Pre-July US Wheat/S&D Updates

Market Analysis

After last week’s US acreage report showed higher plantings than expected for many crops, the trade’s focus has switched to the ending stocks for these crops and the impact of Friday’s US and Chinese tariff announcements on the US soybean trade going forward. With the US corn crop’s pollination period occurring over the next 3 weeks, the trade will also be watching the central US forecast. Mid 90s or higher daytime temperatures can damage corn’s pollen while high overnight minimum temperatures (mid 70s and above) can reduce yields because of excessive nighttime respiration reducing the energy flow to the ear’s development.

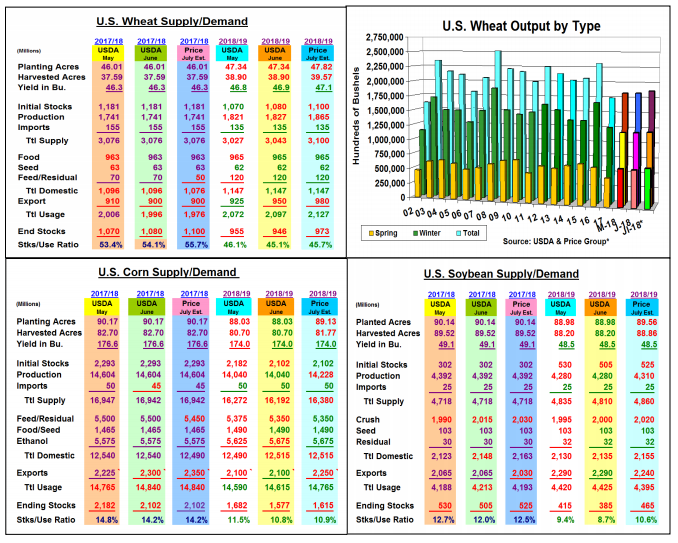

Last week’s larger-than-expected spring wheat seedings and recent harvest reports of better-than-expected winter wheat yield results had us expecting a 35 million bu. rise in spring output and 12 million bu. increase in the winter crop to 1.864 billion bu. Last month’s 20 million bu. higher wheat ending stocks also adds to US supplies, but recent cuts in the Russian, Ukrainian, and EU crops because of dryness could boost US exports. This should keep the US carryover at 973 million bu. vs 946 million in June. The USDA will also be projecting 2018’s small grain (oats and barley) output while no official corn and soybean survey work occurs until August.

With no strong history of the USDA changing its corn or soybean US yields until August, June’s 1.1 million higher plantings will still raise corn’s crop size by 188 million to 14.228 billion.bu. With Brazil, the Black Sea and Europe all experiencing shortfalls, a higher export level by 150 million bu. seems likely resulting in just a 38 million rise in corn’s US stocks to 1.615 billion this month. The impact of the Tariff War will center on soybeans exports - a likely 35 million old-crop cut and 50 million new-crop reduction. Crush increases will counter these declines, but a 30 million larger crop will push stocks to 465 million bu.

What’s Ahead:

A post-tariff announcement relief rally has begun. However, a report of trade negotiations beginning and hot and dry weather returning to the central US are needed to sustain today’s soybean and corn price recoveries. Thursday’s bean demand levels will be curtailed. Utilize August $8.85-8.98 values to sell final 10% of old-crop beans and move up old-crop corn sales to 60-70% on $3.67-$3.77 Sept strength.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more

Good read, thanks.