Quick Take: Traders Take A Step Back

The focal point in the markets this morning appears to be the potential for tax reform and some new developments in the French election.

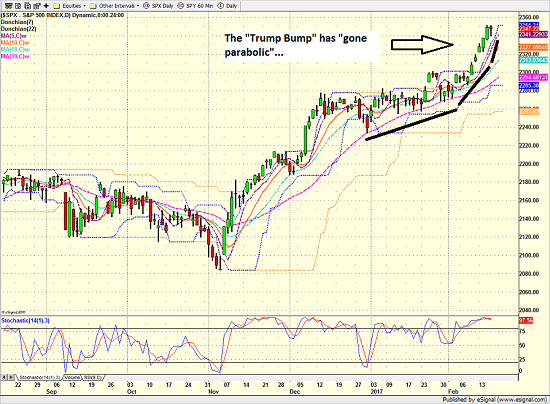

As far as the “Trump Bump” is concerned, there can be no denying that the current rally has run a long way in a very short period of time. For example, stocks have put in the equivalent of an above-average calendar-year return on the S&P 500 in a little over three months. In short, this is what an overbought condition looks like.

S&P 500 – Daily

(Click on image to enlarge)

So, with a long weekend ahead, traders may be reassessing both the probability and perhaps more importantly, the timing of the “massive” tax plan currently being hatched by the White House.

The latest development here is yesterday’s comment that health care must be dealt with before tax reform. As such, traders may decide to take a step back from the frenetic pace of buying seen over the past couple weeks.

Looking across the pond, there appears to be a new twist in the French election. According to Bloomberg, “Socialist Party presidential candidate Benoit Hamon said he’s in talks with far-left candidate Jean-Luc Melenchon about the prospect of uniting the left by establishing a single candidacy for the election. Polls suggest that such a move could leave the run-off vote potentially between far-right Marine Le Pen and a strongly leftist candidate, neither of which would be viewed as a good outcome for markets.” In response, French bonds are taking a hit.

But in our opinion, while the movement toward political populism is likely to be felt across the continent in 2017, it is unlikely to reach any sort of “crisis” level for the stock market.

The Bottom Line: At this point, stocks are overbought and sentiment has reached an extreme, which creates a condition that tends to lead to a garden-variety pullback. But with lots of folks having missed out on the post-election surge, we will be watching to see the veracity of the dip-buying that occurs if prices dip a couple percent or so.

Thought For The Day:

“The art of investing is not as much about developing indicators as it is about knowing which ones to watch at the appropriate time.” – Ned Davis

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any ...

more