Oil, Empire And Playing The Great Game

Those waiting for the U.S. and its dollar to collapse in a heap may find their own stability is more contingent (and fleeting) than they reckoned.

Many observers (including myself) question the coherence of U.S. foreign policy in the Mideast: The Fatal Incoherence of the Bush/Obama Foreign Policy (June 18, 2014).

In my view, the incoherence stems from the intrinsic conflict between traditional (i.e. pre-1941) U.S. foreign policy (based on an uneasy marriage of non-intervention and the explicitly interventionist Monroe Doctrine) and the anti-imperialist values of the Founding Fathers, and the demands of maintaining global hegemony.

The other source of incoherence is the recent policy dominance of an intrinsically incoherent ideology of neo-Conservative Imperialism that is disconnected from both traditional non-interventionist U.S. values and the nuanced demands of maintaining global hegemony.

If we strip away these sources of incoherence, we're left with the Deep State playing the Great Game of controlling the master resource, oil. A consistent narrative has little value in the playing of this game, other than for public-relations value, and those seeking a single narrative are inevitably perplexed by the multiple paradoxes and agendas of the Deep State.

This leads many observers to declare the Deep State's game plan a disaster.

The important question is: which game plan? The incoherent one articulated by the president and his secretary of state? Or the one that nobody lays out because it would be the equivalent of showing everyone at the table all your cards?

The real game plan is flexible enough to tolerate multiple inconsistencies and paradoxes. The only goal is controlling the extraction and distribution of oil, and whatever serves this goal is in play. Switching sides, abandoning proxies, cutting deals with enemies--it's all in play, all the time.

From this perspective, the game requires constant shifting of strategies in response to what's working and what's not working. If taking down Syria's Assad with proxies didn't work, then move on to Plan B or Plan C. If degrading Iran's influence isn't working, then move on to reproachment (privately at first, of course).

In other cases, the strategy is public but the working parts are not necessarily public. Financial sanctions are a good example; beneath the PR bravado and the propaganda war of sanctions and counter-sanctions, one side is getting hurt where it counts (i.e. in the personal fortunes of its Power Elites). If sanctions aren't working, they're replaced with Plan B or C. What Plan B or C might be is only visible between the lines.

In other cases, allies are reminded of who controls $40 trillion in financial resources and who controls $2 trillion.

The U.S. Deep State isn't collecting "likes." Everyone with a piece on the board has to deal with the U.S. in some fashion, whether they like it or not. Even the cliche of the enemy of my enemy is my friend doesn't explicate the conflicting alliances the U.S. maintains.

One need only recall Nixon's visit to China as evidence that all sorts of sacrosanct policies are fluidly jettisoned once the board changes and the Deep State sees the advantages of another arrangement.

In the case of Nixon and China, Nixon sought to rearrange the triangle of China, the U.S.S.R. and the U.S. to the advantage of the U.S. and China at the expense of the U.S.S.R.

In other cases, the U.S. game is served by disrupting competitors' control of resources; if direct control isn't possible with available assets, then indirect control via global finance is always an option. If that isn't possible, then disrupting competitors' control until other stresses bring them to their knees might work.

Everybody with a piece on the board is serving their own best interests. When cutting a deal with an implacable enemy serves your interests better than remaining enemies, that's what you do--consistency doesn't count. Friends, enemies, frenemies--labels, like consistency, don't count.

I don't know any more than any other marginalized, non-insider citizen. But just reading between the lines, I see the various Deep States playing 3-D chess and constantly adjusting strategies and game plans in response to other players' moves. I would guess one U.S. Deep State strategy involves disrupting the alliance of Russia, Iran and Syria by whatever means are available, with the goal of securing working relationships of some sort with all three such that energy flows serve the U.S. Deep State agenda.

This doesn't mean others' interests aren't being served; arrangements are only stable if they meet all the players' core interests. Costs are raised or reduced, changing the incentives to deal, and at some point the benefits of changing the arrangement outweigh the costs.

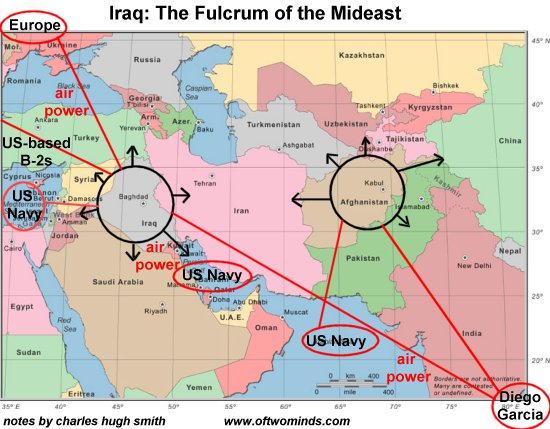

Just glancing at this map, I'd guess it would serve both the U.S. and Iran to reach some sort of mutually beneficial arrangement.

Glancing at this map, it follows that the energy stranglehold Russia currently enjoys on Europe is not permanent:

Again, reading between the lines, we can discern these Great Game possibilities:

1. As I described on Monday, I expect oil to plummet at some point as the global economy implodes. As demand and price crash, oil exporters on the thin edge of domestic instability will maintain production in a desperate attempt to keep their welfare states afloat. The Oil Head-Fake: The Illusion that Lower Prices Are Positive.

2. This dramatic decline in oil revenues will trigger domestic regime change in nations which are dependent on oil revenues for the maintenance of their welfare state/Armed Forces/Political Elites.

