Odds Rising For Inverting Yields, Falling Stocks & Recession

Yesterday the Federal Reserve hiked rates .25%. It is the second time they have tightened this year. And Yellen even laid out the foundation of "quantitative tightening" (QT), which is their beginning to unwind the Fed's $4.5 trillion balance sheet.

How did the bond market react? Interest rates on the 10-year Treasury fell to around 2.10%.

Why? Because bond investors are calling the Fed words, a bluff...

The economic data is all crummy. For instance, the CPI fell 0.1% against economists expectations of a .02% increase. And retail sales had their biggest drop in 16 months. Even the Atlanta Fed revised their Q2 GDP estimates to 3 - 3.2% from last months 4.3% estimate.

These aren't signs of a recovering economy. These are signs that indicate a rather weak economy. And as I highlighted earlier this week, growth in real estate, auto, and commercial loans are spiraling downwards.

What's going on?

The Fed is doing what I thought they would do. They are committing to this tightening 100%, even when the market isn't buying their "economic recovery" banter.

Why are they committed? Because they have no choice...

The Fed isn't blind. Disregarding their smiles and carefully worded speeches, they know things aren't looking good.

After 95 months of expansion, although anemic, since the Great Recession, things are turning. And the Fed knows they must gear up for when a recession strikes.

Imagine what would happen if the economy slides into a recession in a time of near-zero interest i.e. ZIRP (zero interest rate policy)...

ZIRP is the treatment for when recessions occur. Like how a doctor gives his patient antibiotics to cure an infection.

But the economy is dangerously close to a recession. And the Fed can't really cut rates because interest rates are already near 0. They won't get any stimulus from that. Imagine the patient gets another infection while he's still on the antibiotics. The doctor will have to prescribe something far more extreme since using the same dose of antibiotics won't do anything.

Economic research tells that in a recession, the Fed needs to cut rates at least 3% to get stimulus. . .

But interest rates after today sit at 1 - 1.25%. How are they going to be able to cut 300 basis points if they're only at 1%? Well, they can't. And at their current pace of hiking, it will take at least another 1.5 years.

They are racing against time and deteriorating economic growth. Which will come first? Their 3% target or a recession?

The Fed is raising rates only to be able to cut them. And it is beginning to quickly try and clean some of their bloated balance sheet so that they can engage in more bond-buying during the next economic rut.

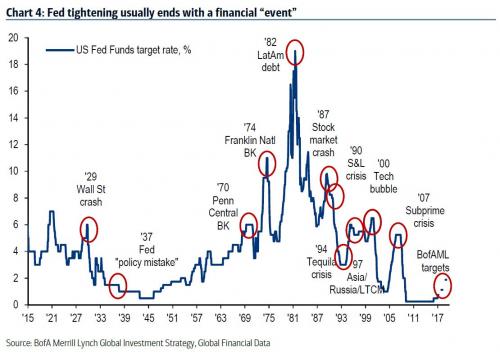

The sad irony is that the Fed's tightening will most likely cause the next recession. So either way, they need to get rates up as soon as possible, no matter the economic data.

But the bond market is catching on. . .

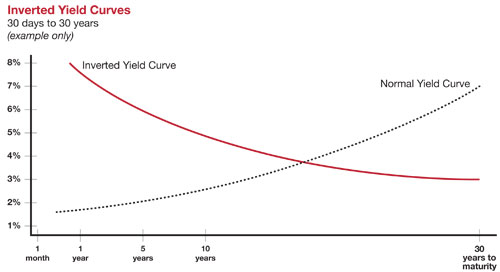

Interest rates are heading toward inverting at this pace. This is when short-term rates rise above long-term rates. Or rather the Fed funds rate (FFR) is higher than the 10-year treasury.

Inversion tells us there is doubt in the economy. Bond investors expect deflation and the Fed to lower rates in the future to combat economic slowdowns. So they lock up longer term yields in advanced.

