QE Unwind Not Happening

The Fed’s balance sheet needs to be studied extensively because of the unique policies the Fed has put in place in the past few years. The difference between what’s likely to happen and what’s expected to happen is getting larger as we approach Trump’s presidency. It’s going to be interesting to see when this difference plays itself out. The economic data worsening, the quarter point rate hike in December, or one of Trump’s initial policies may be the catalyst for the market to realize the situation at hand.

The differentiation I’m referring to is the market’s assumption the Fed can raise interest rates and sell the $4.5 trillion in assets on its balance sheet as the economy improves under Trump even as we are due for a recession. I view the exact opposite policy as likely as I think the Fed will have to buy bonds to pay for any deficit spending. Trump‘s plans call for issuing debt with longer maturity dates which have higher interest rates. This excess spending will call on the Fed to foot the bill.

There is also a cognitive dissonance in the market. The market believes the Fed will coddle it by easing back at any sign of turmoil. Selling the assets and raising rates is what will cause the volatility in the first place, so how can the Fed protect the market from its own policies? If you logically extend the expectations of the market, there is the implicit guarantee the Fed will buy corporate bonds and stocks in the next recession. It’s as if the market only wants to recognize the possibility of there being another recession if it comes with stock buying. Only bullish scenarios are assumed to be possible.

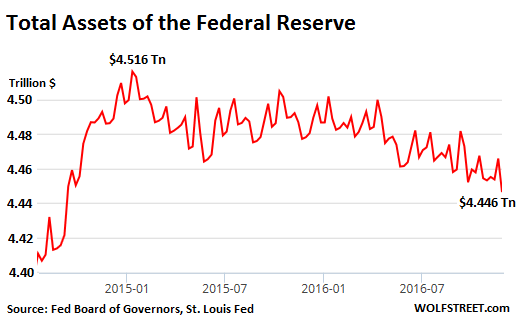

You may have seen the chart of the Fed’s balance sheet before. It’s been relatively steady for the past few quarters. I was reading an article on WolfStreet.com which zoomed in on the recent trends in the balance sheet. As you can see in the chart below, the balance sheet has shrunken 1.55% or $70 billion since the peak. Within the movement, mortgage backed security holdings fell $10 billion and federal agency debt securities fell $20 billion. Inflation indexed notes and bonds increased 8% to $106.7 billion. This makes sense because inflation has been creeping higher. The movement actually started before Trump even was elected, but has accelerated since then.

I think the article is mistaken to derive any implicit decision making for future policy initiatives based on these small changes. The end of the article points to hawkish language by a FOMC member. I can grab a quote from Yellen to support any point I want to make because the Fed has been both dovish and hawkish this year as it tries to placate the market every time it sells off. The point I am making is the Fed will not be unwinding its balance sheet without providing guidance. I think this would cause panic in the market if the pace of declines accelerated and there was no statement. The analogy to a punch bowl is often given. The Fed supposedly takes away the punch bowl before the party gets crazy. However, the party isn’t crazy and the market relies on the punch. I would instead describe the Fed normalizing policy as it taking away the oxygen in a room. The market would suffocate without the Fed.

The Fed’s decline in its balance sheet pale in comparison to the increases in the ECB and JCB balance sheet. The decision the ECB will make on whether to taper or continue quantitative easing in March will have much bigger implications on the market than any small vacillations in the Fed’s balance sheet. I treat all the central banks as one because of the interconnectedness of financial markets. I expect the ECB to keep going with this policy given the weakness in the Italian banking system and the continued political risk in 2017. The ECB won’t always be able to paper over political risk, but it won’t be for a lack of trying.

