One-Edged Sword

Things are seldom what they seem,

Skim milk masquerades as cream;

Highlows pass as patent leathers;

Jackdaws strut in peacock’s feathers. – H.M.S. Pinafore

It turns out the Brexit was just about the worst thing that could have happened to the bears. On the night it happened, I was ecstatic. I thought, finally, “this is it” – – a real turning point. Nope! The bounce emboldened the bulls, and they have been slicing bear throats ever since.

Virtually every day has brought more disappointment. My “tripod” of 2016 – BULLISH bonds, BULLISH precious metals, BEARISH equities – has been pretty much “2 out of 3” all year. Bonds are at lifetime highs, gold and silver are strong, but equities…curse them…keep lurching to levels never before seen in human history.

The divergences are getting grotesque. Stocks “should” be lower due to

(1) a collapsing crude oil market

(2) a soaring Japanese Yen

(3) plunging interest rates

...and yet…nope. Indeed, I’m wondering if the market is just a 1-edged sword, because if these three factors actually move in favor of the bulls (strong oil, weak yen, strong interest rates), won’t it just mean that the Dow goes roaring past 20,000 and beyond?

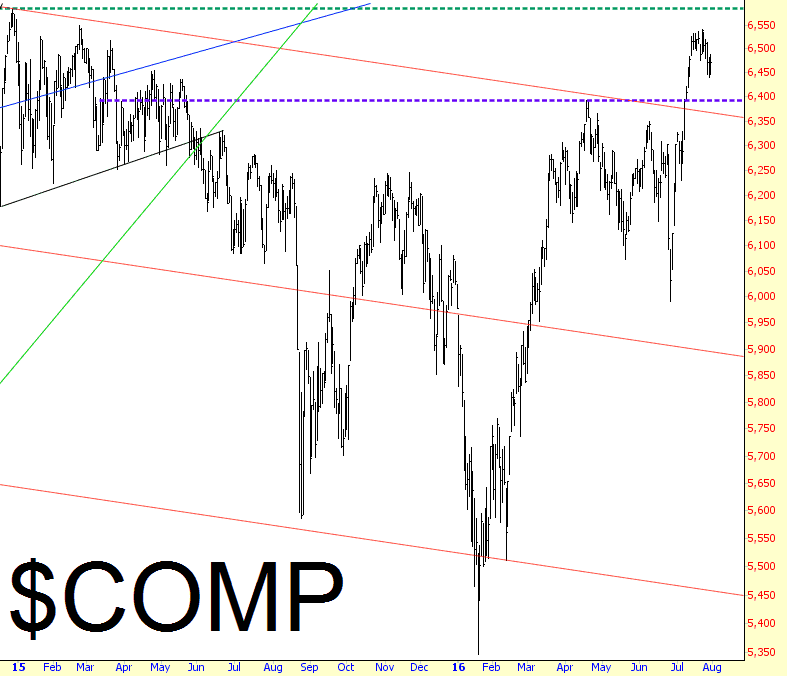

The Dow Jones Composite needs to break below the purple line for the bears to have a fighting chance; if we get above the teal line, screw it, 2016 is complete toast for the bears.

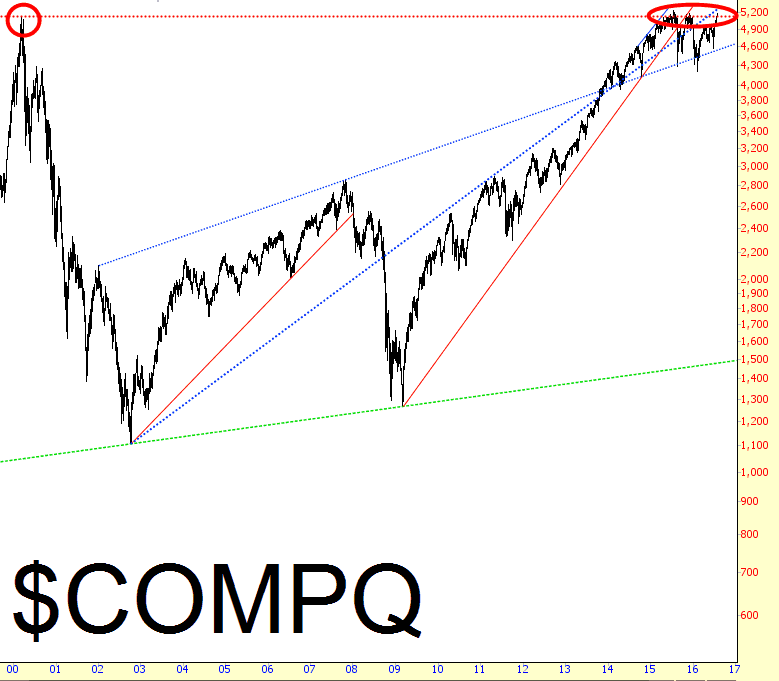

The Nasdaq is likewise supporting the bull case, as it threatens to push into lifetime highs.