An inverted yield curve means investors believe they will make more by holding onto the longer-term bond than if they bought a short-term Treasury bill. That's because they'd just have to turn around and reinvest that money in another bill. If they believe a recession is coming, they expect the value of the short-term bills to plummet sometime in the next year. That's because the Federal Reserve usually lowers the Fed funds rate when economic growth slows - wrote TheBalance

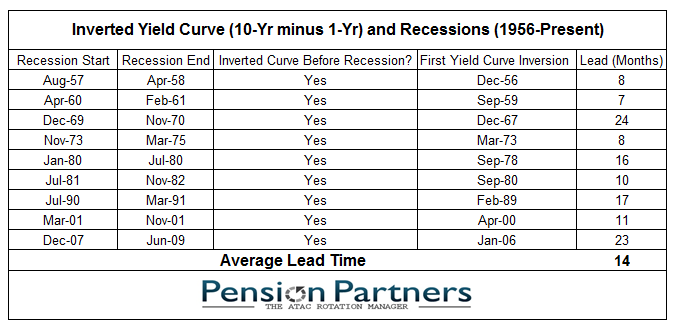

Inversion has preceded the last 9 recessions since the 1960's. . .

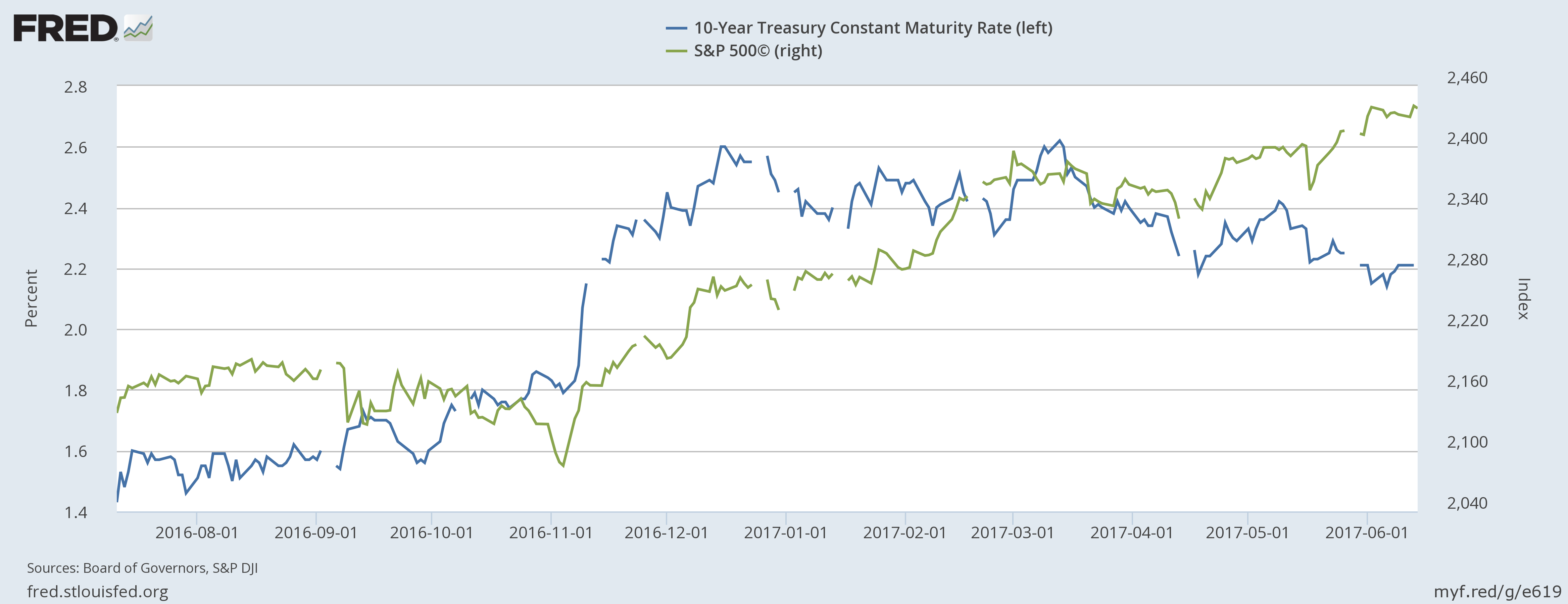

The idea that the Fed is rushing to hike, when data doesn't justify it, to be ready for the next recession is becoming clear. And while bond investors are realizing it, stock traders clearly believe the whole recovery talk.

Even gold is holding strong against rising short-term rates and with the USD bouncing around multi-year highs.

Thus a great divergence between the stock and bond market.

(Click on image to enlarge)

The market was quick to price in Trump's economic stimulus and tax cuts when he was elected. But now it looks like getting congress and the senate to agree and pass those agendas are pipe dreams, at least anytime soon. Bond investors faith since March has diminished in Trumps "reflation".

I believe the economic data, an overly ambitious Fed, the price of gold, and bond markets are all signaling weakness ahead.

There is one question now, when will the stock market converge back with bonds?

Disclosure: None.