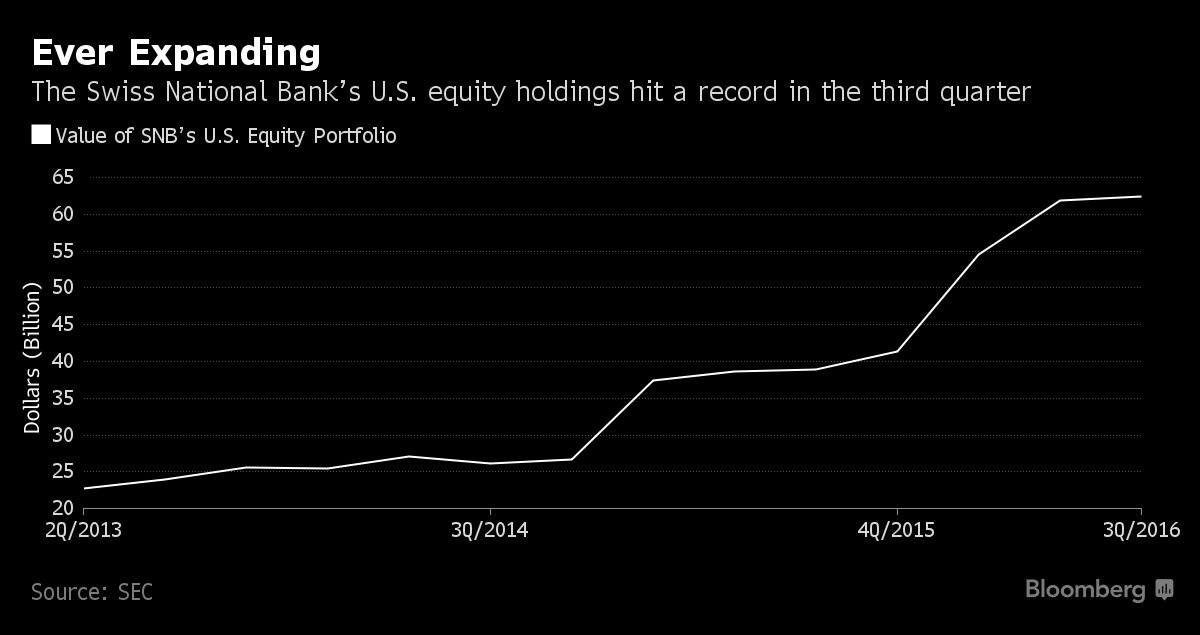

One way to look at the $70 billion decline in the Fed’s balance sheet is to compare it to the increase in the Swiss National Bank’s equity holdings. They almost match up. Some has claimed the SNB is a working in the Fed’s interest. I wouldn’t go that far. There’s no need to make claims which aren’t provable. It distracts from the fact that the central bank is inflating our stocks which could eventually cause a bigger bust in the end. It’s almost an act of economic war to inflate another nation’s equity market because of the negative effects a burst brings. I would consider it nefarious if every other central bank didn’t have the same policy. Therefore, I’d call it business as usual.

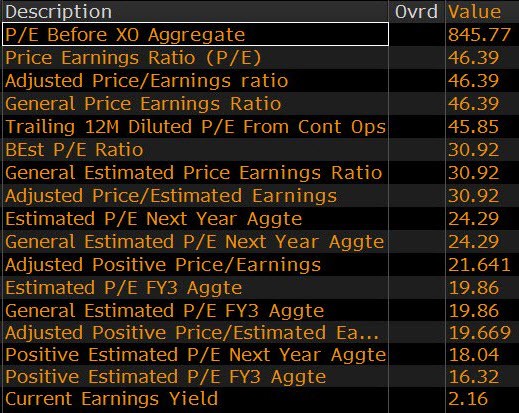

As I said, the SNB buying stocks can inflate bubbles, Lately the biggest bubble is in small cap stocks which have rallied almost 17% since November 3rd. The Russell 2000 is up almost 42% since the February lows. Given the lack of earnings growth, this has ballooned valuations. As you can see from the chart below, Bloomberg is showing extraordinary metrics. The 46 price to earnings ratio needs to go lower which can either come from stock declines, earnings increases, or both.

Conclusion

The fed is not secretly unwinding its balance sheet anytime soon. While I expect a rate hike in December and maybe one more in 2017, the Fed will need to institute QE4 if Trump plans to spend with reckless abandoned. If Trump’s stimulus falls short, it can lead to volatility in equities and declining inflation expectations. In that case the Fed would need to do QE4 to prop up the market. I see no scenario where the Fed sells assets. I can’t believe I must say this, but valuations matter even if it’s central banks who are causing these prices to occur. The gravity of valuations will still weigh on the Russell 2000 eventually, although it may take longer to fall than most bearish traders expect.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more