Quiet Friday

Very little to say about Friday's action; tight intraday spread on low volume was not going to send the world alight. The only index to post a modest gain was the Semiconductor Index.

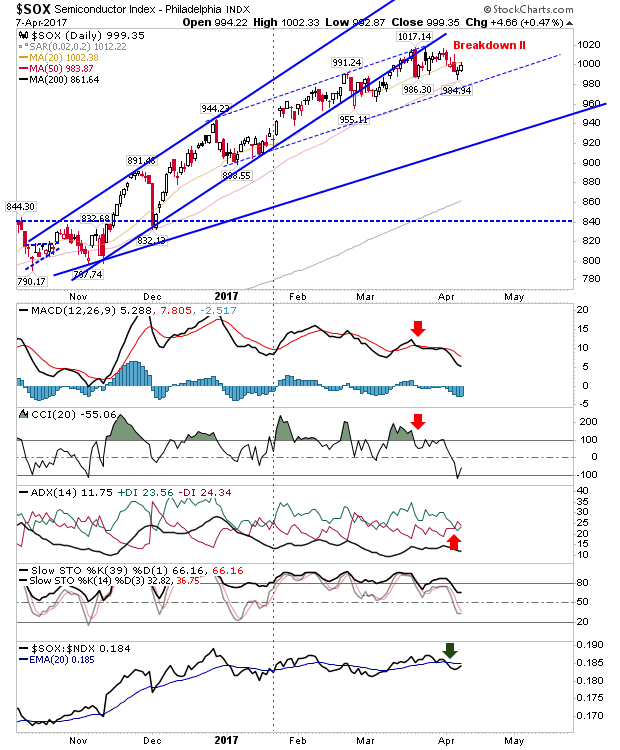

The Semiconductor Index rallied from a minor support level marked by the big-one day loss in March (with a low of 986), but the rally was made away from channel support and never challenged the 20-day MA.

The Nasdaq 100 is lingering near its 20-day MA with resistance at 5,440 just over 20 points away. Gains in the Semiconductor Index didn't make their way to the Nasdaq 100, but it wouldn't take much to repeat another breakout as was mounted last week.

The S&P is setting up a swing trade. A second narrow trade range offers a chance for a breakout/breakdown on a loss of Friday's high and low. The presence of the 50-day MA suggests a rally is favoured, but don't discount the alternative (as the counter move is likely to prove stronger if the index breaks below the 50-day MA).

The Russell 2000 is hanging on to its 50-day MA after the index retained Thursday's gain. Technicals are poor, with the MACD trigger perhaps the best opportunity for a recovery. If the Nasdaq (Nasdaq 100) is able to breakout then Value buyers may begin fishing for opportunities in the Russell 2000 and component stocks.

Longer term, the Transport index is again feeling the pressure as it loses ground against the Dow Jones Industrial action. As a weekly chart it's a slow burner, but the relationship is a long way from the highs of 2014 and this is not a good sign.

Closer to home, breadth metrics are on the rise for the NYSE, which should see higher prices in the near term (again, favouring the long side of the market).

Momentum traders keep an eye on the Nasdaq 100, Value traders on the Russell 2000. If longs get a positive start with a gap higher at the open, then a positive week could ensue. However, if indices open flat and the Nasdaq 100 drifts below its 20-day MA, then another round of profit taking could emerge - much as it did on March 21st.

Disclosure: None.