Oil Inventories Continue To Rise But Gasoline Production Slowing

The latest oil inventories report from the Energy Information Administration shows the continuation of several trends that have been ongoing for the past several weeks, with one notable exception. That exception is found in the nation's commercial gasoline inventories, which declined slightly over the past week, a reversal from the increases that have been occurring over the past few weeks.

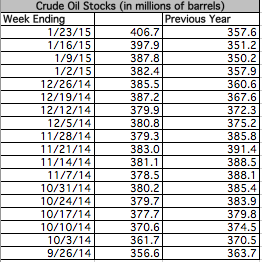

During the week ended January 23, U.S. commercial inventories of crude oil increased to 406.7 million barrels. This represents a fairly substantial increase from the previous week, the end of which saw these same inventories containing a total of 397.9 million barrels of crude oil. Inventories also contained substantially more oil at the end of the most recent week than they did at the end of the corresponding week of 2014. At the end of the week ended January 24, 2014, the nation's inventories of crude oil contained a total of 357.6 million barrels of oil. The continuation of growth in the oil inventories lends support to the media reports of an oversupply of oil relative to demand and is, admittedly, one reason why oil prices continued to weaken over the week corresponding to this report.

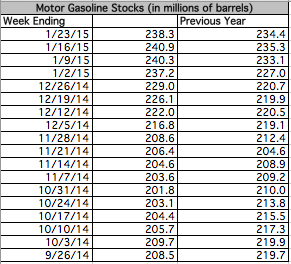

As I mentioned in the introduction to this article, the amount of gasoline in the nation's commercial inventories declined over the week to 238.3 million barrels. This represents a marked departure from the growth in gasoline inventories that has been occurring over the past several weeks. It is worth noting that these gasoline inventories contained significantly more gasoline than they did at the same time last year. At the end of the week ended January 24, 2014, the nation's inventories contained a total of 234.4 million barrels of gasoline.

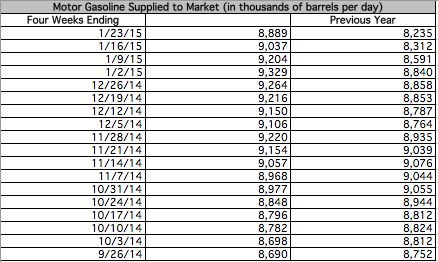

While some may attribute the decline in gasoline inventories to increasing demand for gasoline among consumers, it is more likely that gasoline inventories are declining because gasoline production has been declining. This has been the case for the past few weeks. During the four-week period ended January 23, 2015, the nation's oil refineries produced an average of 8.889 million barrels of gasoline per day. During the four-week period ended January 16, 2015, these same refineries produced an average of 9.037 million barrels of gasoline per day. Despite this decline in production, the nation's refineries still produced more gasoline than during the corresponding period of last year. During the four-week period ended January 24, 2014, the nation's oil refineries produced an average of 8.235 million barrels of gasoline per day.

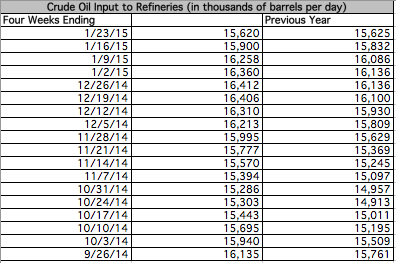

The reason for the declines in gasoline production is likely that refinery utilization and thus the amount of crude processed by the nation's refineries has been declining. During the four-week period ended January 23, 2015, the nation's refineries processed an average of 15.620 million barrels of crude oil per day. These same refineries processed an average of 15.900 million barrels of crude oil per day during the four-week period ended January 16, 2015. This was also a lower level than where these refineries were operating last year, a departure from the trend that has been present for some time now. During the four-week period ended January 24, 2014, the nation's oil refineries processed an average of 15.625 million barrels of crude oil per day.

Thus, the latest oil inventory report seems to point to a confirmation of the oft-reported story that the world is currently oversupplied with oil. However, should production of gasoline continue to decline, we may continue to see further declines in these inventories assuming demand remains steady (which may not be the case).

Disclosure: I am long several oil stocks and MLPs as are several clients. I have no positions in oil futures.

Despite all the above, oil prices jumped about 8 percent on Friday, the biggest daily gain since 2009 for Brent, after data showed the number of U.S. oil drilling rigs had fallen the most in a week in nearly 30 years. With more oil refineries being idled, its only a matter a time before demand outstrips supply and prices of oil double or triple again.

I'm thinking of putting aside the money I'm saving on gas to invest in something that would hedge my oil-impacted investments. Any suggestions?