No More Subtleness – It’s Show Time!

On May 1st, we knew that the precious metals sector was starting a 2-week rally based on cyclical turning points, apex-based reversals, and True Seasonality for May. The rally is over, the profits cashed in… And growing once again thanks to the new short position. What’s in store for the rest of the month and the next few ones? Something epic.

Let’s start today's analysis with the two most important short-term reasons due to which the outlook for the precious metals sector just became very bearish.

Breakout and Breakdown

(Click on image to enlarge)

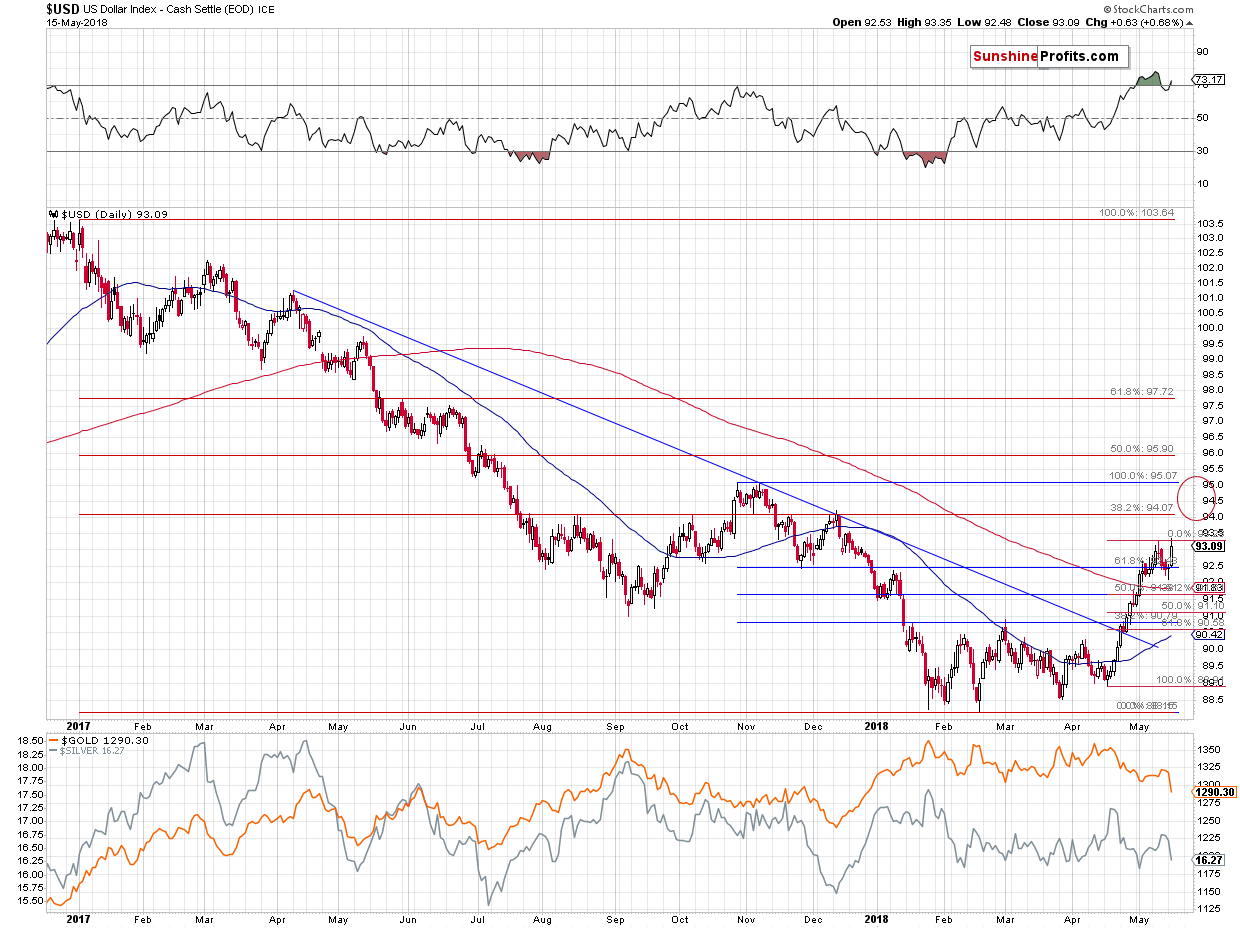

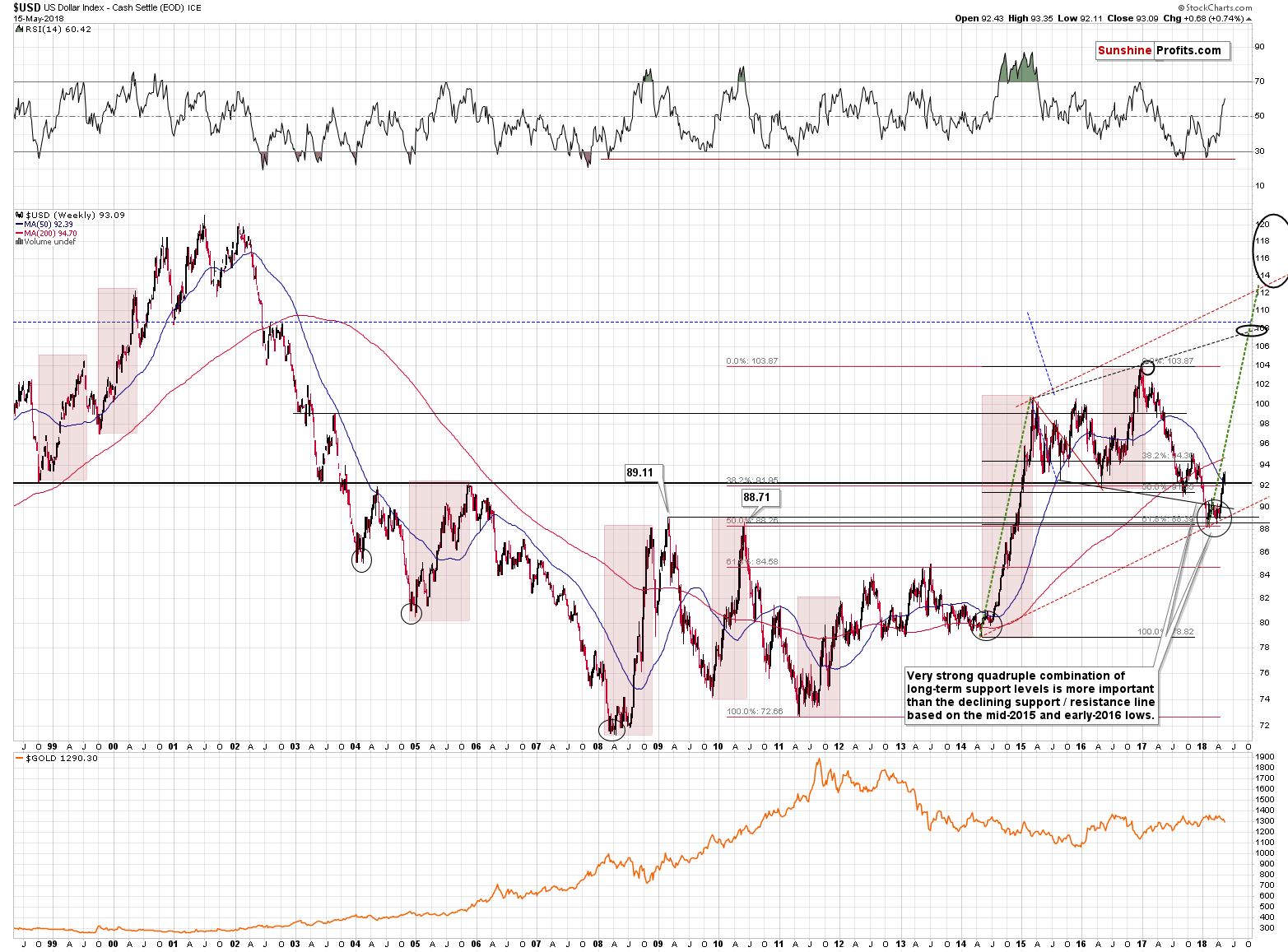

The situation in the USD Index was the only thing that had bullish implications for the PMs and based on what happened yesterday, the implications are now bearish. The USDX moved to new 2018 highs in terms of both: intraday and closing prices. This invalidates the previous theory according to which there will be another short-term downswing after a few days of pause. Based on the breakout, this is no longer likely. Instead, the USD is now likely to move to the next resistance or even higher (in fact, our short positions in EUR/USD are already profitable). The next two target prices are at about 94 and 95. The former is provided by the December 2017 top and the latter is based on the October / November top. The 94 level seems more important as its strengthened by the August and early October tops and the 38.2% Fibonacci retracement level.

