Next Wave Of Housing Demand...Renters

“Davidson” submits:

2yrs ago I sent a note about the imbalance in rental vs single family homes due to Dodd-Frank policy. This will reverse if Jelena Williams, new Chairwoman FDIC, normalizes Dodd-Frank mtg rules to let millennials to buy homes. I think this is going to occur which will mean a flood of new homeowners as rental properties as a percentage of the whole falls. Those the rental market will correct and we will have an issue with defaults.

WSJ: Freddie Mac Joins Rental-Home Boom

The mortgage-finance firm is backing loans used to buy single-family rental houses.

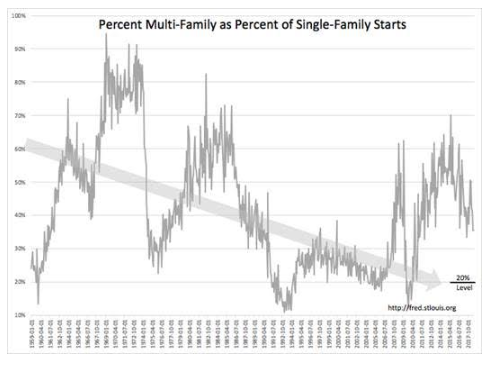

This is an updated chart. Single-Family starts have grown with changes in government policies post-WWII. This chart shows the Percent of Multi-Family as a Percent of Single Family Starts which exaggerates the differences between the two categories. The Community Reinvestment Act 1995 pushed Multi-Family below 20% in 2005 as the Sub-Prime Crisis built to its peak in 2006. Dodd Frank’s restrictions on mtg lending resulted in an explosion in Multi-Family starts with access to mtg restricted reaching a peak of 70% in June 2016. With the current administration, it is apparent some regs have been eased and Single-Family starts are beginning to regain in importance. Hard to say where the level will settle out, but Single-Family is likely to be higher with millennials beginning families which culturally leads to suburban home ownership with private yards for children to play in. This is likely to hurt rental markets as this shift occurs.

(Click on image to enlarge)

Freddie Mac is coming in with lending along with the surge in investor confidence at the ‘top of the market’ in my opinion.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more

I think it has been discredited to say that the Community Reinvestment Act pushed the housing bubble. This chart clearly shows that your explanation is not accurate at all. The CRA clearly was in play, but before 2005 that all changed and the private money pools and the big banks took over: www.exam...lesofglobalization.com/.../...hart.html