Negative Momentum Weighs On Major Asset Classes

Positive price momentum is in short supply these days among the major asset classes. Is that a bearish signal? Well, let’s put it this way: the current technical profile doesn’t inspire a lot of confidence about the near-term outlook for asset prices.

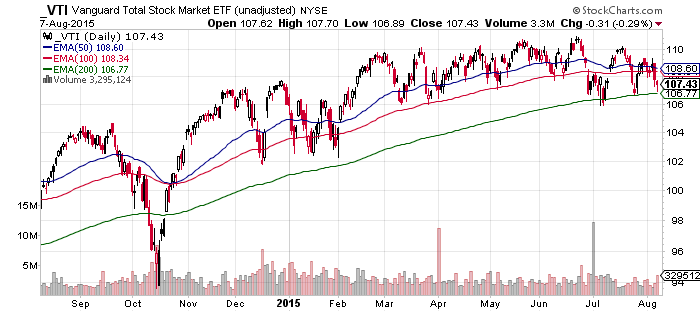

Granted, there are still pockets of strength. In particular, US stocks overall continue to post upbeat momentum signals, although the degree of strength has weakened lately. Otherwise, the field is looking rather grim from a technical perspective for a set of ETF proxies that represent the major asset classes, based on data through Friday, Aug. 7.

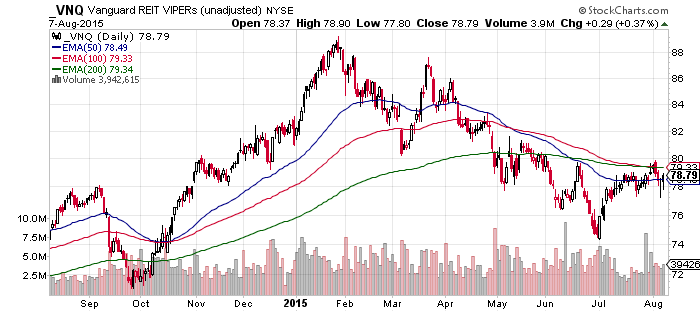

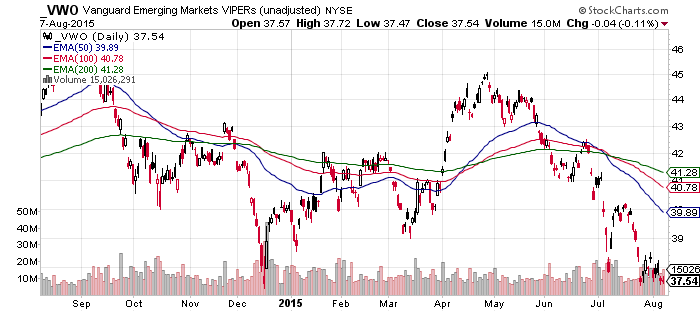

The definition of momentum here is defined in two parts: trailing one-year return and the ratio of the 50-day exponential moving average (EMA) to its 200-day counterpart. That’s far from the last word on measuring momentum, but it’s a useful way to begin the analysis. Note that return and EMA numbers in this review are based on price-only data—i.e., excluding dividends and other payouts. By this standard, only US stocks are posting bullish signals on both fronts—a positive trailing one-year return and a 50-day EMA that’s above its 200-day EMA.

Otherwise, the ETFs representing the major asset classes are in various stages of posting a loss for the trailing one-year window or a negative 50-day EMA/200-day EMA ratio–or both, which is the dominant profile at the moment.

The question is whether the darkness is a temporary setback or a sign of deeper trouble to come on a sustained basis? In other words, is the current situation a buying opportunity or a trap? No one really knows the answer at this point. For what it’s worth, I’d be inclined to wait for a return of positive momentum before trying to catch a falling knife.

In any case, it’s clear that there’s a bearish wind blowing in asset prices generally. Let’s take a closer look at some of the highlights, starting with the strongest member of the pack: US stocks via the Vanguard Total Stock Market (VTI):

Foreign stocks in developed markets (VEA) are positing slightly negative price returns, although the 50-day EMA is still marginally above the 200-day EMA:

US real estate investment trusts (REITs) are still ahead on a one-year basis, but the 50-day EMA remains well below the 200-day EMA for VNQ:

Elsewhere, negative results have a commanding influence in terms of the rolling one-year return and the 50/200-day EMA ratio. That’s certainly true for emerging-market stocks via (VWO)…

and for commodities (DJP) overall:

Disclosure: None.