There is something else that is only visible on the above chart if one knows how to look. It’s the indication that we shouldn’t put too much weight on the USD Index’s signals in the next few months when it comes to predicting gold prices.

We just saw a powerful weekly reversal in the USD Index and it seemed to be a major bullish factor for metals and miners. It turned out that the PM-specific factors like True Seasonals and apex-based reversals were much more important. Plus, if the current rally is indeed going to be similar to the 2014 one, then predicting any pullbacks will be very risky.

(Click on image to enlarge)

There were very few corrections in the second half of 2014 and in early 2015 and timing them would have been extremely difficult.

Consequently, going forward, it will be important to focus on what’s going on in gold, silver, mining stocks, their ratios and in the proprietary tools and techniques, and only look at the USD for possible confirmations. The USD on its own, however, may not have enough technical predictive power in order to make us keep or exit a certain position.

All in all, the first short-term development that made us double the size of the short position was the breakout in the USD.

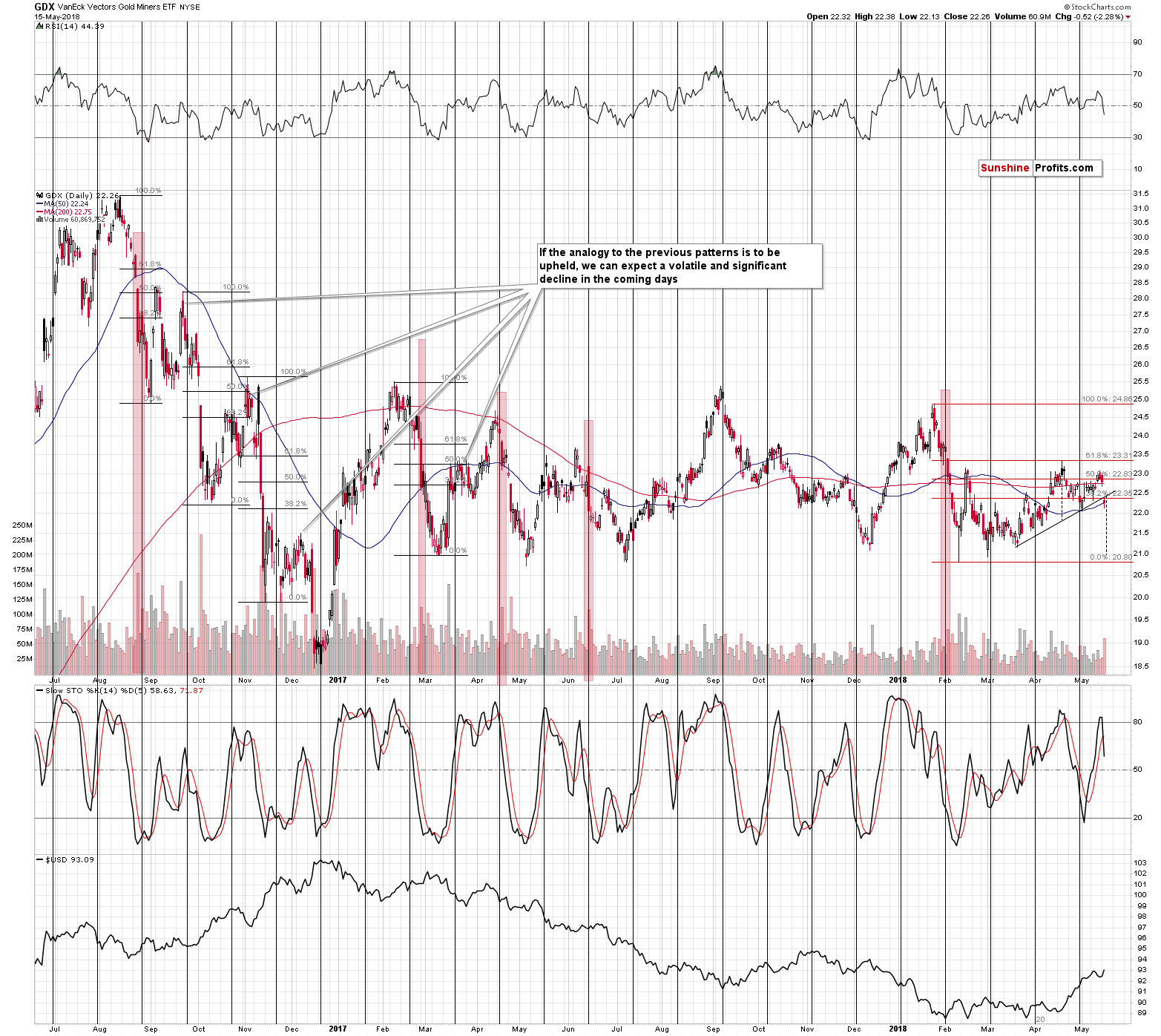

The second development was the breakdown in the GDX ETF.

(Click on image to enlarge)

The breakdown is clear and it took place on huge volume. While its usually best to wait for two additional closes below a certain price level, based on the size of the volume, we can say that the breakdown was already verified in a way.

Moreover, yesterday’s decline created and completed a bearish head-and-shoulders pattern. The minimum target based on this formation can be obtained by applying the size of the head to the price of the breakdown. We marked both with dashed lines and based on this technique it seems that the GDX is about to decline to the previous 2018 lows. At about $21.

However, there are two factors that suggest that miners will decline much more. The less important is the analogy to the late-2016 declines. The double / triple (when counting this month’s upswing) move back to the 50% - 61.8% Fibonacci retracement levels makes the entire 2018 performance similar to the short-term downswings that we saw in late 2016. If the similarity is to continue, then the first big sharp move lower is just a start of something much bigger.

