Netflix Junk-Rated Bond Sold Out Raising $1.9 Billion Cash

This junk-bond market is in peak-bubble mode, and Netflix is just doing what investors want it to do.

Wow, that was fast and huge. After announcing this morning that an investor call was scheduled to try sell a “drive-by” issue of $1.5 billion in 10.5-year bonds that S&P rates four notches into junk (B+) and Moody’s three notches into junk (Ba3), Netflix found insatiable investor demand and sold an additional $400 million, for a total of $1.9 billion, Netflix’s largest bond offering ever.

The investment banks running the deal were Morgan Stanley, Goldman Sachs, J.P. Morgan, Deutsche Bank, and Wells Fargo. The notes, which mature on November 15, 2028, priced at a yield of 5.875%, just 291 basis points over the equivalent US Treasury yield, according to S&P Global Market Intelligence.

This comes just six month after Netflix borrowed $1.6 billion in 4.875% bonds due in April 2028. And earlier in 2017, it had sold €1.3 billion of 10-year unsecured junk bonds in Euroland at a yield of 3.625%, bringing its total issuance in 2017 to about $3 billion. So interest rates are rising, debt is getting more expensive, and there’s a lot more debt, but it doesn’t matter to Netflix investors.

Last week, Netflix reported total long-term debt of $6.5 billion as of March 31. With the $1.9 billion just added, it now has $8.4 billion in long-term debt.

This is in addition to current and noncurrent “content liabilities” of nearly $8 billion. This company is rated deep into junk for a reason.

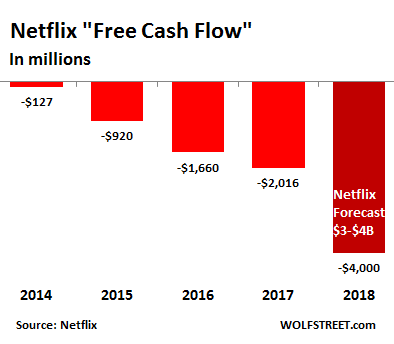

And it’s going to get a lot worse. In its earnings report last week, it disclosed that its negative “free cash flow” – a measure of the amount of cash it burns – of -$287 million was “less negative than we expected due to content payment timing differences.” In the prior quarter, it had booked negative free cash flow of -$524 million.

In total, it forecasts to be “free-cash-flow negative” between -$3 billion and -$4 billion in 2018. So the next quarters, when the “timing differences” are reversing, the negative free cash flow is going to be a doozie. And it also disclosed that it would be “free cash flow negative for several more years as our original content spend rapidly grows.”

This is Netflix’s negative free cash flow history and propitious forecast:

(Click on image to enlarge)

In its earnings report last week, Netflix said that it had $2.6 billion in cash (all of which is borrowed money) and that it would “continue to raise debt as needed to fund our increase in original content.” And it didn’t wait long to raise some of this debt, with $1.9 billion raised today.

In its earnings report in January, Netflix explained how this works. “Our debt levels are quite modest as a percentage of our enterprise value,” it said, adding that junk bonds have “rarely seen an equity cushion so thick.” It’s saying that its market capitalization ($142 billion currently), based on its sky-high share price, is so huge that Netflix thinks it can always sell more shares if it can’t sell enough debt to service its current creditors and fund its gigantic and growing negative cash flows. This math assumes that its share price will always remain sky-high.

At the time, it also disclosed that its “net income” as reported to investors is a mirage that likely turns into a loss when reported to the IRS. It said so indirectly when it explained with a reference to the new tax law that limits the deductibility of interest expenses: “The new limitation on deductibility of interest costs is not expected to affect us.”

In other words, that “net income” is just for show.

So here we have it: A mature company that has been publicly traded for about 16 years, and has been bleeding cash at ever larger amounts, and that has to sell ever more junk bonds or shares to fund its bleeding operations, finds enthusiastic demand for its debt, backed by nothing other than its sky-high stock price, which is premised on its being part of the FAANG stocks whose shares can never decline. Nevertheless, when word got out with the details of the bond offering today, shares declined 2.8%.

But the company is just doing what investors want it to do. These investors are hooked on the metric of “subscribers” and the sky-high share price itself, and they don’t care about much else, based on the demand for its bonds today, which shows just how bubbly the junk-bond market is, and based on its share price with a P/E ratio of an astronomical 214, which shows just how bubbly the stock market is.

Historically it went up 7-10 percent after such events in past