Oil Sands Outlook

On Friday I visited the University of Alberta in Edmonton, where falling oil prices have brought a record provincial budget deficit despite aggressive tax increases and spending cuts. Here I pass along some of what I learned about how the plunge in oil prices is affecting Alberta’s oil sands operations.

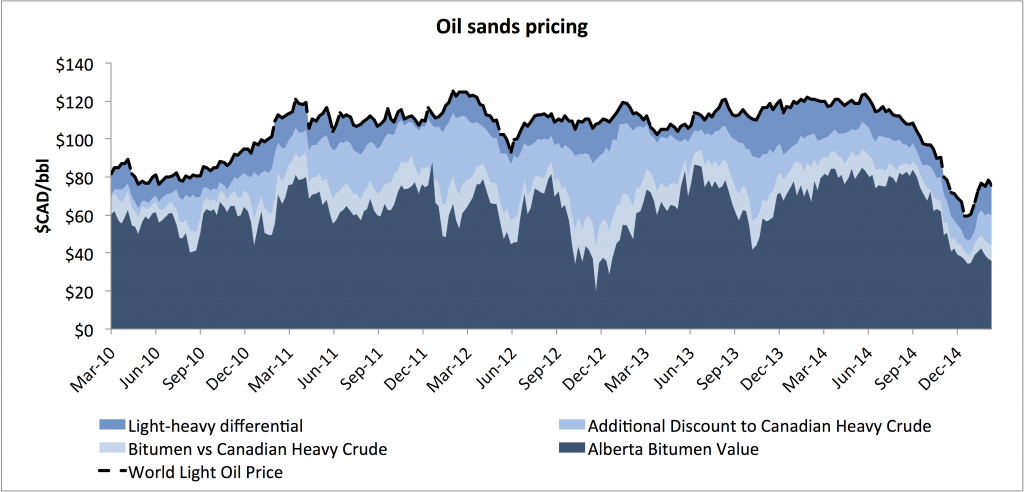

A couple of factors have cushioned Canadian oil producers slightly from the collapse in oil prices in the U.S. First, while the dollar price of West Texas Intermediate has fallen 45% since June, the Canadian dollar depreciated against the U.S. dollar by 18% over the same period, and now stands at CAD $1.26 per U.S. dollar. Since the costs of the oil sands producers are denominated in Canadian dollars, the currency depreciation is an important offset. There has also been some narrowing of the spread between synthetic and other crudes. As a result of these factors, the University of Alberta’s Andrew Leach calculated that when WTI was selling for US $50 a barrel, Canadian producers were receiving CAD $60 per barrel of synthetic crude.

Source: Andrew Leach.

Oil sands and U.S. tight oil production have been the world’s primary marginal oil producers in recent years, by which I mean the key source to which the world could turn in order to get an additional barrel of oil produced. Ultimately in this regime it is the long-run marginal cost of the most costly producing operation that puts a floor under the price of oil. A company with sunk fixed costs will continue to produce even if price is below long-run marginal cost as long as cash flow is greater than current operating expenses. But for anybody considering a new project, the up-front capital costs and required rate of return have to be factored into new decisions. A project won’t be started if price is below the long-run marginal cost.

But oil sands and tight oil are polar opposites in one important respect. Tight oil projects can be up and running with a short lead time and have a short producing life. I expect for this reason that declines in tight oil production could be seen very soon. By contrast, oil sands represent a decades-long investment, meaning that completed projects that cover operating costs, as well as many projects that have already been started but not yet completed, will be producing for a long time. Leach estimates that operating costs are CAD $34.45 barrel for Suncor and CAD $38.31 barrel for the Canadian Natural’s Horizon project. As long as synthetic crude fetches $CAD 60, those operations are not about to shut down. Leach concludes:

So, what does this all mean? Oil sands production will continue to increase in the near term, likely through 2020 if not beyond, unless prices decrease materially relative to today. If they remain as low as they are, there’s certain to be a downward revision in the long-term growth forecasts for oil sands, but don’t expect production to decline in the near term. At today’s prices, industry forecasts of three million barrels per day by 2020 are likely to underestimate production by a bit, but the real kicker will be on the value of that production to all concerned—governments, via taxes and royalties, and shareholders will all suffer much lower returns from this development than they would have expected less than a year ago if prices stay where they are today.

But evidence of retrenchment is nonetheless unmistakable. Last month the Financial Post reported

Producers including Suncor Energy Inc (SU), Cenovus Energy Inc. (CVE) and MEG Energy have slashed 2015 capital expenditures in response to the oil price slump. Wood Mackenzie estimates industry spending will drop by $1.5 billion over the next two years, down 4% from its fourth-quarter 2014 assumptions…. Royal Dutch Shell Plc (RDS-A) said it was shelving plans to build the 200,000-bpd Pierre River oilsands mine in northern Alberta, the largest such project to be deferred.

And in another report from March 12:

About 1,000 construction workers employed by a contractor at Husky Energy Inc.’s Sunrise oilsands project were laid off unexpectedly on Wednesday, a union official confirmed…. Suncor Energy Inc said in January that it would cut 1,000 employees and contractors, while Royal Dutch Shell Plc is cutting about 300 from its oilsands operation.

And on Friday the Globe and Mail reported that China’s CNOC decided to write down $842 million in its overseas investments, including extensive investments in Canadian oil sands.

Price cannot exceed long-run marginal cost in equilibrium. But at least in the case of oil sands, it could take a long, long time to reach that equilibrium.

Disclosure: None.