On The Edge Of Panic

It was a bad day in the market yesterday, down 2%. That’s nothing in the big picture. The market is up 300% since 2009. A 2% move shouldn’t be a problem in a normal market. But, we have an extremely overvalued abnormal market, propped up by excessive levels of debt and hundreds of billions in corporate stock buybacks. These CEO titans of industry are driven by greed and personal ambition. They aren’t smart enough to grow their businesses, so they have bought back their stock at record high prices in order to boost Earnings Per Share and their own stock based compensation packages.

They did the exact same thing in 2007, just before the last crash. They always buy high and sell low. In 2009, when their stocks were selling at bargain prices, they bought nothing. With markets in turmoil, they don't hesitate to buy back their stock. Fear will overtake their greed. This form of liquidity for the stock market will dry up in an instant.

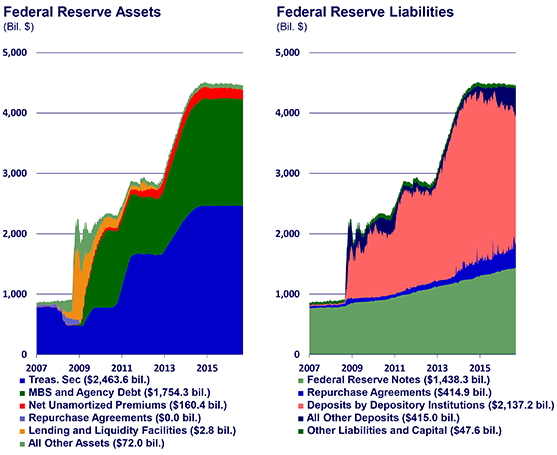

The Fed’s QE1, QE2, and QE3 were the primary driver of the stock market for the last five years. The rise in the Fed’s balance sheet from $900 billion to $4.5 trillion tracked the rise in the S&P 500 perfectly. I wonder why? Since October, the Fed stopped buying toxic mortgage assets, and its balance sheet has stayed at $4.5 trillion. In a shocking development, the stock market also went flat since November. With ZIRP supposedly ending in September, the endless liquidity and free lunch for Wall Street is over.

And now we have the final nail in the bull market coffin. The Wall Street lemmings have all piled into the market, believing the Fed has their back and stock markets only go up. Please closely examine the chart below. Margin debt isn’t just high, it is off the charts high. It makes 2000 and 2007 look like minor league events.

The investing geniuses who don’t believe in bear markets have borrowed over $500 BILLION against their existing stock holdings. This is the tinder for the coming wildfire. The way it works in the real world is – the market drpanicops 2% to 4%. At the end of the day the margin lender assesses the position of their borrowers. If their collateral (stock holdings) has fallen below an allowable level, they make a margin call. The borrower must come up with cash immediately. Since they are hocked up to their eyeballs, they are forced to sell stock the next day to meet their margin call. The selling creates its own momentum.

With margin debt at epic levels, the margin calls will be epic. Panic will set in quickly. All of the stock market geniuses will be trying to get out the same door at the same time. Bodies will be piled high at the exits. The 2% decline will not provoke the panic, but another plunge in the 3% to 5% range will create a waterfall effect. We are on the edge of panic. Can Yellen and her central banker cohorts keep the inevitable from happening? We’ll see.

Disclosure: None.