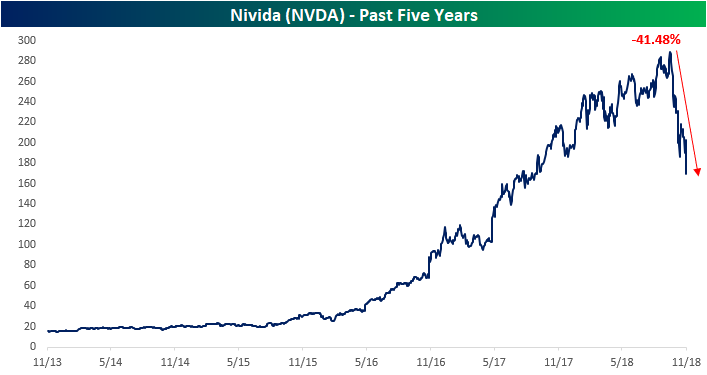

Nvidia Falls Off A Cliff

To say that Nvidia (NVDA) has had a rough fall would be an understatement. The severity of this recent downturn is striking on a longer-term chart (see below). The stock has more than erased its YTD gains at this point, falling to its lowest levels since the summer/early fall of 2017. Since peaking on October 1st, the stock has been closing in on eliminating half of its value. After last night’s earnings report, which missed analyst expectations for revenues and lowered guidance, the stock has fallen another 17%+ as of the time of this writing. This was the second quarter in a row in which the company lowered guidance; a rare occurrence considering guidance had been raised the prior 11 quarters.

The weak earnings report partially comes from an excess in inventories that the company reports could take some time to wind down. Another factor playing into the decline in revenues as well as the build-up in inventories is the winding down of the boost from the cryptocurrency craze. It has to be noted that everyone’s desire to be a Bitcoin billionaire was not what necessarily led to Nvidia’s growth; it was more supplementary in the past year. That exponential growth had been in place for a few years prior. In the case of NVDA, on the backs of a few years of explosive growth—and as a result, explosive growth in expectations—this decline may simply be that investors are re-evaluating if this candle will continue to burn twice as bright.

From the chart below, the stock’s multi-year uptrend is clearly broken.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more