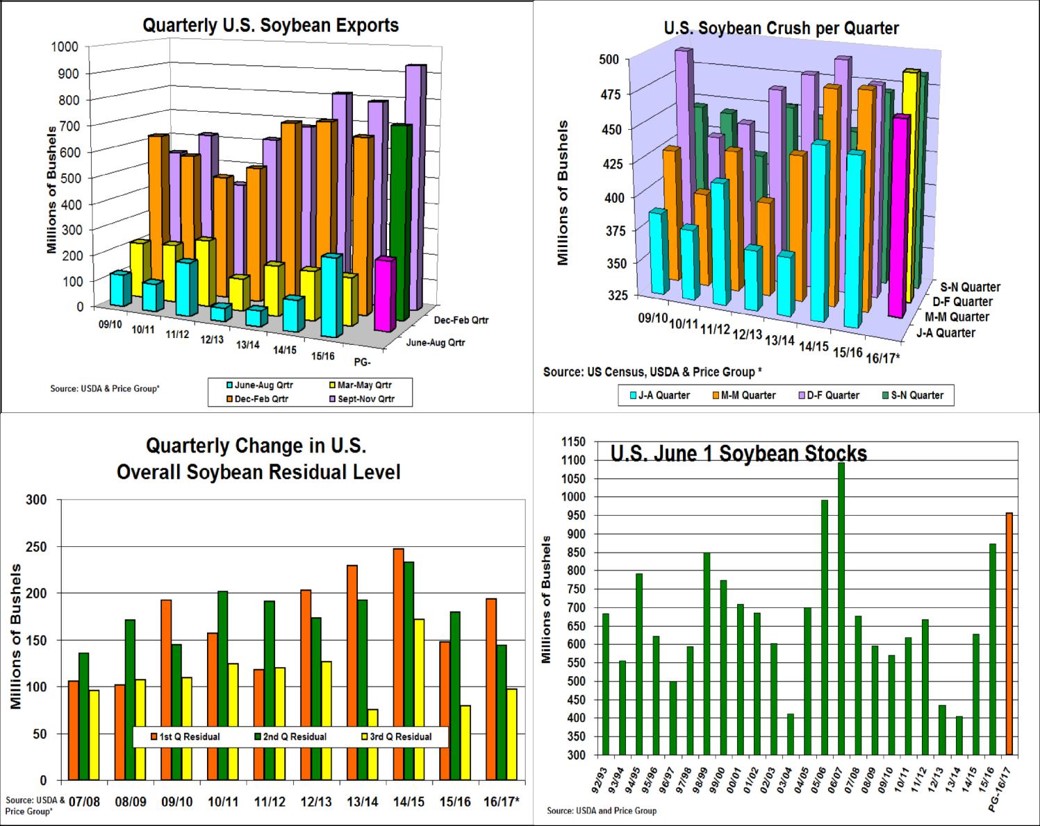

The USDA reduced its 2016/17 U.S. soybean crush by 15 million bu. after some recent disappointing monthly outputs and they left their export outlook unchanged for the seventh month in a row on their June supply/demand revisions. What does this mean for the upcoming June 30 US soybean quarterly stocks report?

After a record 1.659 billion bu. in first half shipments, U.S. soybean exports this past spring quarter continued their record pace with another 260 million bu. moving through our ports and rail shipments to foreign buyers. With only 131 million bu. of shipments needed to achieve the USDA’s 2.050 billion bu. forecast over the final 13 weeks of the crop year, this year’s exports may still be 25 -35 million bu. too low.

May’s U.S. (NOPA) processing pace was higher than expected at 149.25 million by about 5 million bu., but this spring’s total quarterly crush of 468 million bu. was 17 million bu. lower than 2015/16’s 3rd quarter usage. This advanced this year’s processing level to 1.444 billion bu., only 6 million higher than first 9 month of 2016/17’s crushing pace. To reach the USDA’s recently reduced crush forecast, this summer’s demand needs to be similar to this past quarter’s processing pace vs. a seasonal dip that normally occurs during the summer months.

After last fall’s record export program, December’s stocks revealed a residual disappearance of 194 million bu. that were in transit; not counted in either our on-farm or warehouse counting systems. This spring’s (March) unexplained usage declined to 144 million bu. as a portion of our traditional seed bean movement from producer's bins to commercial seed facilities occurred over the winter. With another 50 million of this movement occurring during this past quarter, June’s residual is likely to be about 95 million, which would place soybeans’ June 1 stocks at 957 million bu.

(Click on image to enlarge)

What’s Ahead

The upcoming June 30 stocks report will show strong soybean disappearance during the first 9 months of the crop year. However, the USDA’s acreage update will likely garner more trade attention along with 2017’s growing season weather, particular during August when the US bean yield is normally determined.

Continue to utilize SX rallies in the $9.50-$9.60 range to have 35-45% of 2017/18 crop marketed.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more