No FOMO

Another day, another little tidbit pointing to the adoption of the crypto asset class by major institutional players.

We already know that Nasdaq and Fidelity are planning on offering crypto products to their clients in the near future. So now it seems they're pooling together to buy out ErisX.com, a regulated online exchange platform.

The reported amount paid for the exchange was just $27.5 million. No doubt they got an excellent deal due to the recent return of the bear market. Of course, details on this deal are still fuzzy as stated in the Reuters article that broke the news.

After recent remarks from the SEC, it's now seeming much less likely that a Bitcoin backed ETF will be approved any time soon but at the rate, new products are coming online I wouldn't worry about it too much. Within a very short time, every trader and investor on the planet should be able to integrae top crypto assets into any investment portfolio fairily easily.

Today's Highlights

- Algo Slides

- OPEC Day

- Another Bounce

Traditional Markets

Shortly after the funeral procession for Bush was over the futures markets opened up with a bad temper. Just about all the major indices experienced a large gap down and are now back near the lows.

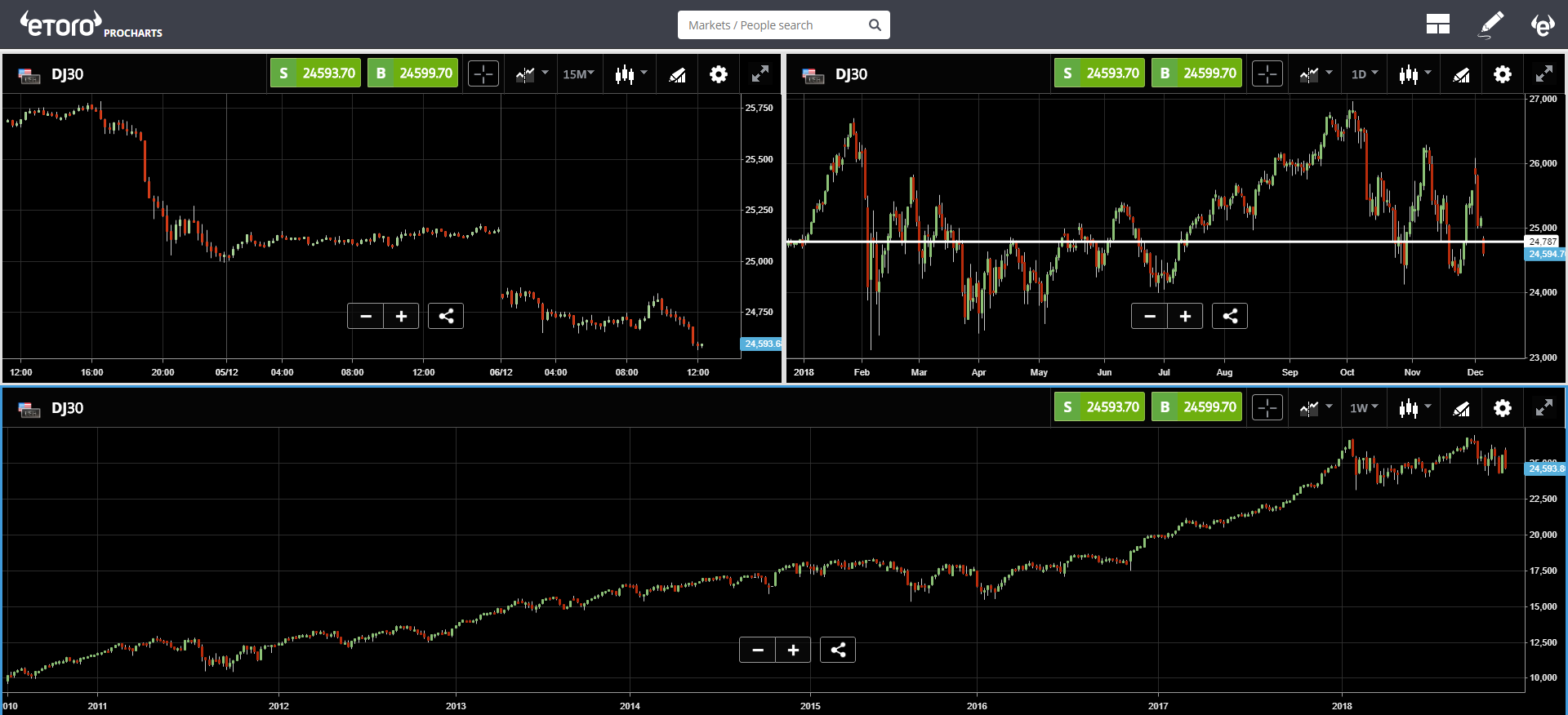

Here we can see the Dow Jones. The short-term chart on the top left shows the opening gap and the chart on the top right shows where we are in relation to the beginning of 2018 (white line), the bottom chart, of course, shows the multi-year bull run, which puts things into perspective for us.

(Click on image to enlarge)

The negative session has continued into Asia and Europe this morning. Some are blaming this headline...

However, further inspection shows us that the arrest was actually made on Saturday but that the media reaction was a bit delayed in penetrating the markets.

Of course, others believe that what human beings think about this story might be less important as "80% of daily volume in the US is done by machines."