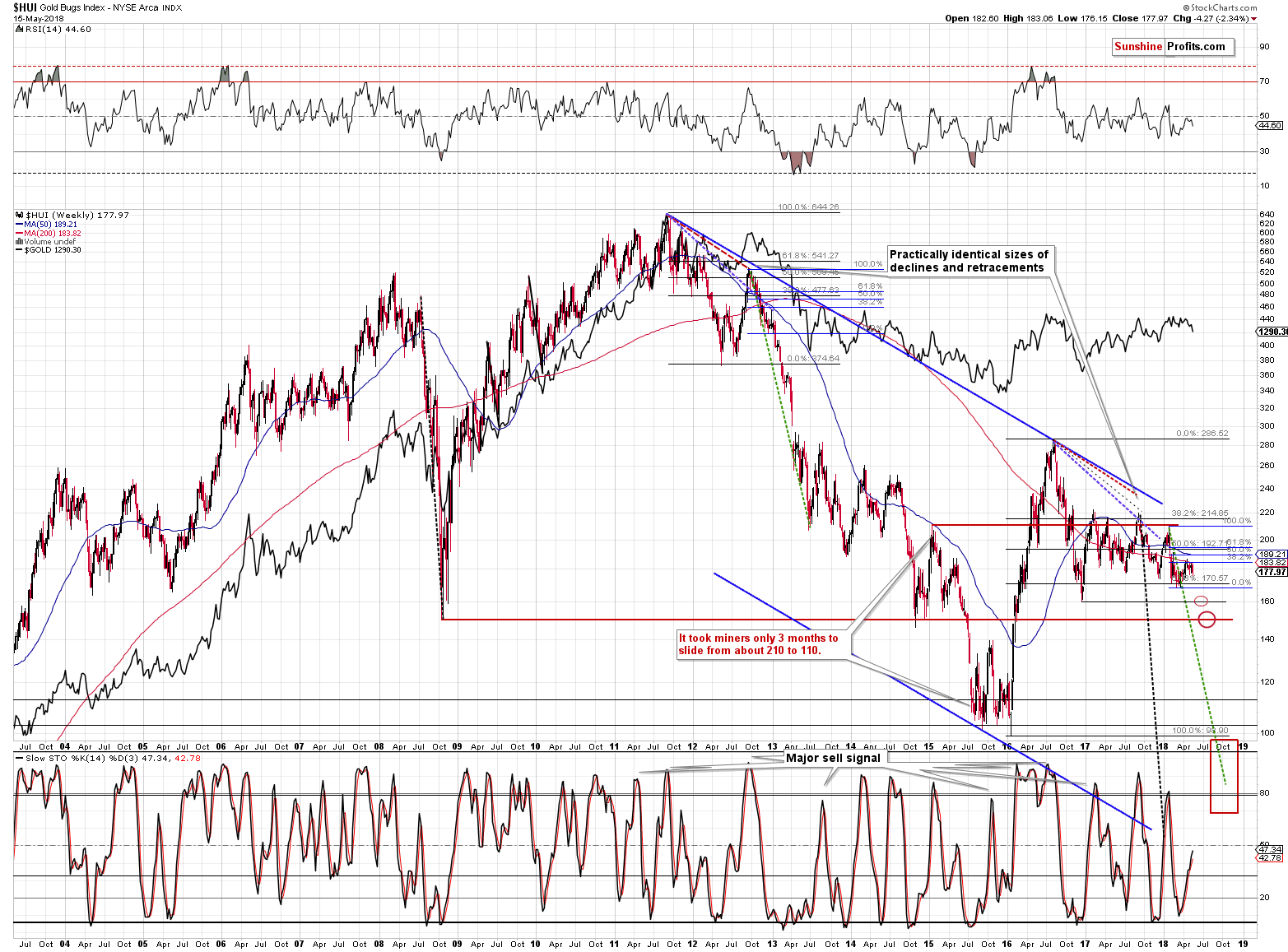

The more important factor is the analogy to the 2012-2013 decline.

So Room Much to Decline, So Little Time

(Click on image to enlarge)

Based on the 2012/2013-now analogy, it seems that the most recent upswing was nothing more than just a final pause before the big drop. The decline is lightly to be sharp, as the final bottom is likely to be seen in late September or early October and this leaves just a few months for the prices of mining stocks to be cut in half or so. This means that the declines are likely to be significant and quick and corrective upswings very tricky.

There are 3 nearby support levels – one at the previous 2018 lows, the second at the late 2016 low (at about 160), and the third one at about 150 – at the 2008 and 2014 low. Once the latter is taken out, there will be little to prevent a slide to 100 -110 level.

