Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at Treasury, it was to be reassuring with what sounded like specifics; a message of “we are working on it.”

Given the nature of the downturn, the issue of banks had to be addressed in the color of currency elasticity.

Yesterday, Secretary Geithner announced a new plan that will partner government resources with private investment to buy up the assets that are preventing our banks from lending money. And we will continue to do whatever is necessary in the weeks ahead to ensure the banks Americans depend on have the money they need to lend, even if the economy gets worse.

No one could argue with the goal, but in the end the idea was simply undone by another mischaracterization. Asked specifically about Chinese leaders who had “publicly expressed an interest in an international currency,” the President responded with a long homily on American strength before being pointedly asked one more time if the subject should be addressed.

I don’t believe that there’s a need for a global currency.

It was a fundamental misunderstanding of both the Chinese critique as well as the monetary system as it was and remains. The eurodollar has been the global currency effectively for half a century, and what the Chinese would have asked of President Obama wasn’t whether one was needed but rather if a different one was needed.

I have always found it unsettling that the Chinese communists have known more about the dollar than anyone at the Treasury Department. What PBOC Governor Zhou had specifically warned about in March 2009, writing out his thoughts for publication by the Bank for International Settlements, was for world leaders to first understand the true nature of the problem before setting about to create solutions to it. The world didn’t run on dollars, but credit-based currencies that were linked in ways unimaginable to almost every other policymaker.

I don’t want to discount the politics of global money, as clearly there is always an impulse for China, Russia, or whomever else to agitate. But China also had a working knowledge of it that, again, escapes even today almost all commentary about it. In July 2008, after having de-pegged CNY from the dollar three years before and allowing a managed float supposedly indexed to a basket of other currencies, the PBOC once again re-pegged CNY. Had it happened a year or two earlier, it would have been the only topic of discussion, especially on the side of US politics and economics, but in the summer of 2008 the world was, to put it mildly, distracted.

The problem really was that CNY’s re-peg and those diversions were one and the same. It wasn’t coincidence that the PBOC’s reneging on the “managed float” occurred within two days of the final top in oil or copper. When the real reserve currency, the eurodollar, made its presence felt even the vaunted PBOC had to tread very, very carefully. A week after the President’s press conference in March 2009, of the few who noticed CNY’s carefully laid sideways track wondered why if China’s central bank was willing to do that they weren’t further willing to just let CNY drop to at least “stimulate” their export sector in bad need of a push. Chief economist for CLSA, Eric Fishwick, wrote:

The economic rationale for that [letting the yuan depreciate] is quite compelling. Why isn’t it happening? One explanation is that it would be seen as inflammatory in an already troubled international trade environment.

According to the BIS in December 2009, however, the Chinese had done it – just not against the dollar. They calculated that after letting CNY rise 14% in 2008 against the currency basket, it fell 9% in 2009. They clearly pegged to the dollar and only the dollar for a reason, yet that reason seems to have escaped everyone. Given the events of that time, this should not be especially surprising.

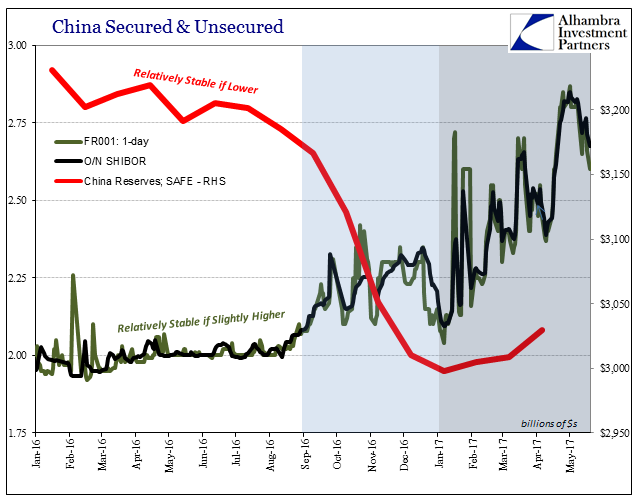

In the eight years since, CNY has been re-pegged two other times (by my definition). The next one occurred from mid-March 2015 until August 10, 2015, ending badly for everyone and similarly the mainstream unsure why that was. The third is as of today still ongoing, though much looser in terms of intraday volatility, but a steady sustained sideways nonetheless.

What is common about the last two, and even much of the first re-peg? The world in March 2015 had suffered several “unexpected” shocks, an oil price crash, the prospect for a ruble collapse, and then the Swiss National Bank being knocked off their peg to the euro. Again, the were seemingly unrelated events by traditional views, but all sharing a single common source. The world of March 2015, however, seemed to be following Janet Yellen’s prediction for “transitory” weakness and disruption. It was under that banner the PBOC proceeded.

The characterization might be different today, but from mid-December 2016, CNY’s reborn peg to the dollar takes place under almost exactly the same anticipation – the world is getting better. It is a pocket of calm following an enormous storm, which only raises further questions particularly since the that last re-peg ultimately failed and did so spectacularly. If there is a difference between them, it is that since 2014 the eurodollar appears to be angrier with Asia than Europe or elsewhere, the perhaps inevitable condition of its post-crisis evolution (toward Japan and FX).

Recognizing the eurodollar system for what it is and was, the first of them actually could be considered along the same lines. Though the initial period of CNY/USD stability took place during global panic, it was more so one centered in the European eurodollar rather than the Asian (apart from Japan). Thus, CNY stability, even artificial, appears to be a prophylactic response, so that China didn’t suffer the immense pressure created by “dollar” demise. They kept at it until May 2010 when China’s apparent and expected recovery at that point provided a sharp contrast to the growing unease over same in the West.

In other words, the Chinese have in these instances no desire for further “devaluation” as that would be the worst possible occurrence. Instead, they will expend great resources to keep CNY stable so that whatever “dollar” issues might hopefully work themselves out. Given this situation, again politics aside, you can appreciate why Chinese officials would be so keen on replacing the current global monetary arrangement with something else; anything else, even the ridiculous SDR’s that Zhou argued for in 2009. An illegitimate idea of the IMF was preferable to the eurodollar, and history has only shown that at least in terms of the latter as bad as it was then it never got better for China.

We can further appreciate why they might in March 2015 go for it again, because at least at the end of the first re-peg China emerged about where it expected to be; on the upswing. Imagine, then, their surprise at the end of the second when “dollar” pressure was so intense that it against all considerable effort totally overwhelmed the Chinese central bank. Consider that during the worst, supposedly, global monetary crisis since the Great Depression, Chinese officials handled CNY pegging for almost two years without further incident; but were only able to in 2015 manage less than five months before it chaotically blew up the second time. Having then experienced the exact “wrong” outcome after that second, why would the PBOC then opt to try for a third?

The answer, I believe, is simple enough; they don’t think they have any other option. It’s give fake stability another chance or be resigned to the “dollar’s” ultimate fate. They are stuck, caught, as I wrote yesterday, between a rock and a hard place, where, ironically, the eurodollar is both of those! Maybe in March 2009 it was too much for arrogant officials like Ben Bernanke to be told they had no idea what they were doing (even as it should have been obvious by the results) but how about almost a decade later? Maybe the Chinese weren’t the best way to offer up such criticism, how about now?

It seems so simple yet for Economists it can’t be; understand the problem before trying out often very intrusive “solutions.” The symptoms are just as easy, for every time CNY gets re-pegged there is absolutely no question why.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more