Pricing In A Bluff

There's a lot going on in the world right now. Of course, images of the historic handshake between the leaders of North Korea and the United States are grabbing the headlines, but there is a lot more happening under the surface that has much more potential to affect your investment portfolio.

In fact, now that the big news is behind us, markets are more likely to react to the Fed and ECB meetings.

Today's Highlights

- Pricing in a Bluff

- Big Meetings Coming

- Bitcoin Finding Footing

Traditional Markets

As Donald Trump and Kim Jong Un make their way through the Elton John Playlist (going from Rocket Man to Can You Feel the Love), the world is left questioning the logic of the American President who walked out of a G7 meeting to sign a deal with a man who has until recently been seen as a great threat.

Even the International Monetary Fund seems to think that he's gone too far.

Trump's proponents however remain firm, stating that this is simply a negotiation tactic to get the world back on track. As any poker player will tell you (or won't), a bluff only really works when your opponent believes you have the cards and are ready to play them.

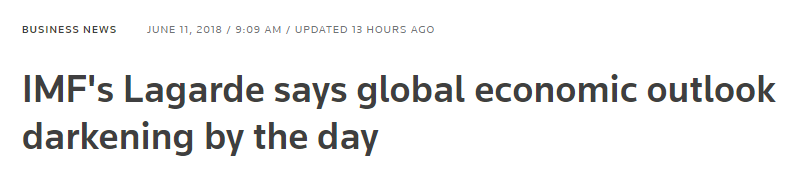

As far as global markets are concerned, the entire trade war is just a series of bluffs. Global stock markets have been holding up just fine over the last month and some of them are not too far away from their all-time highest levels.

(Click on image to enlarge)

Of course, if everything is priced to perfection, it does leave very little room for failure. On the other hand, a large amount of money left over from all the quantitative easing still seems to be finding its way into the markets. How long that will take to dry up is anybody's guess.

