Non-Farm Friday: Is America Working?

It's Non-Farm Payroll Day today.

We should be around 160,000 jobs and this is Obama's last report card as we approach 15M jobs added since 2010. This ranks Obama way behind Clinton, who created 22.9M jobs but still, it's a pretty good number. Much more important than jobs, however, is hourly earnings and those have been rising steadily over the same period and that's the number we need to watch for signs of whether or not the economy is healthy.

President Trump (get used to it) saved 800 jobs yesterday at a cost of just $7M in addition to continuing to provide United Technology (UTX) with $6 BILLION in defense contracts which make up a good portion of their $7.5Bn in profits. UTX thanked the President by shipping 1,300 jobs overseas anyway and closing another plant in Indiana – the state whose taxpayers are on the hook for the $7M bailout of the hugely profitable corporation.

CNBC analyst Jim Pethokoukis said Trump's speech at Carrier yesterday was "absolutely the worst economic policy speech since Mondale" but that's not fair as Trump isn't actually President yet so we shouldn't count it – I'm sure he'll be able to top it once he's actually in office – there's no way Trump will let himself come in second to Walter Mondale!

"The idea that American corporations are going to have to make business decisions, not based on the fact that we've created an ideal environment for economic growth in the United States, but out of fear of punitive actions based on who knows what criteria exactly from a presidential administration. I think that's absolutely chilling," he said in an interview with CNBC's "Closing Bell."

And that guy works for a CONSERVATIVE think tank!

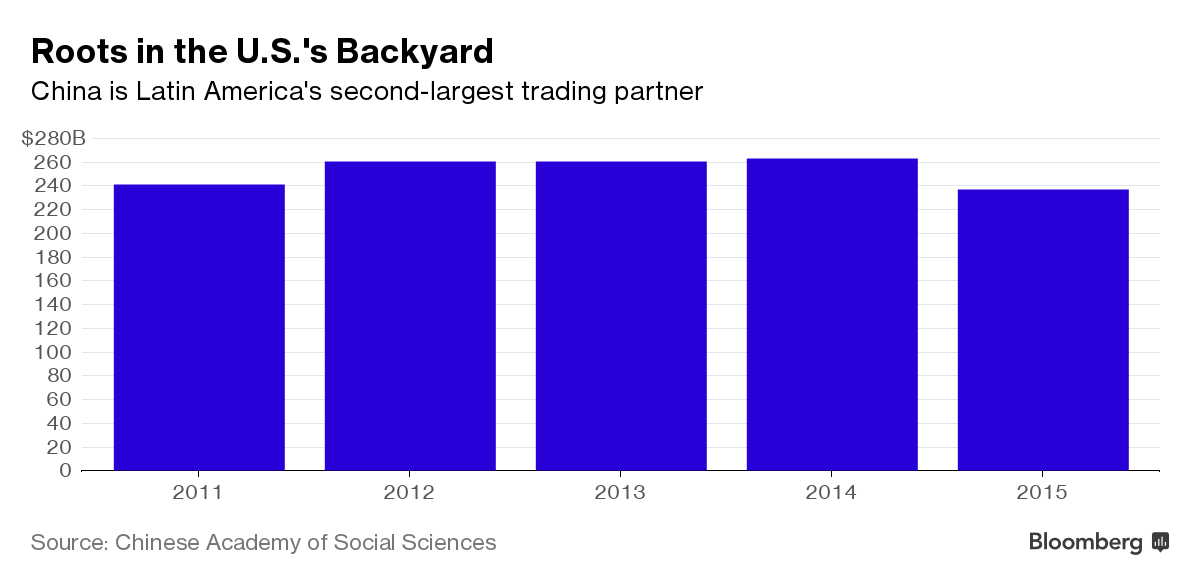

This is going to be a fun four years and I'm very excited by the trading environment, with Presidential tweets moving the market up and down regularly. Meanwhile, China is wasting no time at all filling the Global leadership gap as President Xi headed straight to Latin America where he's set up a huge trade deal with Ecuador, raised the diplomatic status of Chile and initiated trade relations with Peru. China already has a wall but they've been reaching over it to make deals right in our back yard.

Now China finds itself in position to become Latin America’s primary growth driver, increasing its chances of surpassing the U.S. as the region’s largest trading partner. Trump, meanwhile, is vowing to crack down on immigration from places like Mexico and withdraw the U.S. from the 12-nation Trans-Pacific Partnership free trade pact, which includes Chile, Mexico and Peru.

Xi signed more than 40 deals – spanning agriculture, energy, finance, infrastructure, technology, tourism and other areas - during his week-long visit to the region, his third since becoming president in 2013. He upgraded Ecuador and Chile to “comprehensive strategic partnerships” and expanded trade deals with Chile and Peru. A delegation of 35 Chinese entrepreneurs from banking, construction and telecommunications expressed interest in investing in Panama’s energy and port sectors after concluding a visit to the Central American country Friday, according to the official Xinhua News Agency.

Meanwhile, the bond route continues as the 10-year note is up 40% from it's lows of the year(1.5% to 2.5%) and that would be my top concern over the weekend (especially if we pop 2.5%) but then there's Italy, who have a referrendum on Sunday that could lead to the unwinding of the entire EU – so maybe some fun chaos to look forward to on Monday!

As noted by Business Insider:

Investors need to care about this because the market has decided that this vote is an indicator of Italy’s ability to make much needed reforms and that matters because of the impact of Italy’s banks and sovereign debt. The actual quality or validity of the reforms proposed in the referendum have become almost meaningless.

If contrary to the polls the “yes” vote wins, Italian bonds and banks will rally and the MIB (Italian stock index) will have a huge relief rally, particularly given its over-exposure to banks, and the euro will likely strengthen relative to other currencies.

If the polls are right and we see a “no” vote by a large margin, Italian yield spreads over German bunds will widen a lot. Italian bank stocks will accelerate downward and Banca Monte dei Paschi di Siena (MPS) will likely need external aid, which will put the European Central Bank in the hot seat, and all eyes will be on German Chancellor Angela Merkel who is also watching Germany’s Deutsche Bank spiraling downward.

If contrary to the polls the “yes” vote wins, Italian bonds and banks will rally and the MIB (Italian stock index) will have a huge relief rally, particularly given its over-exposure to banks, and the euro will likely strengthen relative to other currencies.

If the polls are right and we see a “no” vote by a large margin, Italian yield spreads over German bunds will widen a lot. Italian bank stocks will accelerate downward and Banca Monte dei Paschi di Siena (MPS) will likely need external aid, which will put the European Central Bank in the hot seat, and all eyes will be on German Chancellor Angela Merkel who is also watching Germany’s Deutsche Bank spiraling downward.

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more