Neutral Day For Indices

Markets were unable to build on premarket gains, but did manage to finish the day where they started.

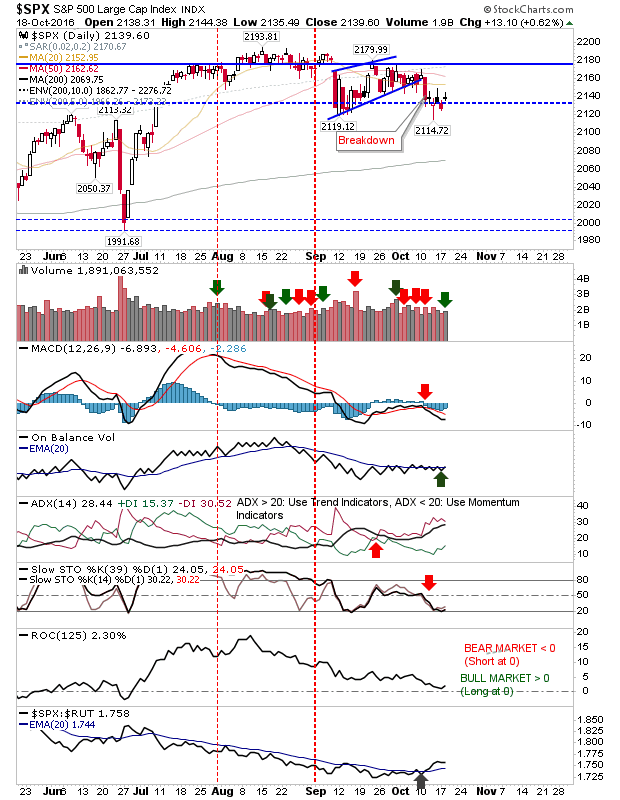

The S&P closed with a narrow range doji, a doji which finished below Friday's bearish black candlestick. The pattern of the last five days is playing more in bears favour, but with support around 2,115 holding there is still a chance a broad swing low is in play; confirmation comes on a move above 2,160. Trading volume sided with bulls on a confirmed accumulation day.

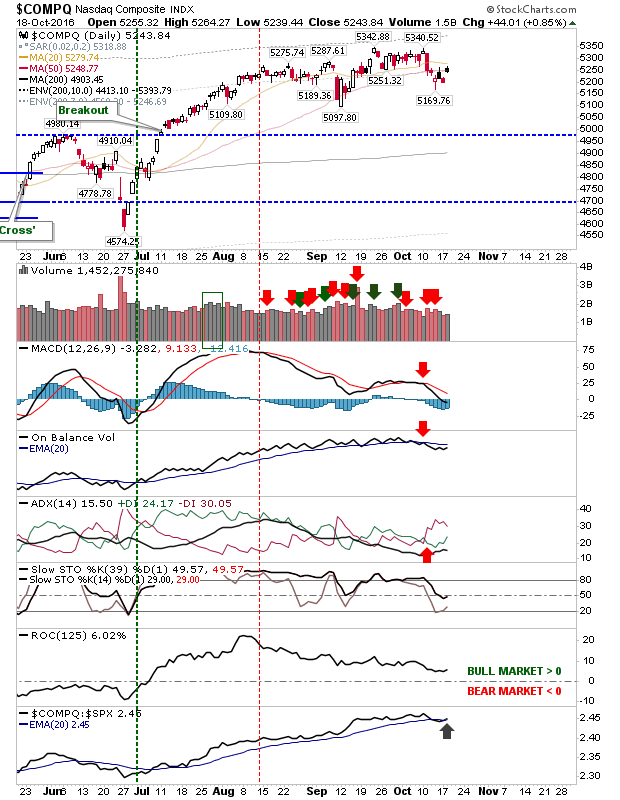

The Nasdaq was able to push above Friday's highs, although weak afterhours action from Intel is likely to put a dampner on action tomorrow. With moving averages converging overhead, the likelihood of a more extended move lower increases. The presence of two black candlesticks in close proximity is bearish.

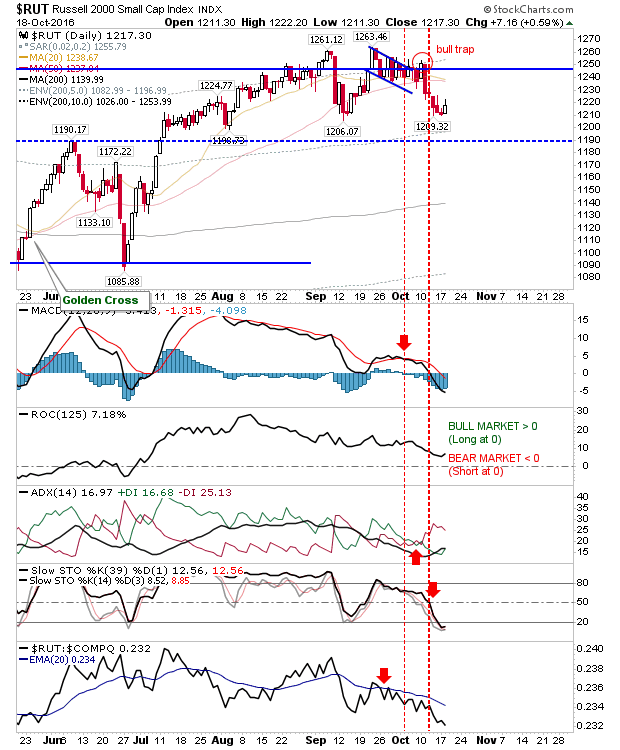

The Russell 2000 is attempting to build a rally from 1,210. Of the 'low risk' long opportunities this is the best for longs, but as action is showing a squeeze with lower highs it would need a push above 1,220 to offer bulls confidence a low is in fact in place. While technicals are bearish, they are oversold enough to mark a bottom. The most bearish action comes from the relative performance of the index to its peers.

For tomorrow, things remain precarious for bulls, but until there is a confirmed break of last week's lows there isn't reason to become a seller or go short either.

Disclosure: None.

thanks for sharing