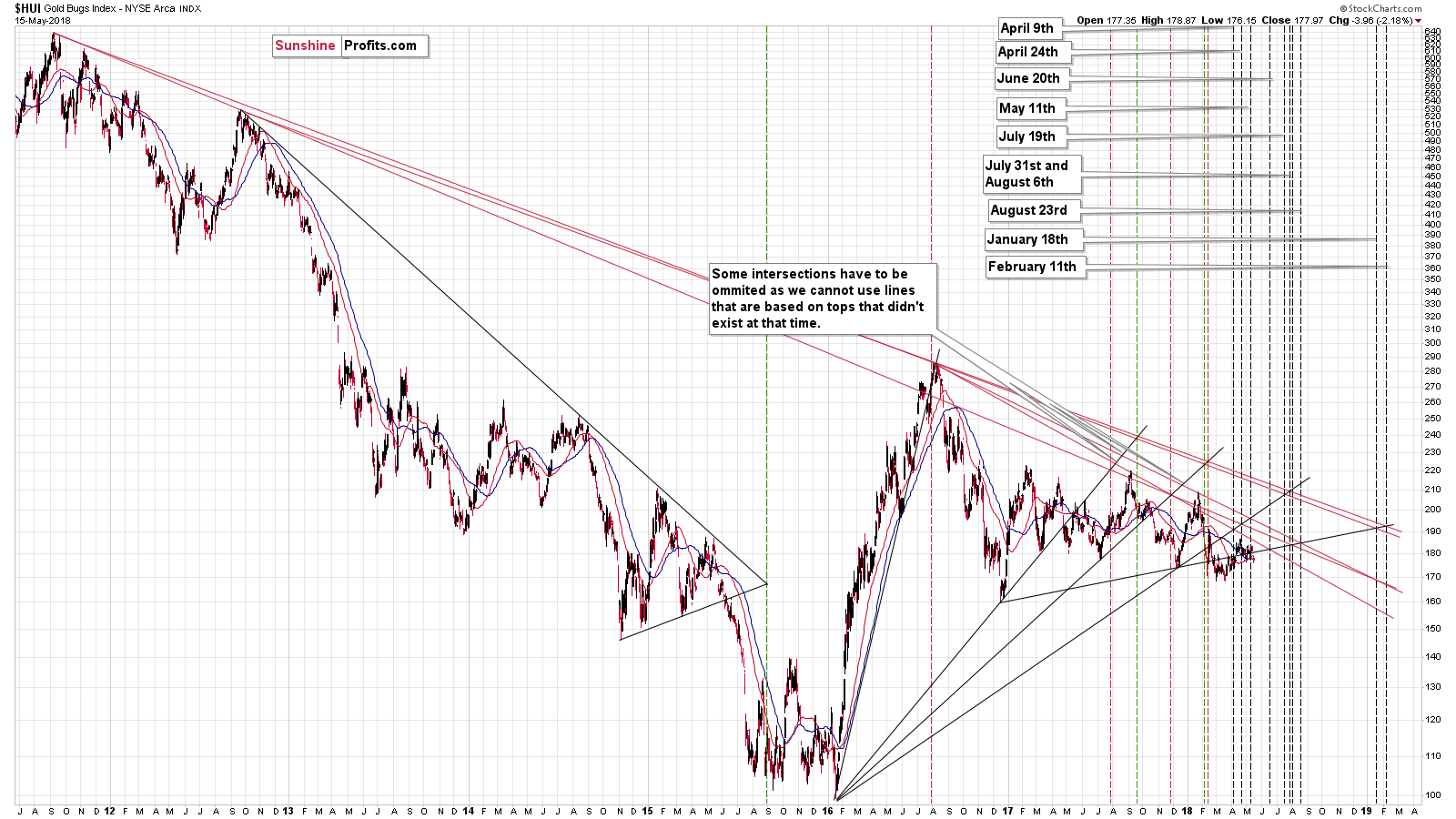

According to the long-term apex-based reversals for the HUI Index, there might be even less time.

(Click on image to enlarge)

There are several reversals in the middle of the year – in late July and in early August. There’s also one on August 23rd. Does it seem familiar? It should, because that’s what we saw in the second half of 2015, before the final bottom, but relatively close to it.

If the multi-year decline in the precious metals and mining stocks is about to end, then we can expect it to end in a similar fashion to what ended the big medium-term decline in 2015 and that’s exactly what the apex-based reversals are suggesting.

If there are multiple bottoms at similar price levels and the biggest support close to 100, then we shouldn’t be surprised if the HUI moves close to this level in late July. That’s about 9-10 weeks away, which is very little time for about a 70-index-point decline. There might be ups and downs during the decline, but overall that would be a very steep move – about 7 index points a week. Trading in and out of this market may be extremely difficult and it might be better to simply buckle up and ride the slide until the HUI is much lower.

