Oil Prices And Consumption

“Davidson” submits:

As you are well aware $WTI priced over $72BBL in early morning. I have been suggesting higher prices due to underlying economics, but any pricing is really market psychology and not predictable. While I think it likely we will see $80BBL as economic fundamentals will surprise investors and cause market psychology to continue its shift towards optimism, Setting a price target is not predictable with all the potential and unpredictable events which typically occur.

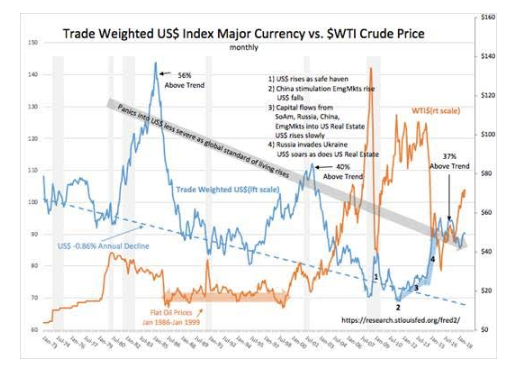

Economics suggests continued oil consumption and higher prices. Geopolitical events, i.e. Iran sanctions, could spike prices short term, but too hard to call. The inverse US$/$WTI relationship appears off trading desks for now, but may return if US$ begins to fall as early indications tend to support. Market psychology is important but it always follows economic events. Recent currency declines for Russia, Iran, Venezuela, Turkey, China and etc are all due to internal destruction of local free market business activity causing capital shifts to safe havens. The threats to capital in these countries began years before they were ever reflected in economics. With global commodities priced in US$, there is a natural connection between commodities and currencies. The better risk-adjusted-return on capital is the driver of capital flows and whether it is economics or politics is dominant for any period shifts in dominance with perceived events.

The best I can do is watch the trends evolve, shift, then evolve in response to the latest influence.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more