No Deal-Making Yet For Monsanto; What To Expect From Tomorrow’s Earnings Report

Monsanto (MON) reports its FQ3 ’15 results before the opening bell tomorrow. Both Estimize and Wall Street are predicting a fall in EPS QoQ but a rise YoY. The Estimize consensus is predicting an EPS figure of $2.11 and Wall Street analysts are projecting $2.05. The Estimize community have assumed a revenue figure of $4.683B compared to the Wall Street assumption of $4.654B. Monsanto’s stock has underperformed year-to-date (YTD) with a negative capital return of -5.16%. The S&P 500 has managed to rise 3.09% (YTD).

Monsanto has made clear to the market that it plans to enhance growth through M&A activity. Monsanto recently made a $45B offer for Swiss-based competitor Syngenta AG. This offer valued Syngenta at a 43% premium to its previous closing price before the announcement was made public. The deal cleared another hurdle this morning when the Chairman of Syngenta expressed they would only consider the deal if it was likely to be passed and there was a breakup fee involved. In addition to Syngenta, Monsanto has also expressed interest in the German firm Bayer.

Investors are going to want more guidance on how management plans to approach these and future acquisitions in tomorrow’s report. Further, it is important that management outline the importance of organic growth and how they plan on achieving it.

Demand for Monsanto’s products continue to exponentially rise and the company’s cash flows from operations are benefiting as a result. Product superiority and innovation are stimulating sales to farmers who are always searching for premium agriculture products in order to maximize crop yield. For example, sales from its Soybean segment have been rising at above 30% YoY.

Despite the fundamental positives present within Monsanto’s business model, MON may experience some volatility after the result. Currency fluctuations, uncertain guidance, investor’s fear of overpaying for acquisitions and a cyclical downturn in the agriculture industry could all contribute to negative sentiment surrounding the stock.

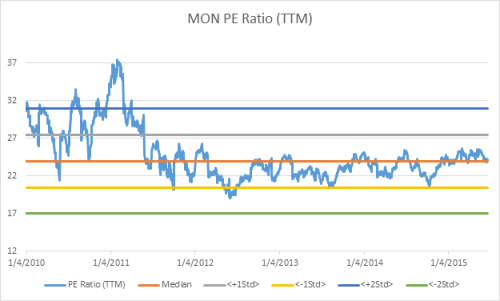

Monsanto is currently trading on a PE Ratio (TTM) of 23.97X which is very close to its 5 year average of 24.53X. The stock could quite easily rerate after tomorrow’s report depending on the figures and management’s guidance on the acquisition strategy.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.