Nothing But Sunshine For This Cloud-Based REIT

Yesterday I wrote a Forbes article in which I described my reasons for selecting Don Wood, CEO of Federal Realty (NYSE:FRT), as the best chief executive in REIT-dom. I explained my reasoning as follows:

In an effort to measure leadership within the REIT sector, I decided it would be interesting to rank CEOs based upon their overall worth. Not just a personality contest, but instead I opted to take a more tactical approach based on hard analytics, weighted on crucial metrics such as dividend safety, shareholder returns, and market capitalization.

The battle for the top spot was based on a number of factors, and it is my hope that the "article can also serve as a "wake up call" aimed at certain REIT board members who don't see their company on the list."

However, one CEO that did make the cut, with the least experience in the "corner office" is William "Bill" Stein. In my analysis and final ranking, Digital Realty's (NYSE:DLR) CEO was #8 and his performance since being designated as the chief of the enterprise was 91% better than the US Equity REIT average.

Digital's previous CEO, Michael Foust, "departed" on May 17, 2014 and previous CFO, Bill Stein, was named interim CEO. At the time of the "boot", Digital's chairman said,

The board and Mike mutually agreed that it was an appropriate time to find the next leader to help guide Digital Realty to the next level and scale of operational sophistication.

Digital had severely underperformed prior to previous CEO Michael Foust being shown the door in March, and he since he took over (May 2014) shares were up over 35%.

Confidence in Stein and in Digital has continued to grow and in this article I will examine the blue chip characteristics that validate my stake in this best-in-class data center REIT.

Why Data Centers?

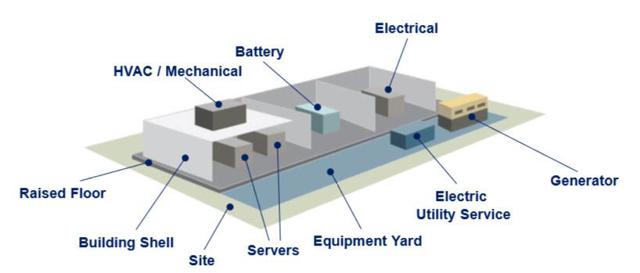

Data centers are designed to house and store data and network equipment. They provide a highly reliable, secure environment with redundant mechanical cooling systems, electrical power systems and network communication connections.

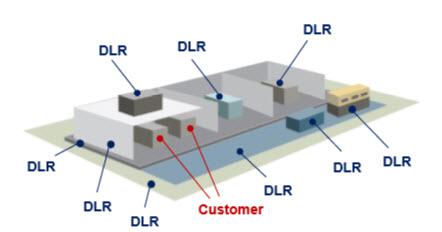

Digital Realty generates around 60% of its customer-driven data rental income as Turn-Key Flex. These properties are fully-commissioned, flexible date center properties with dedicated electrical and mechanical infrastructure. Digital Realty makes the capital investment in the infrastructure and the projects are complete in 26 weeks.

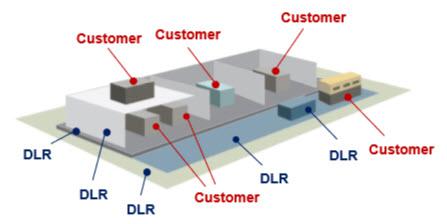

Digital Realty generates around 25% of its rental income as Powered Base Building®. These are master planned facilities with power and network access. The tenant makes a significant capital investment in the data center infrastructure.

The remaining (~15%) of ABR is generated from colocation (7% of ABR) and non-core assets (6% of ABR).

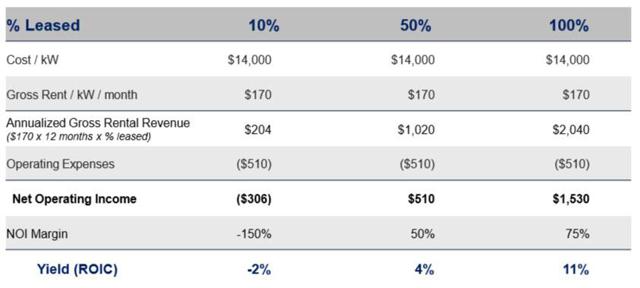

Digital Realty's core business (Turn-Key Flex and Powered Base) provide attractive returns. Here's a snapshot of the economics of a sample development project - as the buildings reach stabilization (100% leased) the data centers generate 10%-12% un-leveraged returns.

