Pre-August Crop Report

Market Analysis

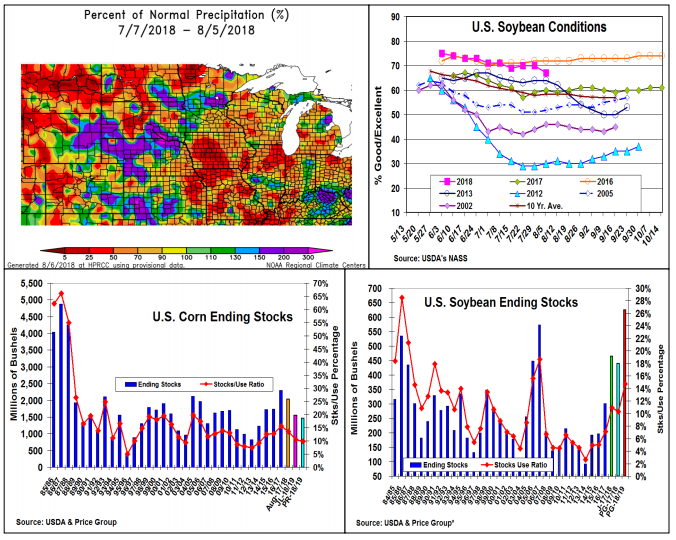

As we approach the USDA’s 2018 crop report on August 10, more trade chatter has been surfacing about this year’s corn and soybean prospects. After a cold April, warm and rainy May skies advanced planting in many Midwest fields, except in some northern and western states that had excessive moisture. Above normal June temperatures across the Central US advanced the crops with most corn fields developing a deep green color and good height by July 4th. Excessive heat has been limited during July, but dryness has surfaced in the central Corn Belt prompting recent declines in ratings. Our late July crop tour around C. Illinois revealed a strong and consistent corn crop but curtailed ear populations and row counts seems to prevent many of our fields from calculating super yield levels this year.

Normally, the USDA’s August production reports are based upon plant counts and a survey of producer’s yield expectations. With most of our corn samples dough/early dent (10-14 days advanced), some observation plot data could be included in this year’s numbers. 2018’s good/ excellent crop ratings have decline 7-8% from their early season highs to 71% and 67% for corn and soybeans. Utilizing our tour data trends and various state G/E crop ratings, our initial US corn yield is 173.8 bu. for a 14.21 billion bu. crop. With US soybeans highly correlated to August weather in their yield determination, we only made general observations about this crop on our tour. The overall look (deep green), some early podding and less drown out spots suggest a slightly better potential than 2017. However, last August’s Midwest dryness curtailed soybeans’ final yield to 49.1 bu. vs. 2016’s record 52 bu. level. Taking a wait and see approach, we are using only 49.5 bu. level for our initial August bean yield. This will still advance US beans output to 4.4 billion bu. A smaller spring crop could cut US wheat by 20 million bu.

What’s Ahead:

Despite no old-crop corn demand changes, the current European drought that has cut their wheat output will impact their feed grains, too. Corn’s 2018/19 US exports should expand by 75 million bu. dropping corn’s new-crop stocks to use below 10% - first since 2014/15. In beans, higher 2017/18 demand by 25 million will help compensate for 90 million bu. larger crop, but US stocks will be at 2006/07’s level or higher.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more