No Longer Overseas

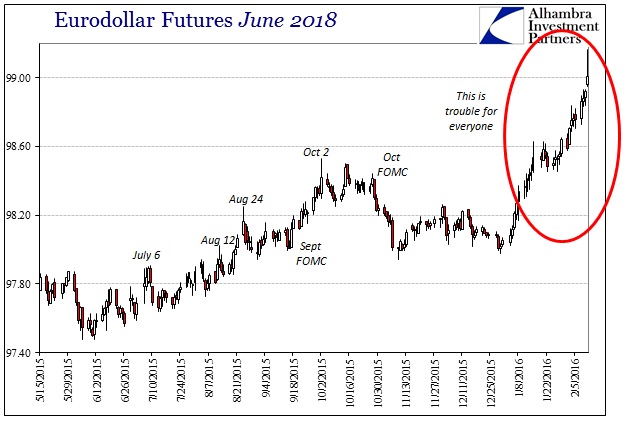

I use the June 2018 eurodollar futures contract as a significant benchmark in my analysis of money markets because I feel it represents a solid cross section of sometimes conflicting influences. It’s close enough to the front end as to be significant both in terms of monetary policy as a factor but far enough to be as heavily if not more representative of intermediate economic expectations. And on that account, there is still enough volume and open interest where the depth of liquidity cannot be questioned.

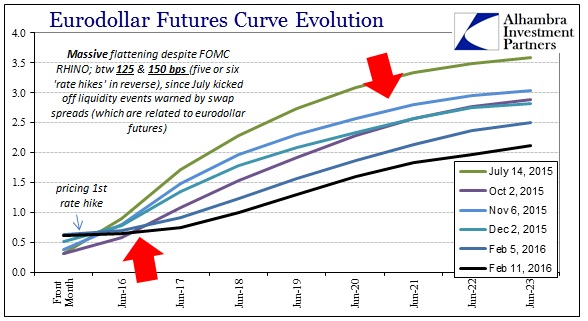

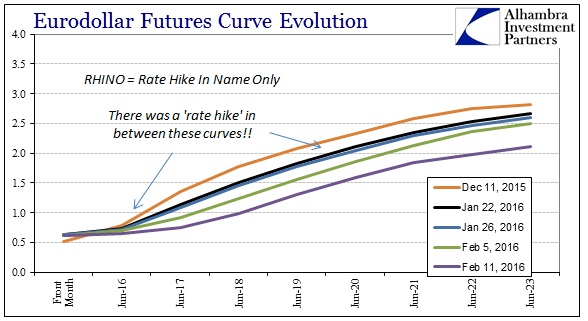

As of yesterday, the CME reports open interest of 416,955 contracts each for delivery of $1mm, meaning $417 billion or so in gross contracts written. Thus, to see it move so far so fast being bid is simply astounding. This morning, the June 2018 was as a high as 99.165! In closing price alone, currently at a still impressive 99.01, that’s 30 bpsjust this week. And that follows a mind-boggling collapse (for Yellen’s dreams) 103 bps in 2016 alone. Yellen ordered a quarter-point hike in federal funds and received instead four of them in reverse across the much more significant and important eurodollar complex.

We must be mindful, too, that China is closed all during this week, surrendering an easy and overseas story for causation. I don’t think China is out of the equation entirely, especially via Japan, rather it seems though the current flurry of bearishness is eurodollar all its own. The curve collapse is similarly beyond easy description.

What has happened in just one month (or so) had until January typically taken three months or more to accomplish. I think that offers sufficient commentary on the state of liquidity in the eurodollar world at this moment, apologies to the FOMC.

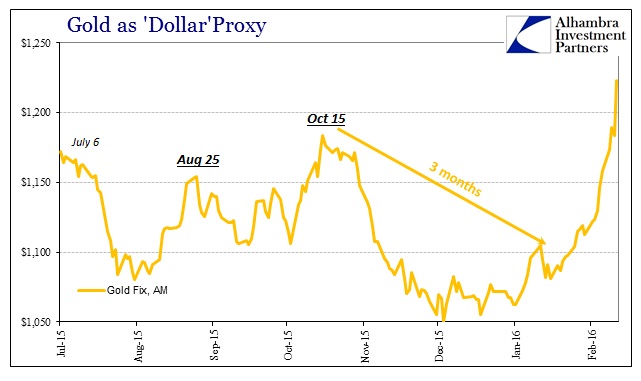

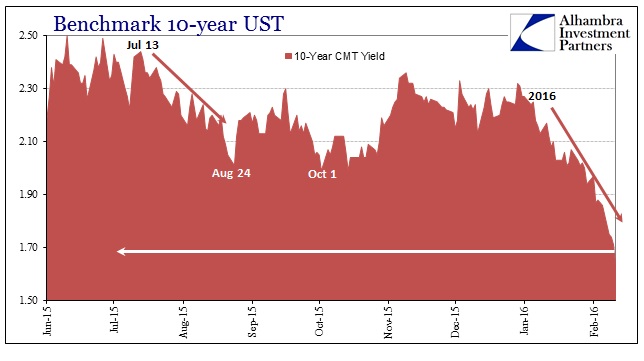

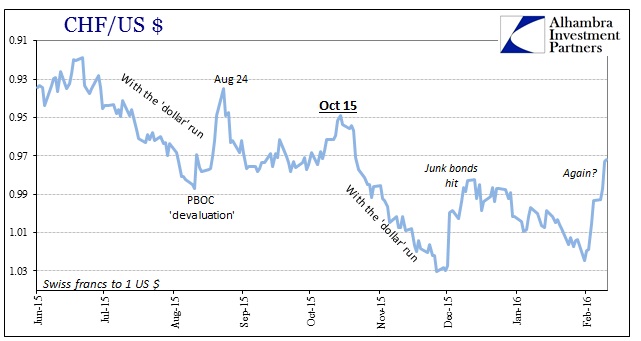

As such, any and all of the “safety” assets and bids are just as active and impressive; from gold to UST’s to the usual suspect currencies especially yen and franc.