In any case, even if that statistic is true it wouldn't exactly explain the delayed impact of the Huawei news. More likely what we're seeing is simply a continuation of the volatility as we approach the end of the cycle.

OPEC Day

Leaders of the world's largest oil producers are meeting today and tomorrow in Vienna to see if they can do something to stop the massive slide of crude oil that's been happening these last few weeks.

(Click on image to enlarge)

At this point, things aren't looking too hopeful for them. Saudi Arabia seems to be the most interested to cut production while Russia seems willing but not too eager. We'll watch for updates closely during this time.

Crypto Bounce from the Lows

It's no secret that crypto prices have been under pressure lately. Just yesterday, Bloomberg analysts reaffirmed their position that bitcoin could be headed straight for $1,500.

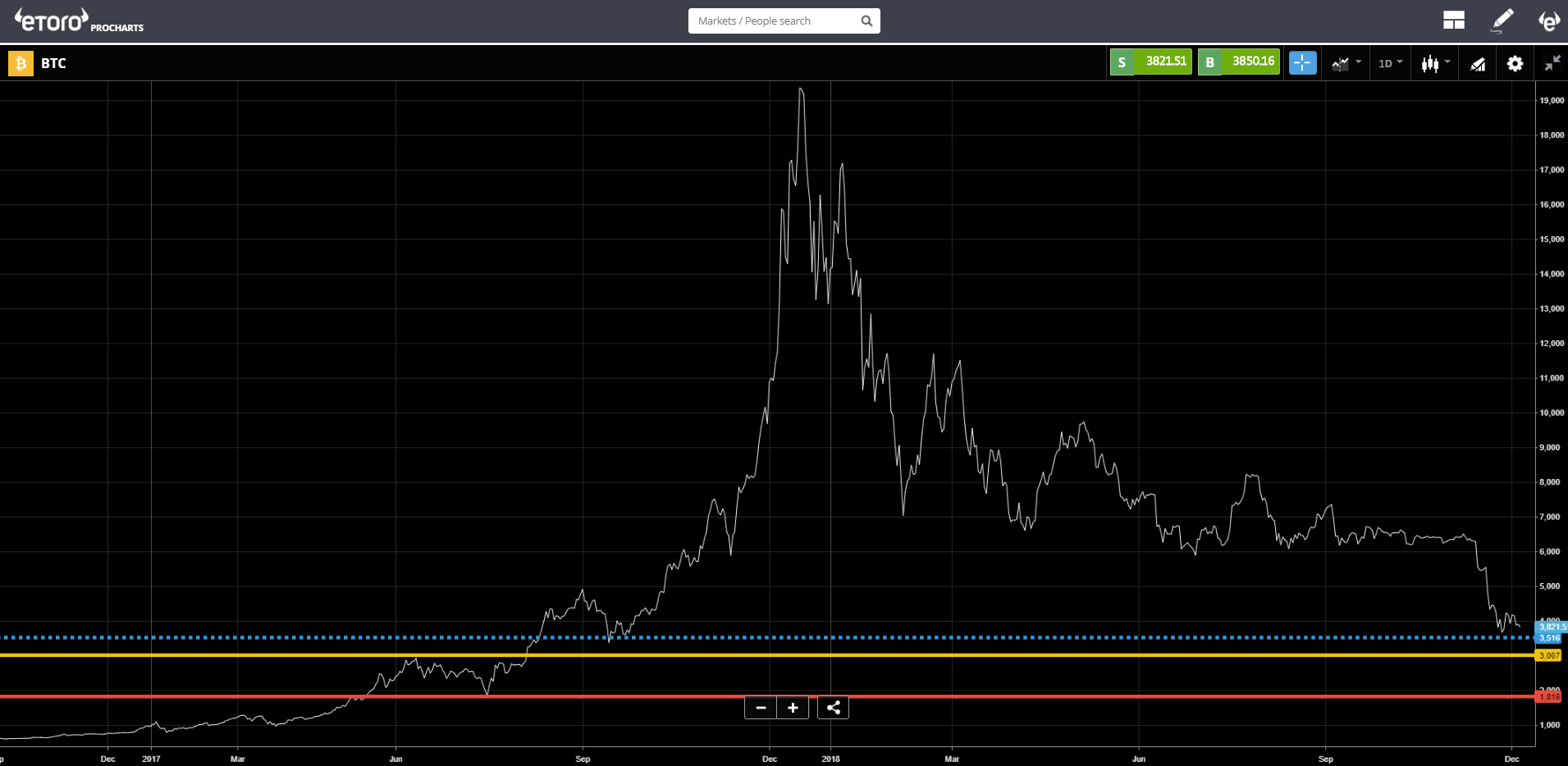

Of course, it's possible to get that low. Anything is possible but I would say that we have a lot of key levels before that will more than likely support the price.

As you can see, we're currently testing the light support level at $3,500 (blue). If it breaks through to the downside we will likely encounter heavy support at $3,000 yellow. The red line is set at $1,800. All of these levels have played a significant role during the rise of 2017.

(Click on image to enlarge)

Of course, the first on that list and the level we're currently testing is $3,500, which I must say has been showing incredible resilience so far. Let's zoom in....

(Click on image to enlarge)

For institutional investors looking to invest in the assets rather than the infrastructure, there really isn't much reason to go in strong at the moment. There simply isn't FOMO.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more