Pattern-Friendly Market

It wasn’t that long ago that I hated the stock market. Nothing seemed to work, and technical analysis seemed to have gone the way of the buggy whip with respect to utility. Now that QE is well behind us (for now, at least), we’ve got a two-way market, and charts are behaving a lot better, even with the mayhem we witnessed over the past few days.

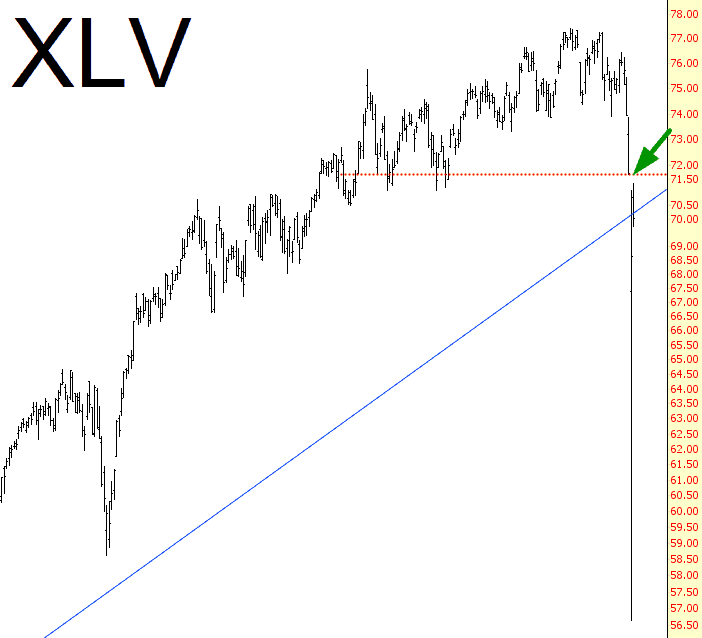

Take XLV, for example, which is the healthcare ETF. It roared higher after yesterday’s collapse, but it is, as I am typing this, daintily perched just beneath its gap. The distribution above above that gap is our ally, and just about every index and ETF I am looking at has some version of this top (with two or three key resistance levels, each one more formidable than the one beneath).

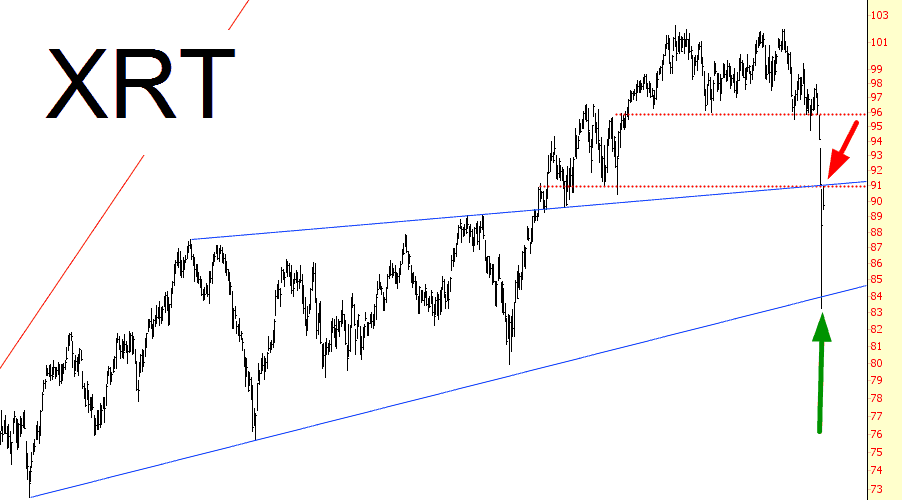

An even better example is the retail ETF, shown below. Even with the unchecked chaos of Monday morning, the low point of the day touched its supporting trendline dating all the way back to June 2013. It powered higher, and with today’s rally, it touched the other trendline that constitutes the pattern (which I’ve marked with a red arrow). This within-the-pattern action is marvelous and affirms the value of the pattern itself.

As I mentioned above, there are multiple levels of resistance. I feel confident – – very, very confident – – that the bears have the upper paw in the market now, and for a while to come, and the question isn’t whether the market will resume its downfall, but when. In other words, how high will the bounce be?

Speaking for myself, I presently have 70 short positions (up from 48 at the close on Monday) and 3 new long positions that my Slope Plus users know about. More important, though, I have a watch list of 93 other stocks I’d love to short, but only at higher prices, so I’ll be checking those on at least a daily basis.

This blog is not, and have never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more