NZD/USD Correction To Face Dovish RBNZ Forward-Guidance

The Reserve Bank of New Zealand (RBNZ) interest rate decision may curb the recent advance in NZD/USD as the central bank is widely expected to keep the official cash rate (OCR) at the record-low of 1.75% in November.

It seems as though the RBNZ will stick to the current script at its last meeting for 2018 as officials pledge to ‘keep the OCR at an expansionary level for a considerable period,’ and Governor Adrian Orr & Co. may continue to strike a dovish forward-guidance in 2019 as ‘trade tensions remain in some major economies, increasing the risk that ongoing increases in trade barriers could undermine global growth.’

As a result, more of the same from the RBNZ may drag on the New Zealand dollar, but signs of strong job/wage growth may push the central bank to soften its dovish tone amid ‘early signs of core inflation rising towards the mid-point of the target.’ With that said, a material shift in monetary policy outlook may ultimately fuel the recent advance in NZD/USD as it boosts bets for an RBNZ rate-hike in 2019.

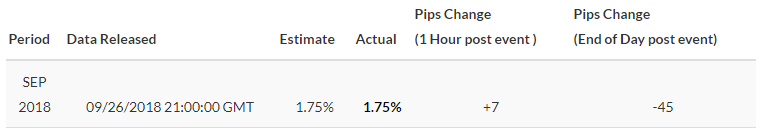

IMPACT THAT RBNZ RATE DECISION HAS HAD ON NZD/USD DURING THE PREVIOUS MEETING

September 2018 Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

NZD/USD 5-Minute Chart

(Click on image to enlarge)

The Reserve Bank of New Zealand (RBNZ) kept the official cash rate (OCR) at the record-low of 1.75% in September and it seems as though the central bank is in no rush to alter the monetary policy outlook as officials ‘expect to keep the OCR at this level through 2019 and into 2020.’ It seems as though the RBNZ will keep the door open to further support the economy as ‘consumer price inflation remains below the 2 percent mid-point of our target,’ and the central bank may continue to strike a dovish tone next year ‘downside risks to the growth outlook remain.’

More of the same from the RBNZ sparked a mixed reaction in the New Zealand dollar, with NZD/USD quickly pulling back from the 0.6680 region to close the day at 0.6611.

NZD/USD DAILY CHART

(Click on image to enlarge)

- Keep in mind, the broader outlook for NZD/USD is no longer bearish as both price and the Relative Strength Index (RSI) break out of the bearish formations from earlier this year, with the exchange rate at risk of extending the series of higher highs & lows from earlier this week as the bullish momentum appears to be gathering pace.

- Will closely watch the RSI as it pushes into overbought territory for the first time since the start of the year, with the oscillator warning of a larger correction in the exchange rate as long as it holds above 70.

- Need a close above the 0.6780 (100% expansion) to 0.6790 (50% expansion) area to open up the Fibonacci overlap around 0.6820 (23.6% retracement) to 0.6870 (78.6% expansion), with the next region of interest coming in around 0.6930 (23.6% expansion) to 0.6960 (38.2% retracement).

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more