Personal Consumption Expenditures: December 2014 Preview

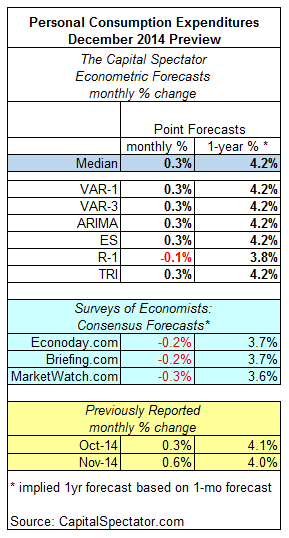

U.S. personal consumption spending for December is projected to rise 0.3% vs. the previous month in tomorrow’s update (Feb. 2), based on The Capital Spectator’s median point forecast for several econometric estimates. The prediction reflects a substantial slowdown in growth relative to November’s 0.6% advance. Note, however, that the previously released data on retail sales reflects a decline for December—a decline that implies that a downside surprise is higher than usual in tomorrow’s report. Not surprisingly, using a model based on retail sales alone anticipates that personal consumption spending will slide in December (see table below).

Meantime, three estimates based on recent surveys of economists point to modest declines for consumption in December relative to The Capital Spectator’s median forecast of an increase.

Translating The Capital Spectator’s median monthly forecast into an annual comparison implies that spending will increase in the low-4% range in tomorrow’s update vs. the year-earlier level.

Here’s a closer look at the numbers, followed by brief definitions of the methodologies behind The Capital Spectator’s forecasts that are used to calculate the median estimate:

VAR-1: A vector autoregression model that analyzes the history of personal income in context with personal consumption expenditures. The forecasts are run in R with the “vars” package.

VAR-3: A vector autoregression model that analyzes three economic time series in context with personal consumption expenditures. The three additional series: US private payrolls, personal income, and industrial production. The forecasts are run in R with the “vars” package.

ARIMA: An autoregressive integrated moving average model that analyzes the historical record of personal consumption expenditures in R via the “forecast”package to project future values.

ES: An exponential smoothing model that analyzes the historical record of personal consumption expenditures in R via the “forecast” package to project future values.

R-1: A linear regression model that analyzes the historical record of personal consumption expenditures in context with retail sales. The historical relationship between the variables is applied to the more recently updated retail sales data to project personal consumption expenditures. The computations are run in R.

TRI: A model that’s based on combining point forecasts, along with the upper and lower prediction intervals (at the 95% confidence level), via a technique known as triangular distributions. The basic procedure: 1) run a Monte Carlo simulation on the combined forecasts and generate 1 million data points on each forecast series to estimate a triangular distribution; 2) take random samples from each of the simulated data sets and use the expected value with the highest frequency as the prediction. The forecast combinations are drawn from the following projections: Econoday.com’s consensus forecast data and the predictions generated by the models above. The forecasts are run in R with the “triangle” package.

Disclosure: None.