If I am right about Japanese banks acting a primary “dollar” conduit for China, and I think that increasingly likely, then what will China look like on Monday for reopening? I doubt very much as if PBOC officials and really the trading and planning staff were able to participate in the holiday; many candles likely burnt at both ends.

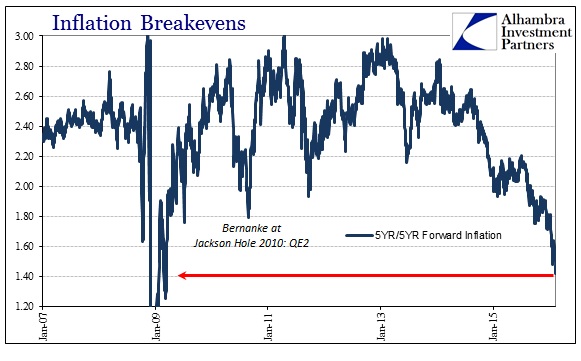

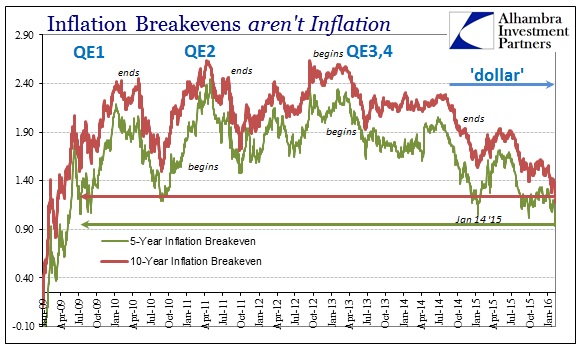

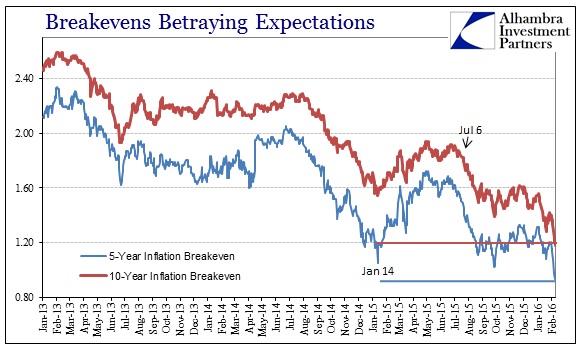

This week, however, still needs conclusion with the economic picture having been unbelievably darkened by the scale of the liquidations this week. In what might be Yellen’s greatest rebuke, 5-year/5-year inflation forwards collapsed today to the lowest level since March 3, 2009. The longer she holds to “professional forecasters” as some legitimate resource for inflation anchor estimations, the worse the Federal Reserve looks by more significant comparison. None of the inflation indications suggest anything but recession and increasingly a very serious one (as more and more the base case, too).

None of this should have been surprising, as warnings have been consistent for some time – including the increasing and persistent difficulties of foreign central banks to manage their “dollar” exposures. While that may have suggested only overseas or offshore “dollar” issues, it was just a matter of time before the dysfunction visited all corners. In fact, though there were emphasized excuses to dismiss the significance as if it were unimportant or even somehow normal, liquidity warnings have been quite regular. As I wrote back in June last year, the US or domestic portion of the “dollar” system seemed inappropriately complacent about all this:

It seems quite clear that the global banking system is again finding itself short of capacity as dealers, what is left of them, scramble for the exits. What started in August 2007 was an irreparable separation between what was (dealer-based, multi-dimensions), what is (central bank-based, reduced dimensions) and what will be (nobody yet knows, which is precisely the problem). Unfortunately, rather than hang on for an orderly hand off between the second and third steps or transitions, banks are again, echoes of 2007, taking their part and leaving without much to fill in the wholesale gaps. This is not to say that we are on the road to repeating 2008, only that the conditions in liquidity, half of what took us down then, may be already as bad. If there were some less benign ignition now, a spark of selling that was the other half of the panic run, what support would there be for orderly pricing?

The answer to that, given already by October 15, December 1 and January 15, isn’t very encouraging. To a great extent, Americans are both sheltered and wholly unaware, but the rest of the world is very much alerted to the continued downside of the eurodollar standard. Stocks may be at or near record highs (though broader stock indices, such as the NYSE composite, have gone nowhere since the “dollar” started to rise), but Brazil is in a state of total economic and financial chaos while China flirts with what was never thought possible (growth at Great Recession levels, a massive housing imbalance and now a stock bubble that in some ways puts the dot-coms to shame). There was a “dollar” system somewhat in place, largely before the middle of 2013, which supported all those but no longer does.

It only took a few more months to be suddenly accosted into the “dollar” maelstrom, and still a few more months further to figure out at least the contours of what might be the full financial and economic ramifications. There were plenty of warnings; more importantly, however, there still are.

Disclosure: NOTE: none of this commentary is intended or should be viewed as offering investment advice about Capital One or FHLB securities in any form. This is ...

more