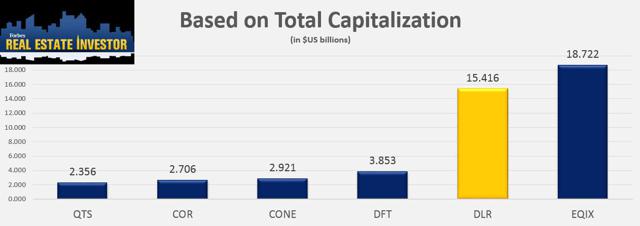

The World's Largest Data Center REIT

Digital Realty is one of the 20 largest REITs in the US. The company has a Total Capitalization of around $15.416 billion and equity market cap of around $9.1 billion.

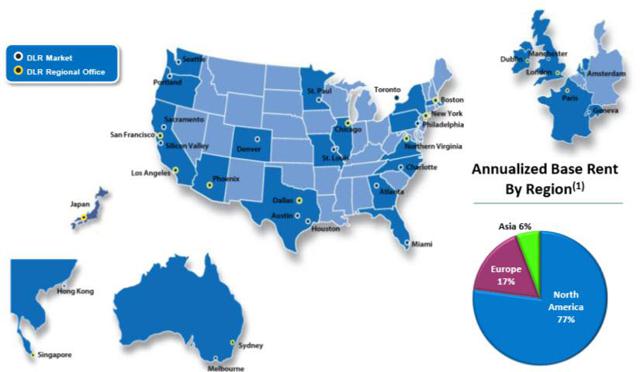

Digital has a diversified portfolio of 130 properties located in 30 markets throughout North America, Europe, Asia, and Australia. The portfolio is over 24.6 million rentable square feet and includes 1,2 million square feet of active development and 1.3 million square feet held for future development.

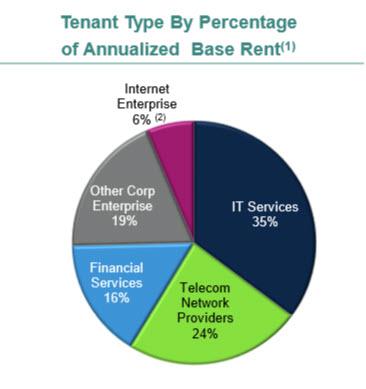

Here's a snapshot illustrating Digital Realty's tenant type:

Digital has no single tenant that accounts for more than 8% of ABR and the company generates a healthy mix of big data providers and cloud service providers. Equinix (NASDAQ:EQIX) is now structured as a REIT and Digital has locked-in long term (15 year) leases with the competing peer.

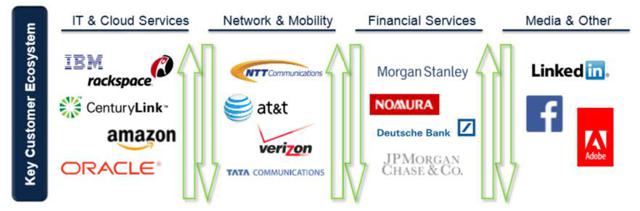

Digital enjoys a vast ecosystem network with over 1,000 network service provider available globally.

Here's a snapshot of Digital's powerful ecosystem supported by multiple campus locations:

The snapshot below illustrates Digital's highly diversified customer base:

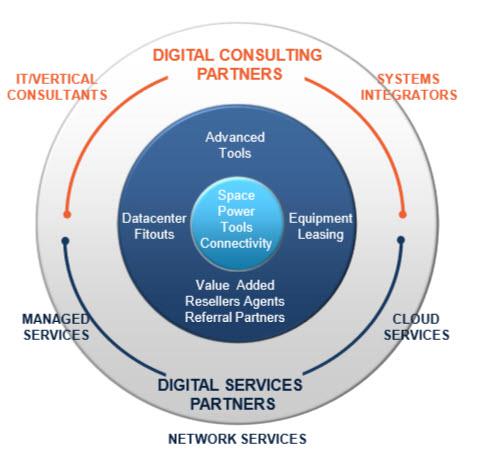

The snapshot below illustrates Digital's strong global alliances and vast partnership network:

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more