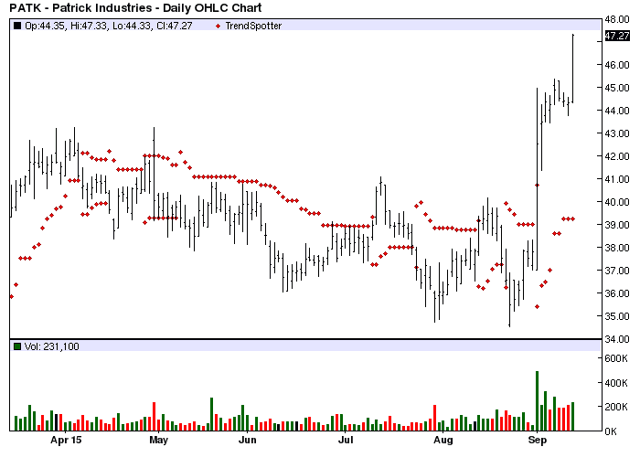

Patrick Industries - Chart Of The Day

The Chart of the Day belongs to Patrick Industries (NASDAQ:PATK). I found the building products stock by using Barchart to sort the Russell 3000 Index stocks for the criteria I like. First I sorted for Barchart technical buy signals above 80% then again for a Weighted Alpha above 50.00+. Next I used the Flipchart feature to review the charts, Since the Trend Spotter signaled a buy on 9/1 the stock gained 11.15%.

The company is a manufacturer and supplier of building products and materials to the manufactured housing and recreational vehicle industries. In addition, they are expanding as a supplier to certain other industrial markets, such as furniture manufacturing, marine and the automotive aftermarket. They manufacture decorative vinyl and paper panels, cabinet doors, countertops, aluminum extrusions, drawer sides and wood adhesives.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 96% Barchart technical buy signals

- 66.94+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 4 new highs and up 20.46% in the last month

- Relative Strength Index 77.83%

- Barchart computes a technical support level at 43.31

- Recently traded at 47.27 with a 50 day moving average of 39.03

Fundamental factors:

- Market Cap $730.32 million

- P/E 1.38

- Revenue expected to grow 28.90% this year and another 12.80% next year

- Earnings estimated to increase 30.40% this year, an additional 27.70% next year and continue to increase at an annual compounded rate of 15.00% for the next 5 years

- Wall Street analysts have issued 2 buy recommendations on the stock

Because of the stocks erratic movement most of the normal technical trading strategies have no been useful. I'd advise using a trailing stop loss 15% below its recent high to preserve your profits.

Disclosure: I have no positions in ...

more