Pattern Analysis Is Dismissed

Pattern analysis is dismissed primarily by pundits who missed the unfolding of the entire 2015 distribution year, and on-top of that the forecast 'brick-wall of resistance' at tail-end 2015 as trades would settle in the new tax year. On top of it most ignored the logic of a push from (month-end and perhaps new month) a necessary 'Pension Rebalancing' that we thought primarily responsible for most of the most recent upside, anticipated to attack the low-to-mid S&P 1900's.

Now, we indicated the other day that the early February action would extend at least for a bit the S&P move; and it did, perhaps helped by a spin about 'Stan Fischer's remarks on a Bloomberg interview that I listened to in-entirety. As the Vice Chairman spoke, there was a clear reference to not knowing what the Fed will do next, and the optimists jumped all over that one. What they missed and I noted, was a response to a question about the bloated balance sheet (too large and unwieldy he inferred) and total debt level he concurred is unsustainable. In fact he referenced that as a reason why the Fed needs to normalize policy.

So I won't delve into the Vice Chairman's remarks deeply here, but basically he is saying data-dependency exists; but we can't risk expanding overall Debt as it is an issue. Also; he challenged the inappropriateness of foreign countries use of 'currency swings' based on rate changes. To wit; he said it's reasonable for a monetary policy to be used to stabilize the economy, but not to move currency.

That seemed to be a slap-down to Japan and China; both of who are doing it in a way that's perceived intended to weaken their currencies; enhancing 'export' competition, not adjusting inflation/deflation in their countries. Another way that we might interpret that is a defense of US Fed policy which obviously is being applied without the intention of improving our global competitive stance or even defending it.

All this means is something for bulls & bears alike in his remarks; which from a policy perspective reinforced San Francisco Fed President William's remarks in a Friday presentation, where he too defended the ongoing Fed stance. This, as well as the S&P seemingly defying the decline in Oil, suggest a detachment of the S&P and Energy; which some pundits or analysts quickly jumped on as well on Monday. We think there's no detachment; it's just the swansong of the move as gets everyone agitated so they try to come up with an explanation.

Actually the most notable things in this market that we haven't explore much go to two areas: one is the return to narrow leadership in today's intraday rallies (perhaps why a decline was ignored in many stocks) while the FANG stocks of course carried the weight of the turnaround (which still left the Averages down).

The other is strength in Utilities, which isn't assured to be a warning as it was in 2007 (when we first forecast a 'liquidity and credit crisis' starting in February, to the subsequently escalated 'Epic Debacle' call, starting in May); but does show, as I thought the move slightly into Gold and Silver did as well recently (even to the Treasury market), as 'flight safety' buying from abroad tries to find US asset classes it can get into; but not necessarily equities. (China in particular; maybe funds from the Persian Gulf or Saudi Arabia, but that's harder to detect, as the latter two would be routed discreetly through London, Paris or even Brussels. You'll recall how the official Chinese flight buying at more favorable Exchange levels by far, was very stealth; with Belgium seemingly a huge Treasury holder.)

Bottom-line: typical rebounds of the typed we looked-for almost a week ago in a washout, are 1/3-1/2 of the preceding decline. We're in that zone now. We're not interested in taking more of our short-sale off the table unless we're at least 20 handles higher than Monday's high; and that's debatable. Note that we got a late fade as speculated possible in the pre-close video.

That's not to say there's not a Tuesday turnaround coming; no matter how the stock market reacts to start; but just noting that the narrow breadth and strong Utilities along with soft oil and a relatively strong Dollar, don't support lots more upside fundamentally; while a bit more range for move within does technically.

Last week I indicated that if we dropped at Monday's start (we did), you'd get a rebound (we did, in phases); and perhaps several alternating rounds of 'battle'. I pointed-out that there were developing opposing market postures from some of the major institutions, which is rare itself in recent times. However that tends to support the idea of temporary indecision, or alternating spates of volatility, as the market tries to decide when to embark on the next 'substantive' move.

In-sum: the pattern we've had and see is not a departure from the evolution of the January-February expectations at all; in fact the mixture is potentially facing completion of this rebound, but (as expected) without Bulls giving-up easily.

At press-time: raw totals show Clinton 53%; Sanders 46% (but it's early). And Fox News entrance polls show Trump with a slight lead; but CNN raw data has Cruz ahead by 1%. It's obviously too early to make anything of this.

Monday (final) MarketCast

3:35 (pre-close intraday) MarketCast

Disclosure: None.

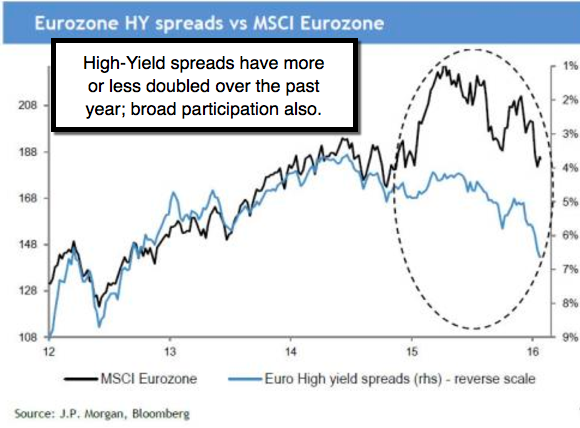

A post-script (of course the report posted is partial; and from Monday). We focused in-depth on the downside of 'negative interest rate policies'; warn about the Banks (especially Europe and Japan); and suggested new ingerletter.com members use the afternoon Monday rally to get short the S&P. The report for Wednesday will outline why Japan has a prospect to crack; why their JGB Auction may be cancelled; and why this confirms my views of the inappropriateness of negative rate policy directives.