Oil Inventories Remain Near Record Levels; Definitely Seeing Signs Of Oversupply In US

For the past few months, I have been maintaining a weekly column on this website showing the status and trends in oil inventories and petroleum products production in the United States. Regrettably, the holiday festivities prevented me from providing my usual weekly update last week and this update is a few days later than I normally like to publish these updates. Therefore, this update will be for both of the last two weeks. Overall, the inventory numbers are showing that the glut which the media has been discussing for the past six months may finally have arrived. However, there have also been some improvements in this situation over the past week.

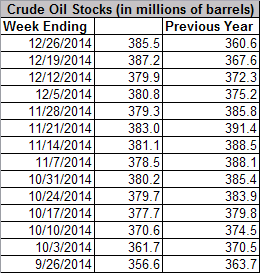

Ever since the price of oil began to decline back in June, the prevailing trend in oil inventories has been that the nation's commercial crude oil inventories consistently contained smaller quantities of oil than during the corresponding week of the previous year. This has consistently been true despite media claims to the contrary. However, this trend was broken during the first week of December and remains true today. At the end of the week ended December 19, 2014, the nation's commercial inventories of crude oil contained a total of 387.2 million barrels of crude oil. This is an increase over both the previous week and is a level that is significantly above last year's level. This quantity actually decreased somewhat during the week ended December 26, 2014 to 385.5 million barrels. However, this level is still substantially higher than the 360.6 million barrels that these same inventories contained at the end of the week ended December 27, 2013.

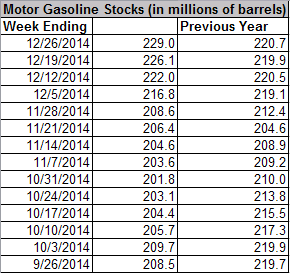

Meanwhile, the nation's inventories of motor gasoline grew relatively steadily over the past two weeks. At the end of the week ended December 19, 2014, the nation's gasoline inventories contained 226.1 million barrels of gasoline. This is a higher quantity than these same inventories contained at the same time last year. This figure grew to 229.0 million during the week ended December 26, 2014. This is significantly higher than what these same inventories contained at the end of the corresponding week in 2013.

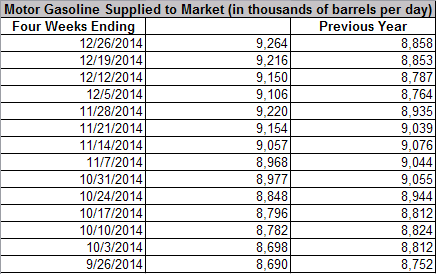

One of the first possible reasons that comes to mind for the rapid growth in gasoline inventories is that Americans as a whole did less driving during this year's holiday season than during last year's. However, it is more likely that this rapid growth in the nation's gasoline inventories is because America's refineries are producing more gasoline than last year. This is a trend that has consistently been true over the past several months. During the four week period ended December 19, 2014, the nation's oil refineries produced an average an average of 9.216 million barrels of gasoline per day. This grew to an average of 9.264 million barrels of gasoline per day during the four week period ended December 26, 2014. This is well above the production level that these refineries managed to achieve during the corresponding period last year. During the four week period ended December 27, 2013, the oil refineries in the United States produced an average of 8.858 million barrels of gasoline per day.

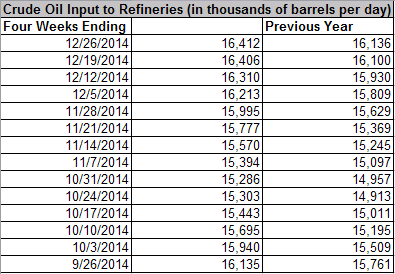

One of the biggest reasons why gasoline production is higher year-over-year is that the nation's refineries have been receiving and processing higher quantities of crude oil than they did last year. During the four week period ended December 19, 2014, the nation's oil refineries processed an average of 16.406 million barrels of crude oil per day. This increased to an average of 16.412 million barrels per day during the four week period ended December 26, 2014. Both figures are significantly higher than last year's average of 16.136 million barrels per day.

Thus, it does appear that the worldwide oversupply of oil is continuing to affect domestic inventories. Despite the slight improvements that we saw in these inventories over the latest week, oil supplies remain at record levels.

Disclosure: I am long several oil stocks and MLPs as are several clients. I have no positions in oil futures.