Q2 2017 Earnings Preview: The Expected Winners And Losers Might Surprise You

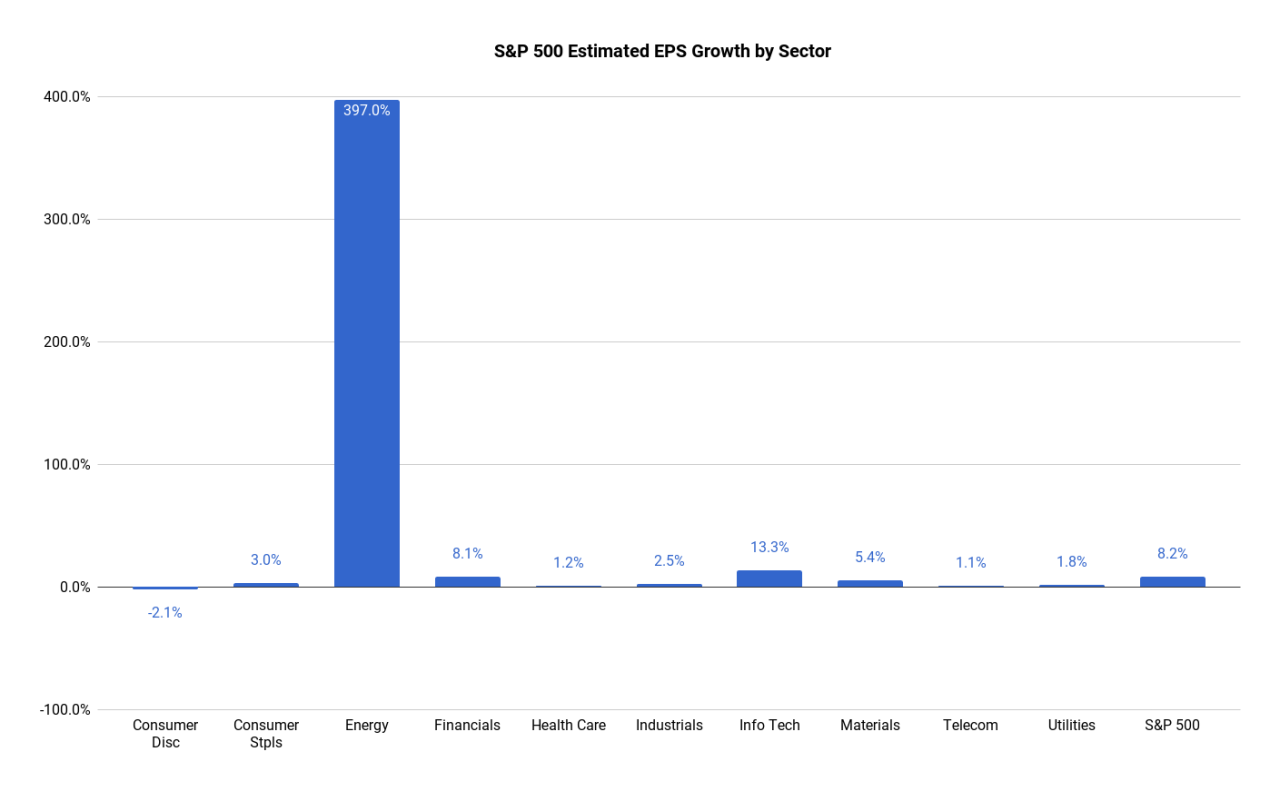

The big banks (JPM, C, WFC, GS, BAC) kicked off earnings season on a high note when they reported on Friday, all beating on the bottom-line, and only Wells Fargo missing on the top-line. Overall the Estimize community is expecting another strong earnings season, but a pull back from Q1. S&P 500 EPS is anticipated to grow 8.2% from the year ago quarter, a deceleration from last quarter’s 14%. Revenues are expected to grow 5%, down from 7% in Q1.

(Click on image to enlarge)

In 2017 we’re seeing a flip in winning/losing sectors, with energy and IT at the top, and health care and consumer discretionary lagging after putting up the best numbers for many of the quarters in 2015 and 2016. Energy is leading the pack right now with expected growth of almost 400% due to easier year-over-year comparisons. If you remove energy, index growth is almost cut in half to 4%, just around the 20 year historical average. The question then becomes, is 4% growth enough to justify a market that is trading at nearly 18x. Investors may be wishing for stronger fundamentals at these prices.

Following energy, technology is expected to see the second highest growth rate of all the sectors with profit growth of 13% and revenue growth of 8%. All 10 industries within the sector are estimated to record positive numbers this quarter, but none more than semiconductors which are currently anticipated to increase earnings by 50% YoY. Micron Technology is driving the semiconductors and is the largest contributor to sector growth. The company posted EPS of $1.62 on June 29 vs. the year ago result of -$0.08, an increase of 2125%. Optimism around Micron’s stock is due to favorable pricing of DRAM and NAND chips, MU’s main businesses. Gartner recently reported that worldwide PC shipments were down 4.3% in Q2, the 11th consecutive quarter of declines, due to supply shortages for memory chips which in turn has driven up prices and pushed down demand. This trend is expected to benefit MU again in Q3 with growth expected to come in even higher at 3600%.

(Click on image to enlarge)

Consumer discretionary is the biggest laggard this quarter and the only sector expected to post negative numbers. Earnings per share are anticipated to fall 2% from Q2 2016, while revenues should remain flat YoY. The automobile industry is driving profit expectations lower, down 15% YoY. Ford and General Motors are the main contributors, with EPS expected to fall 12% and 4%, respectively. The auto component names are also weaker, as heightened raw material costs and labor costs eat into margins, something Autozone mentioned on their recent call.

It isn’t only Autozone that has mentioned the negative impact of rising wages, but it seems to be shaping up as one of the main concerns this season among consumer and other names. Thus far FedEx, Darden Restaurants, Bed Bath and Beyond and others have mentioned higher wages. Increasing labor costs have specifically impacted retailers and restaurants, as local hikes in minimum wage for 19 states went into effect on January 1, 2017, greatly pressuring company margins. In order to offset these higher costs, restaurant chains such as Darden are being forced to expand takeout options, raise menu item prices or employ more technology.

Another familiar concern this season is once again the stronger dollar. More than half of the 30 reported companies have mentioned the stronger dollar having a negative impact on results in Q2, or that it will in in the second half of the year. Mostly companies within Consumer Staples such as Constellation Brands, Mccormick, Costco and Walgreens have commented on this. Companies in the S&P 500 derive approximately 40% of revenues from abroad. A stronger dollar makes prices of their goods and services more expensive to customers overseas, and also means sales decline when repatriated from a country with weaker currency. The dollar is expected to remain strong if further interest-rate hikes take place later this year, although Yellen’s dovish comments last week has put that into question. The Estimize community is expecting a 25 basis point hike in December.

(Click on image to enlarge)

This week 68 companies are scheduled to report from the S&P 500, mostly from the financials and technology sectors

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.