One Chart Says A Recession And Stock Market Crash Could Be Nearing

This Chart Says a Recession Could Be Ahead

A recession could be nearing for the U.S. economy. The writing on the wall is very clear, and ignoring it could be a very big mistake.

The last recession in the U.S. economy began in the fourth quarter of 2007 and ended in the second quarter of 2009. Dubbed the “Great Recession,” it was one of the worst recessions the U.S. economy had witnessed since the Great Depression. Prior to this, the U.S. economy witnessed a recession that began in the first quarter of 2001 and ended in the fourth quarter of the same year. (Source: “US Business Cycle Expansions and Contractions,” The National Bureau of Economic Research, accessed July 13, 2018).

Both times, there was one indicator that correctly predicted the economic slowdown.

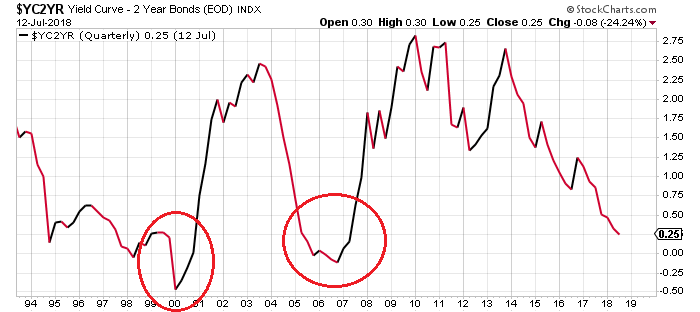

Look at the chart below and pay close attention to the circled area. It shouldn’t be anything new to long-term Lombardi Letter readers. It’s the difference between the yields on 10-year U.S. bonds and two-year U.S. bonds. Whenever this difference nears zero, we see a recession follow in the next few months.

(Click on image to enlarge)

Chartcourtesy of StockCharts.com

Based on the chart above, the U.S. economy is reaching a dangerous level. The difference between the yields on 10-year and two-year U.S. bonds is reaching awfully close to zero very quickly. In other words, the chart is saying a recession could be very close.

Why Should Investors Care?

It almost goes without saying that if the U.S. economy enters a recession, stock investors beware.

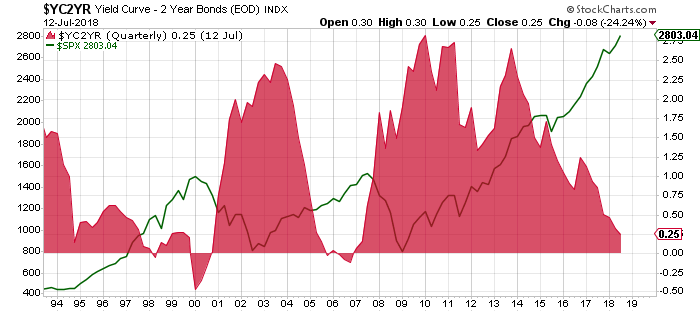

Here’s another chart below. The red area on the chart represents the difference between 10-year U.S. bonds and two-year U.S. bonds, while the green line represents the S&P 500 price movement. If you are a stock investor, this chart should make you rethink your position, at the very least.

(Click on image to enlarge)

Chart courtesy of StockCharts.com

Notice something interesting? Whenever the difference between 10-year and two-year U.S. bonds reaches close to zero, the stock market also closes in on a major top. This happened around 2001, and in 2007 as well.

The stock market is a function of the economy; it tends to lead rather than lag. So if we assume a recession is nearing, it’s time to pause and reflect.

I can’t help but stress that capital preservation is very important in times like these. Let me be very clear: I am not saying that a market top is in place already (predicting exact tops and bottoms is impossible) and to sell everything. Capital preservation could be as simple as just placing stops on existing positions.

I believe that going forward, the returns on the stock market are not going to be as rosy as they have been in the past few years. If a recession does come into play, a stock market crash could be ahead as well.

I will end by saying to not get too complacent. The mainstream may have you convinced that all is well when it actually isn’t.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more