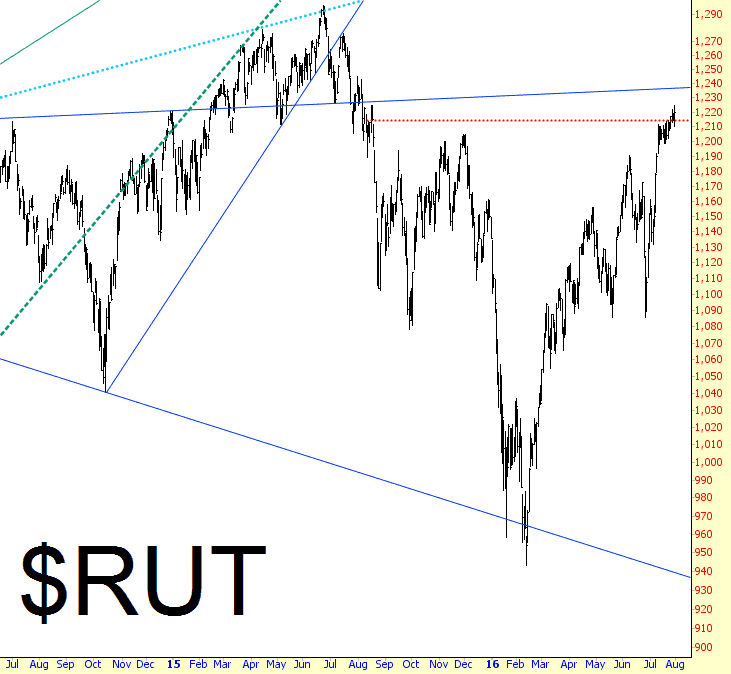

The Russell 2000 expresses its threat to the bulls by way of the upper blue trendline; as with the COMP, the bears can just hang it up for 2016 if we get above that line (and believe me, I’m closing to hanging it up for good).

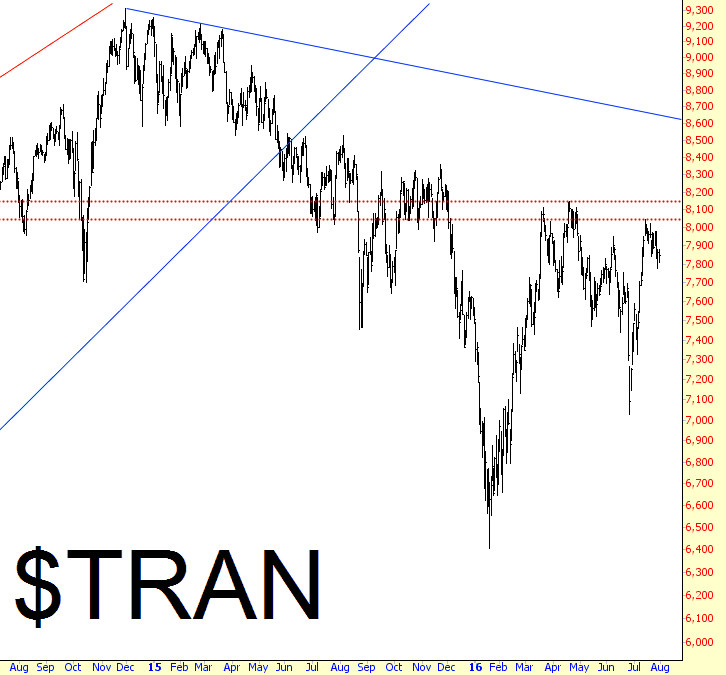

Just about the only index which is clear-as-can-be bearish still is the Transports.

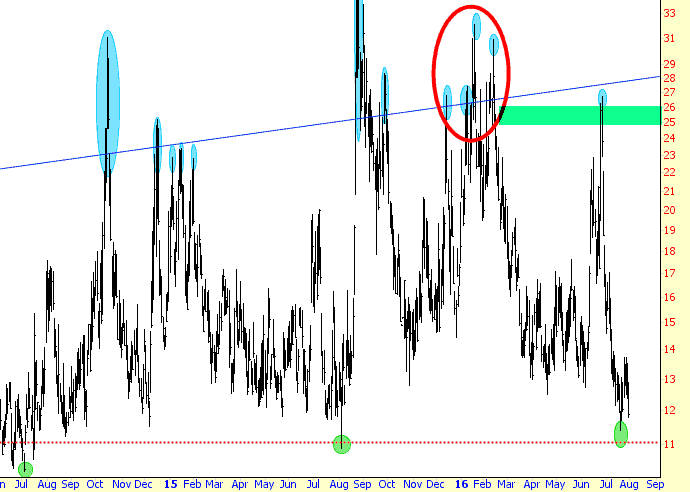

The past five months have been an absolute desert. There was ONE, count ’em, ONE, exciting moment, and that was Brexit. Take note of the “cluster” of VIX surges that took place late in December and early in January. How about since then? Jack. Squat.

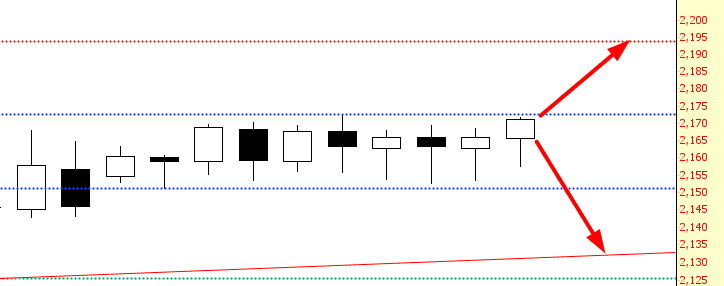

All you need to watch is the ES. I just read it hasn’t been in a range this tight for this long since Richard Freakin’ NIXON was in office. Break the range, and we move where I’ve drawn the arrows.

For me, personally, my enthusiasm about charting and trading looks about like this: