Post-Election Game Plan

Wednesday Could See Heavy Selling

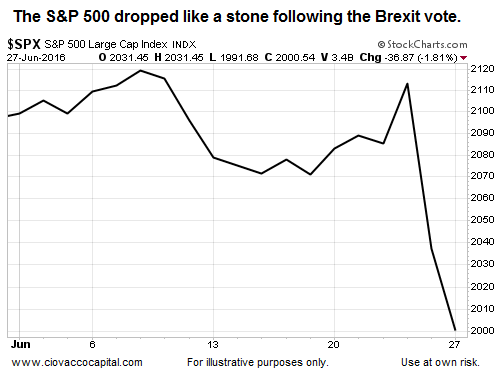

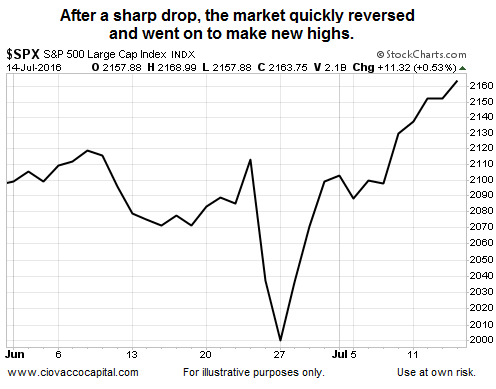

Based on the S&P 500 futures on election night, Wednesday’s open could see heavy selling pressure. While each event follows a unique script, market action following the Brexit vote serves as a reminder sharp drops can be followed by strong rallies.

The Initial Reaction

Following the Brexit vote, the overnight S&P futures dropped sharply. When the market opened the following day, the S&P 500 dropped 113 points in just two sessions.

The Longer-Term Reaction

After the market plunged, one of the primary drivers of the sharp reversal was increasing expectations that central banks would maintain an accommodative stance in the face of new uncertainty. In the Brexit case, the 113 point drop was retraced in a matter of days.

Markets Already Anticipating Friendlier Central Banks

On election night, market probabilities for a Fed rate hike in December plunged from roughly 75% to below 50%, telling us the market once again is leaning toward more friendly central banks in the face of political uncertainty.

Portfolio Has Defensive Positions

Gold, silver, metals, and bonds all rallied significantly on election night. These positions, along with our cash, should provide some offsets to what could be an ugly period for stock-related investments.

We were allocated in line with the evidence in hand last Friday and at Tuesday’s close. We will see where the hard data settles Wednesday after what is expected to be a very sharp gap down when the markets open.

If it is prudent to make some adjustments over the coming days, we will do so. As noted on November 5, short-term market reactions do not always align with longer-term reactions.

Putting Wednesday Drop In Some Perspective

As of the close on election day, the S&P 500 was up 54 points for the week, which means a drop of 80 to 100 points on Wednesday morning would bring the weekly tally to a drop of 26 to 46 points.

Over the next few days, it is important we remain level-headed, flexible, and open to all outcomes, ranging from very bad to much better than expected.

“If you can keep your head about you while others are losing theirs, you can make a fortune.”

Mark Ritchie

Market Wizards

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more

The Fed should probably raise rates. This zero rate mentality is why Trump won. At what point is doing the same thing over and over counted as being stupid?