Central Banks This Week

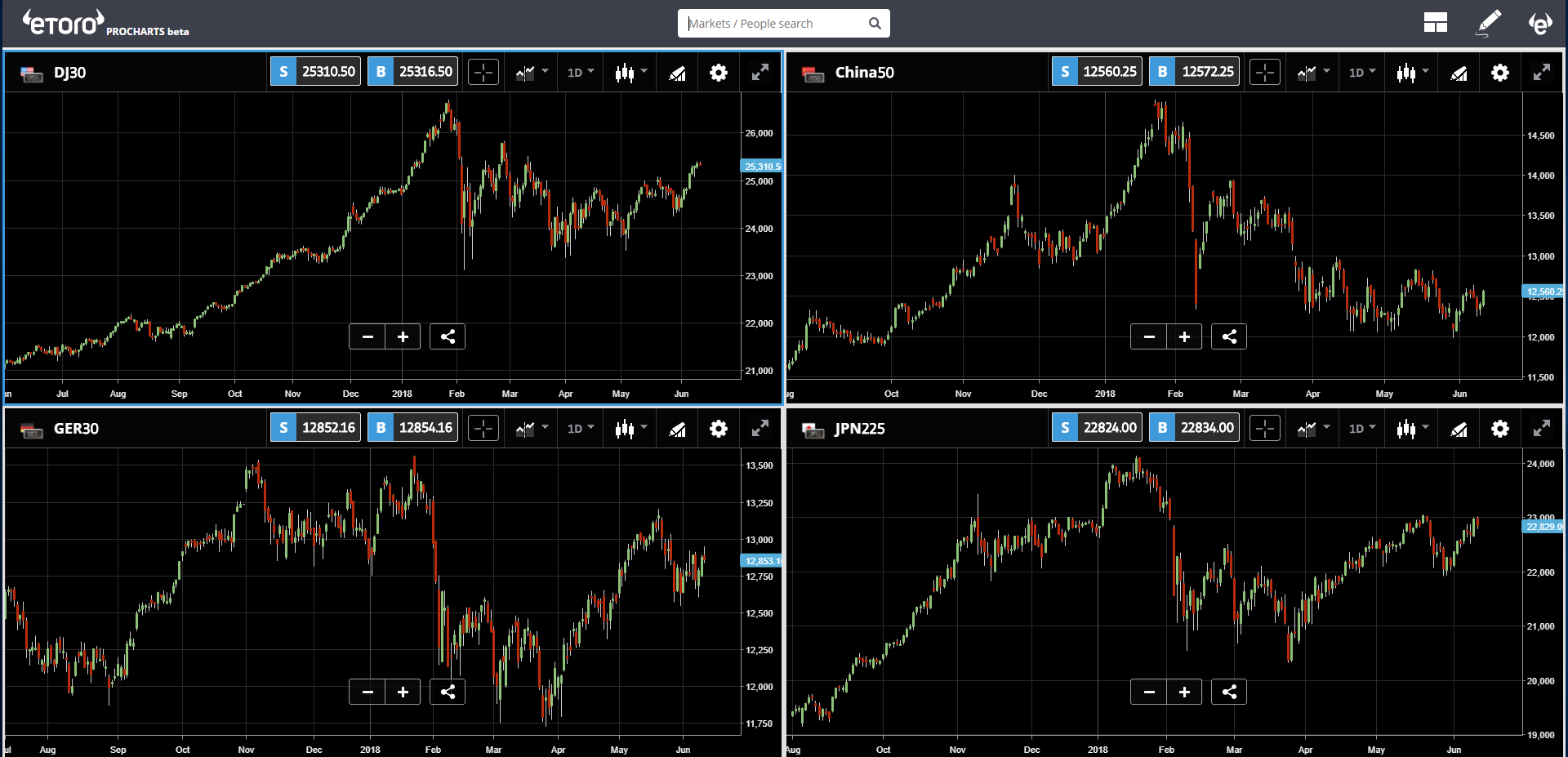

As indicated above, there are two meetings happening soon that have far greater potential to move the financial markets than the historic handshake today.

The US Federal Reserve will publish their interest rate decision tomorrow evening, followed by a press conference with Jerome Powell. The ECB will do the same on Thursday.

As these institutions unilaterally control the monetary policy and supply, we will be listening closely to what they have to say.

The EURUSD has been consolidating tightly over the last week, most likely in anticipation of these two meetings.

(Click on image to enlarge)

Bitcoin Fighting

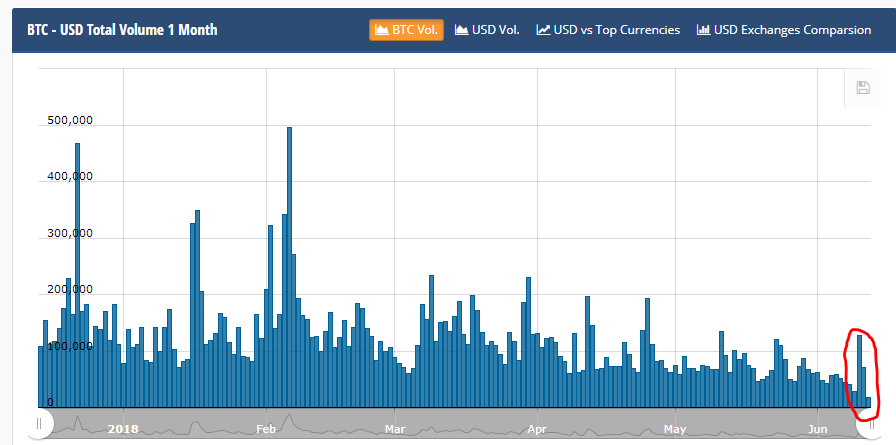

The price of bitcoin is still searching for solid footing after Sunday's $1,000 plunge. For now, we're holding well above the first support mentioned yesterday, around $6,450.

The crypto market seems to be in a liquidity vacuum at the moment. Even though we did see the volumes spiking a bit during the sell-off, it seems that they're receding again quickly.

(Click on image to enlarge)

We have seen several allegations flying around that some large players may be trying to push the price down on purpose, but I haven't seen any proof of that.

If there are any such foul players, they may want to keep a low profile at the moment as the CFTC is now probing this exact issue. If they found Ross Ulbricht, they can probably locate any potential price manipulators rather easily.

We'll need to watch the area of support rather closely over the next few days.

(Click on image to enlarge)

Let's have an amazing day ahead.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more