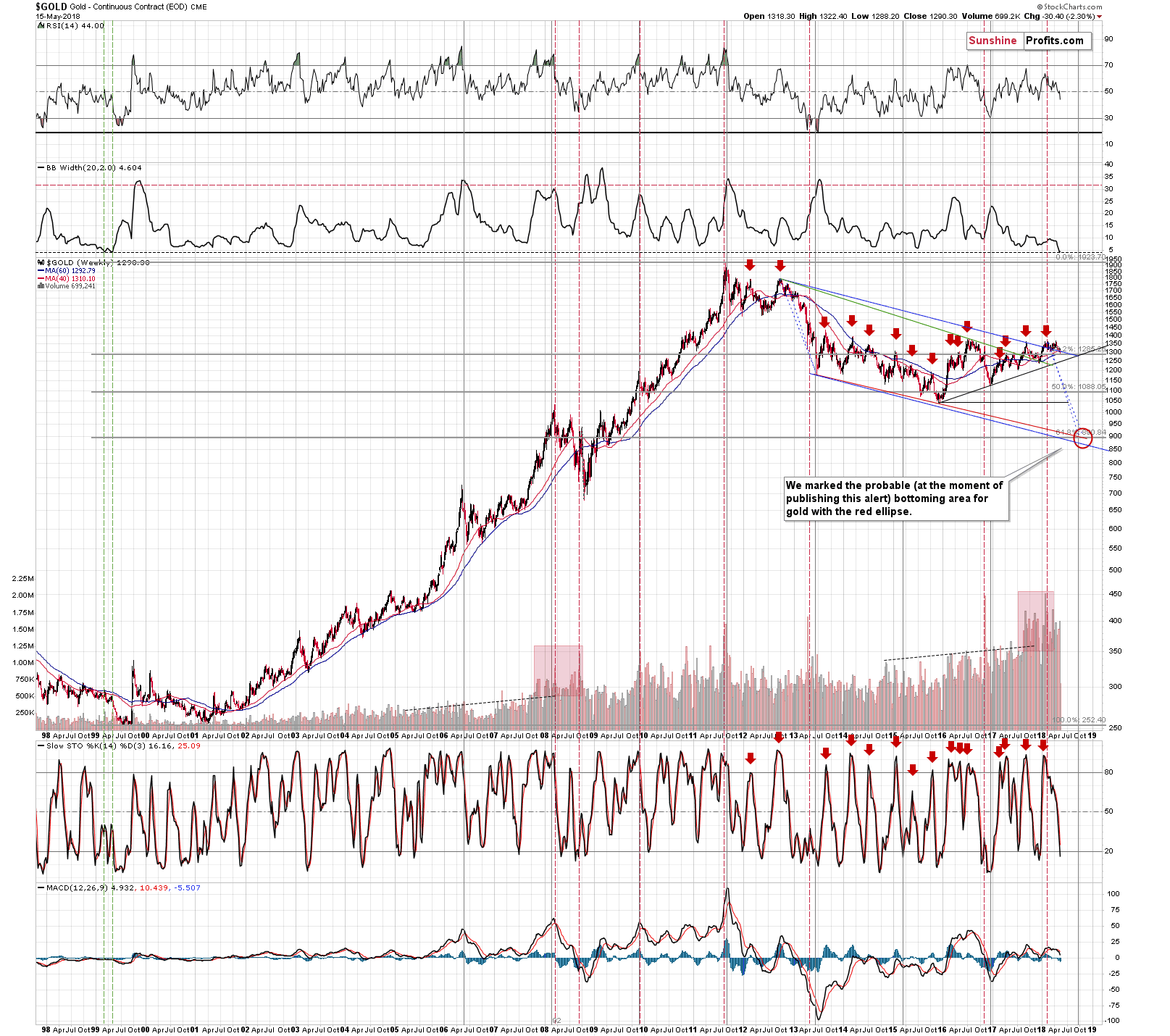

(Click on image to enlarge)

The decline could be very steep based on the very long-term gold chart as well. The Bollinger Band’s width (second indicator from the top) just moved to an extremely low level. This means that the gold price volatility is extremely low. This is exactly what one can see in a market right before a huge move. This is the calm before the storm and the indicator shows just how calm it is from the long-term point of view.

It’s been almost 20 years since the Bollinger Band’s width was this low. We saw it two times in the first half of 1999. Both times were seen right before declines.

Do you know when the final slide of 1999 happened and when it ended?

It started in May and it ended in mid-July, but the true rally started in mid-September.

Please note how perfectly it fits what we wrote earlier, based on entirely different techniques. The decline already began this month, the apex-based turning points suggest an important bottom in late July and/or early August and gold’s apex-based reversal along with the very long-term turning point suggest a major turnaround in late September or early October.

Now we also have a confirmation from the analogy to 1999 that’s based on the extremely low reading in gold price’s volatility.

Summary

Summing up, based on the apex-based reversals, True Seasonal patterns for gold, silver and mining stocks and the way the latter performed yesterday, it seems that the local top is already in. The USD Index broke out and it ceased to have bullish implications for PMs and started to have bearish ones.

Based on the support level that was reached in gold, some kind of corrective upswing was likely, but we already saw a small move higher during overnight trading, so the upswing may already be over.

Those, who position themselves to profit on the upcoming decline in the precious metals sector, instead of being hurt by it, will likely – in our opinion – reap great rewards in the coming months.

Disclaimer: All essays, research, and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more