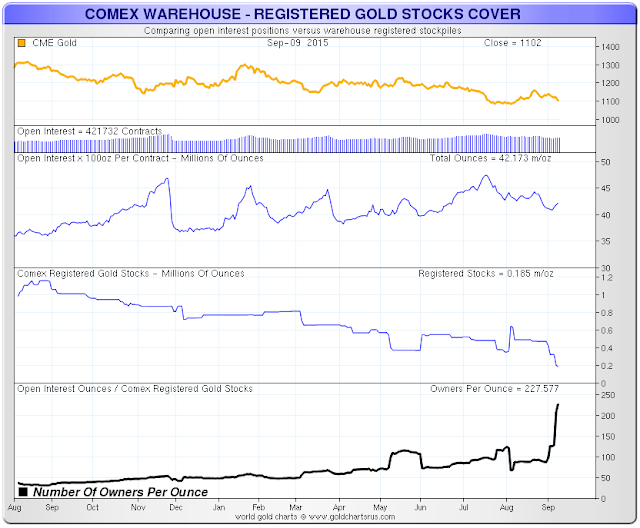

NAV Premiums - Comex Paper Ratio Rises To 228:1 - Sprott Gold Reports More Redemptions

"It is virtually impossible to get physical gold in London to ship to those countries now. We get permanent requests in Russia now. Would we please sell our physical gold to India and to China?

Because there is not enough physical about. There are endless promises. And I worry that the market, the paper market, could be stamped on and people say 'sorry we're going to have a financial closeout' and it's all over. If you want to be in the gold business, you ought to be in the physical business."

Peter Hambro

"I just got off the phone with A-Mark which is one of the world’s largest wholesalers. They are reporting that they have no gold and silver at all live available, that they have stopped taking orders for Silver Maples and Silver Philharmonics altogether and that Silver Eagles are available first in the end of November. For Pamp, there is similarly long delivery times for all minted gold bars.

We still have most products in stock because we stocked up as massively as we could in the last weeks but for many products, we are unable to replenish as of now when we run out."

Torgny Persson, BullionStar CEO

The ratio of potential claims per deliverable (registered) ounce of gold bullion has soared to 228:1.

How fortunate that September is not an 'active month' for gold at The Bucket Shop.

Sprott Gold trust lost another 34,356 ounces of gold bullion since the last time we checked their numbers on August 24th. This is just over one metric ton, or tonne.

None.

real price splitting between spot price ond ral 1 oz silver coin price is unnormal- why fat cat must to got this giant 30% profit instead brave traders?

14,50 spot

16.9-oz coin