Q3 Earnings Were Hurt By Hurricanes

Q3 Earnings Update

This week is when earnings season starts to pick up as Netflix - NFLX headlines the reports. Up until this week, 28 companies in the S&P 500 have reported earnings. Considering the fact that earnings growth is only expected to be 2.1% according to FactSet’s numbers, looking at explanations for why the quarter was so bad makes sense. The chart below shows the reasons companies gave for why their earnings weren’t as strong as they could have been. The number one excuse companies gave was the hurricanes which supports the bullish narrative since they are one time events. PepsiCo said “We estimate the impact of the recent natural disasters to negatively impact EPS by approximately 3 percentage points, and we expect sequential improvement at our North American Beverage business.” Obviously, all companies will have different effects, but this report gives you the idea that earnings growth would have been in the mid single digits if it wasn’t for the storms.

The currency excuse is also temporary because the dollar index has fallen over the past 10 months. In the next two quarters, the index will be lapping the strong dollar which means there should be a positive tailwind. A few companies mentioned how FX issues could diminish or reverse to a positive in the future.

(Click on image to enlarge)

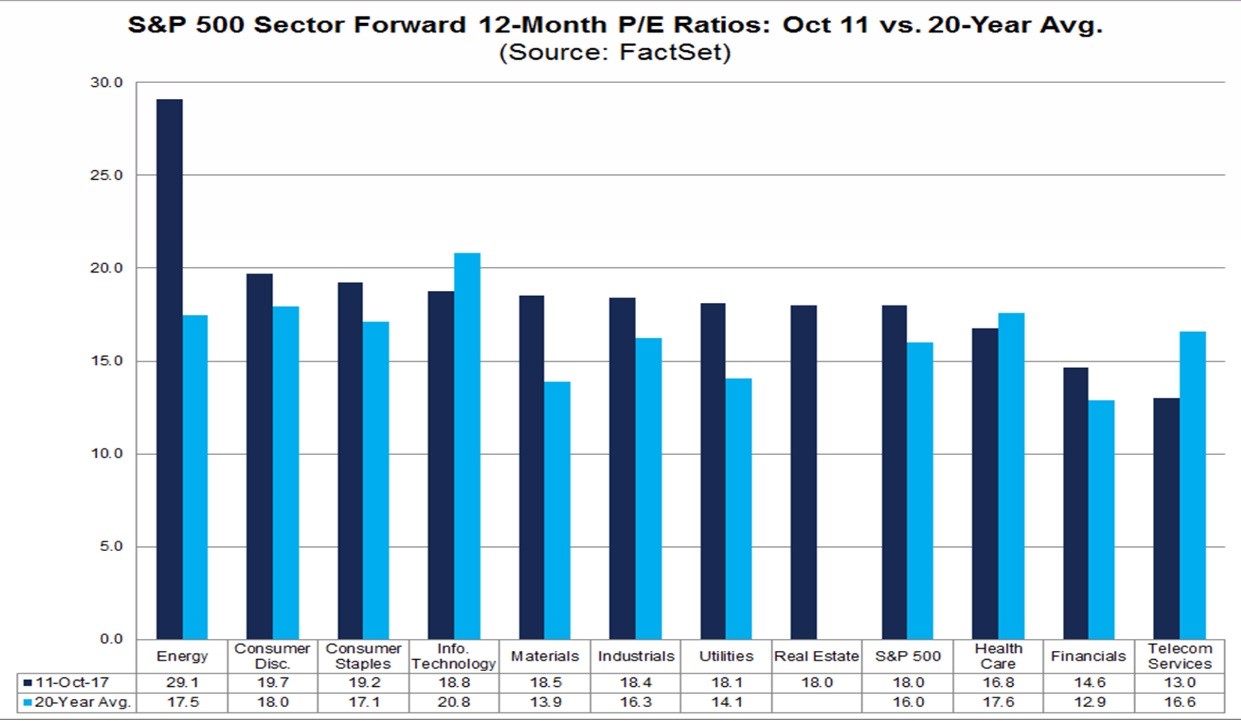

The chart below reviews the current 12 month PE ratios as compared to the 20 year average. As we’ve previously discussed, technology is one of the cheapest sectors. Tech, healthcare, and telecom services all have PEs below their 20 year average. Energy is the most overvalued sector. This is only the first step to analyzing stocks. You need to determine which sectors have the best earnings prospects. Even though financials have higher than average PEs, it could make sense to buy them in a rising rate environment. Their earnings are being suppressed by the hurricanes the most as insurance companies are taking one time losses. The financial sector is expected to see earnings fall 11.4% year over year which makes it the worst performing sector in Q3 if results meet expectations.

(Click on image to enlarge)

The weakness in Q3 earnings has had a big effect on total 2017 bottom up earnings. As you can see from the chart below, the earnings estimates mixed with actual results have fallen to their lowest point in the past 12 months; they are now at $130.70. The Q4 estimates didn’t fall this past week which is a good sign for the bulls. Even if Q3 and Q4 show bad results, the bulls will still try to grasp on to 2018 estimates which are now at $145.80. Perma bulls say earnings will rebound in the back half of the year when the year gets off to a rough start. They switch to talking about the next year when second half earnings are weak. It’s important to avoid this mindset even though it has been correct over the past 8 years. It’s like how a frog doesn’t jump out of boiling water if it heats up slowly. You don’t want to get complacent.

(Click on image to enlarge)

Extreme Complacency

There are two parts to complacency. The first is eternal optimism and the second is bad results. If there’s unwavering optimism while economic reports are good and earnings are decent, then you have a strong bull market. That’s what we have now as the streak without a 3% correction has reached 237 days which is 4 shy of the record. As you can see in the table below, in an E-Trade survey 66% of respondents said the market would increase this quarter compared to only 17% who said it would fall. It’s remarkable to see that 24% think the market will rise at least 10% in just 3 months. That’s over a 40% annualized return. Since 2008, there have been 7 quarters with double digit gains which equates to less than 1 per year. Although the market has lacked volatility and has been on a long bull run, the last time it rallied 10% or more in a quarter was Q1 2013.

(Click on image to enlarge)

The chart below is another way to measure the length of this latest bull run. As you can see, the table shows the number of days the S&P 500 has stayed above the 200 day moving average. This bull market is heavily represented as the largest streak was from 2012 to 2014 and we are currently in the 8th longest streak. This like how multiple months this year have broken the record for the lowest average VIX. This is the Wayne Gretzky stock market. It keeps breaking records. No other period comes close.

(Click on image to enlarge)

Fed Chair Odds Shuffle Again

There was another sharp change in the betting market for who will be selected as the next Fed chairperson. Powell fell by 13%, Taylor went up by 13%, Yellen went up by 4%, and Warsh fell by 14%. The screengrab below shows the latest rankings as Yellen has jumped in front of Warsh who led everyone a couple weeks ago. There hasn’t been any news that would send Warsh’s odds lower. I think his hawkishness is making people second guess him being picked. Powell and Yellen are considered doves. If you add up their total, they have 49% while the hawks have 34%. This makes sense because President Trump has always wanted a dove. I still don’t think the pick is going to be Yellen because of President Trump’s criticism of her during the campaign and her defense of regulations.

Conclusion

The doves are leading the hawks in the Fed chair betting market which is great news for stocks, not that they need any more positivity since this year has seen stocks go up in a straight line. We don’t have enough information on Q3 earnings to make any sweeping proclamations. That information will come in the next 3 weeks. So far, it looks like the hurricanes played a big part in the weakness which is a good signal for future earnings

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more