Nasdaq Is Signaling New Market Highs

Jeff Hirsh in the Almanac Trader talks about how historically the S&P 500 has rallied after Presidential Election Day beyond year end until Inauguration Day. S&P 500 has advanced 75% of the time. History also suggests that the market will continue to rally through President Trump’s first 100 days in office as six of the last nine (66.7%) newly elected Presidents were greeted with S&P 500 gains.

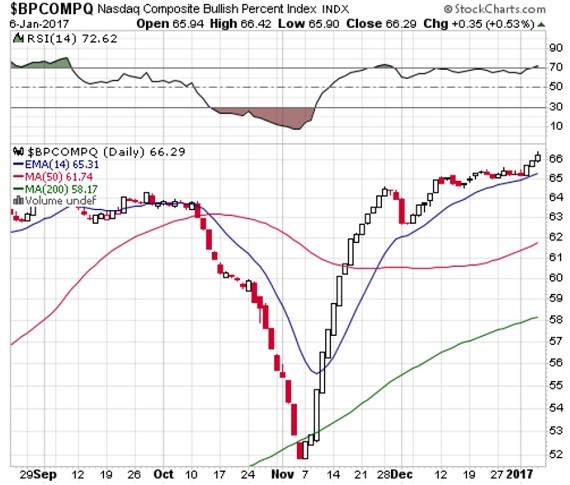

A tool to help confirm the overall market trend is the Bullish Percent Index (BPI). The Bullish Index is a popular market “breadth” indicator used to gauge the internal strength/weakness of the market. It is the number of stocks in an index (or sector) that have point & figure buy signals relative to the total number of stocks that comprise the index (or sector). So essentially it is the percentage of stocks that have buy or sell signals. Like many of the market internal indicators, it is used both to confirm a move in the market and as a non-confirmation and therefore divergence indication. If the market is weak and heading down, the BPI should also be moving lower as more and more stocks are sold off.

Nasdaq stocks led the stock market for the past year. As evidenced in the chart below, the Nasdaq Composite Bullish Percentage Index (BPCOMPQ) is breaking out into a new uptrend. Shares are overbought, but stocks can remain overbought indefinitely. If recent history holds true to form, the Nasdaq Composite Bullish Percentage Index is signaling new all-time highs for the major indexes.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more