3. Capital restrictions will increasingly be viewed as necessary as nations awaken to the fact that their sovereignty and control of their own assets will be lost if they allow uncontrolled flows of capital in and out of their economy.

The currency that will be needed for reserves and to service debts is the U.S. dollar. As demand for USD rises and U.S. imports (i.e. the supply of USD being exported) decline, the value of USD will rise sharply.

4. That means the U.S. can outbid other bidders for any global resource. The U.S. funds its Empire by selling its bonds (debt) to those who have traded goods for our dollars. Thus the cost of the Empire is largely borne by other nations as the U.S. exports inflation and its currency in exchange for goods and resources.

Until China gains an equivalent advantage (and as I have explained many times, nations with trade surpluses cannot issue reserve currencies), then it will have to bid for resources with earned income. Recall that China's apparently substantial wealth is ultimately based on its currency's peg to the U.S. dollar and an export-dependent economy that will run aground once the global recession kicks in.

The Impossibility of China Issuing a Reserve Currency (October 14, 2013)

Understanding the "Exorbitant Privilege" of the U.S. Dollar (November 19, 2012)

5. Capital controls will be followed by resource controls. The export of energy, food and minerals will be limited as a matter of necessity. The excuses given won't matter; there will be no alternative. Governments which let their own populaces starve in order to ship food overseas will be overthrown by whatever means are necessary. As Bob Marley observed, a hungry mob is an angry mob. That's how Bastilles get torn down, brick by brick, by enraged mobs.

That means there will be far fewer resources available for export.

6. The clock is ticking on China's moment in the sun. Its citizens' monumental ambitions will be thwarted by the limits facing all consuming nations, and as the costs of its aging (and increasingly diabetic) populace ratchet higher, China's resources will be stretched too thin to construct a Global Empire with a reserve currency and decisive hard and soft power.

Perhaps if Mao hadn't struck down an entire generation in the Cultural Revolution and China had started integrating its economy and ambitions 20 years earlier, that hard and soft power might have been assembled. But now there are too many demands on China's financial resources and too many imbalances in its corrupt, centrally planned financial house of cards. Its stash of foreign reserves is modest compared to the demands of Empire and a populace of 1.2 billion people with expectations raised to the sky.

When competition between the U.S. and China comes up, I always ask this: Which nation's Power Elites have made sure their children have green cards and homes in the others' home turf?

If the U.S. Power Elites had secured Chinese citizenship for their beloved children and purchased properties in Beijing, then that would be proof that the leadership of the U.S. Empire had lost faith in the Empire's durability and future.

But it is the other way round: it is China's leadership which has moved its capital and offspring to Canada and the U.S. Indeed, having U.S./Canadian passports or green cards for one's children is unequivocal evidence of membership in the Chinese Elite.

In many cases, core goals can be met by doing nothing more than waiting patiently for already-visible internal instabilities to blossom in competing nations and alliances. Those waiting for the U.S. and its dollar to collapse in a heap may find their own stability is more contingent (and fleeting) than they reckoned.

The game is many boards deep. Nobody has god-like powers, every player makes mistakes and miscalculations. The advantages and arrangements are all contingent and temporary; those with the most flexibility and the deepest spectrum of assets will eventually increase their influence at the expense of those with weaker hands and those who fail to respond promptly and decisively to new configurations on the multiple boards in play.

Disclosure: None.

1) The US dollars' rise is due to the fact that its bond selling dollar devaluation scheme is going somewhat wrong. First other countries are now devaluation by the same ridiculous means the US did. Second is the Federal Reserve balance sheet now looks like a overleveraged brokerage firm with stuff they can't mark to market making more QE seem a but absurd. the rising dollar is not good for the US save there is more bond demand.

2) China has a property issue, however it pales compared to the US which has decided to socialize 90% of property through state run entities Fannie and Freddie to keep the market afloat. even then the Federal Reserve must bail them out by giving them liquidity regularly so they can have liquidity to finance more home loans at rates that don't cover default risk and rate rises. The US real estate market is socialistic except when it comes to losses, then it's capitalistic with banks losing nothing and individuals losing it all. This is corruption on both sides.

As for cross citizenship, the US has the same issue mostly for tax dodging. In reality, allowing dual citizenship forces countries to be more equitable to at least its dual holding citizens because it introduces a free market capitalism concept called choice.

3) Russia plays oil games with Europe but the US plays oil games against its own people enabling monopolistic and oligopolistic power to those that pay politically to corner the market in regions and artificially raise prices on the public. California is a good example. Oil is a dirty game. It always has been. The US is in the midst of the biggest glut in oil and prices haven't gone down to pre-recession levels. To keep this from happening oil companies are now trying to export oil so they can justify the price of continuing to import oil. Efficiency is never the model in corrupt business plans to hike prices using the government to screw their own population.

I agree that Russia will rue the day it lost its monopoly oil supply to East Europe. Vacuums always get filled unless prevented by anti-capitalistic regulations that gift monopoly power to a few suppliers like in California.

What do you think could be done (other than regulation) to prevent this unethical and even illegal behavior from happening?

The public must get wise and curb regulatory powers and demand captured regulatory bodies get disbanded or fired. The central bank must never be given the power to print its own liquidity and must represent the public rather than be a bankers union focused on how to keep their banks alive, enrich their execs, and give power to themselves at the cost of our democracy.

We have the tools, democracy and a free market even though the free market is getting gradually distorted and dissolved.

I agree. I hate how ethics are sacrificed for efficiency and profit.