My Take On Recessionary Indicators

Despite the regularity of economic downturns and the existence of business cycles in a free market economy it is quite obvious that recession calling remains an art more than a science with the scientists being wrong consistently. Of course, this is somewhat understandable given the non-capitalistic dithering by the government as well as the central bank to try to prevent or delay downturns which often make things worse save helping political careers and empowering bureaucrats and state agencies at the cost of the greater good and welfare of the general populace.

The simple fact is you are hoping for some clear warnings of an economic downturn from the central bank or economists you have a better chance determining recessions by watching traffic patterns or tracking lipstick sales. Below is a great graph highlighting the poor recessionary calls by economists.

Needless to say, following economic forecasts is a great way to get waylaid more than a way to riches like your investment advisors say to you to justify their outsized fees. One would be better off looking at the frequencies of recessions of the graph below and realize that save for twice in your life avoided a downturn for more than a six year timeframe before another one comes along. If you are more fortunate you may have seen 3 of them but also experienced a world war.

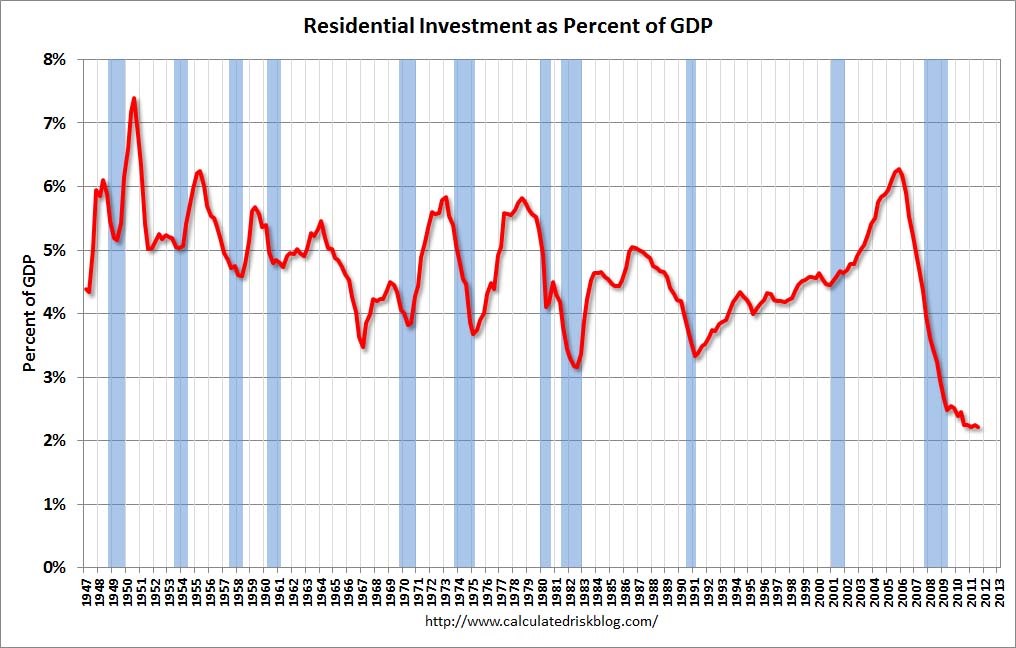

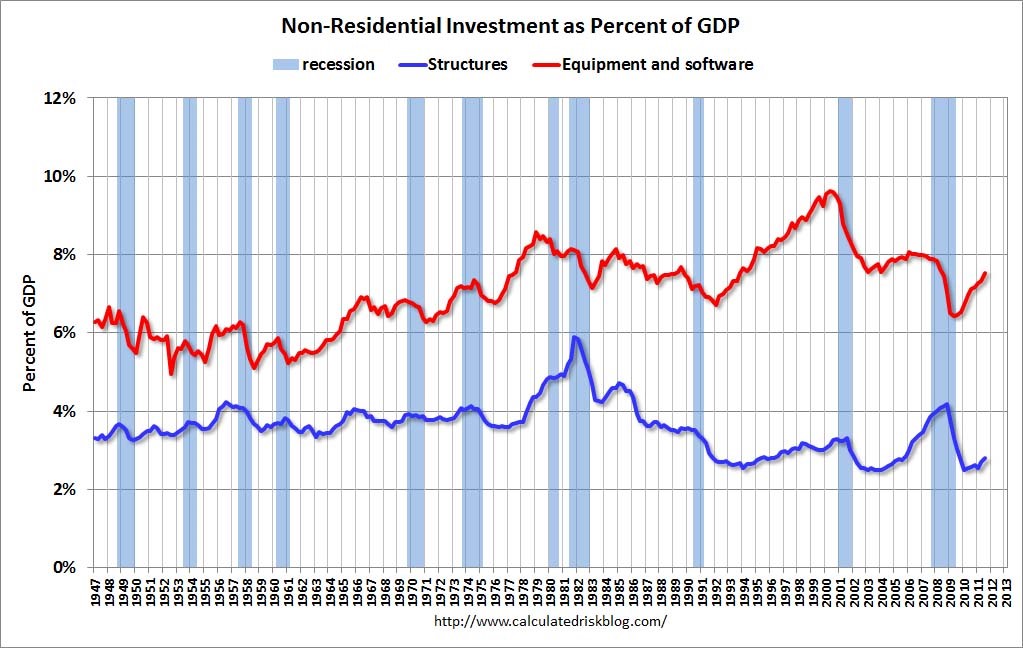

Also noticeable on this graph is a fundamental reason why the US is weaker not stronger after this recent downturn. Not only is businesses weakly investing in capital equipment and labor, residential investment has fallen off a cliff and is still not anywhere close to recovering. Of course, one can’t blame people for not investing in their home given most homes remain artificially supported by Federal Reserve low interest rate policies, rules that allow banks to hold properties on their books and not sell them at artificial prices, and Fannie Mae and Freddie Mac still dominate the housing loan market with government liquidity making the US housing market about as capitalistic as the USSR. The result is a giant vote of no confidence reflected in low housing investment as well as low investment overall.

Anyways on to some of the reasons why economists are always late to the party when it comes to recessions. One reason is their consistent focus on indicators that are far from leading. These are industrial production, real personal income, nonfarm employment, and real retail sales.

As we can clearly see in the graphic, these are post not leading indicators. Worse yet, the indicators are reported and amended after the fact and not as they occur as most economic reports are. Despite this economists cling to this as does the government and central bank which allows them to be the optimists they always aspire to be making their jobs irrelevant.

Therefore, when you get thrown graphs such as this showing how healthy the economy is and how unlikely a recession is around the corner it reads as a big fat zero to me in proving anything besides last quarter we weren’t in an economic downturn yet.

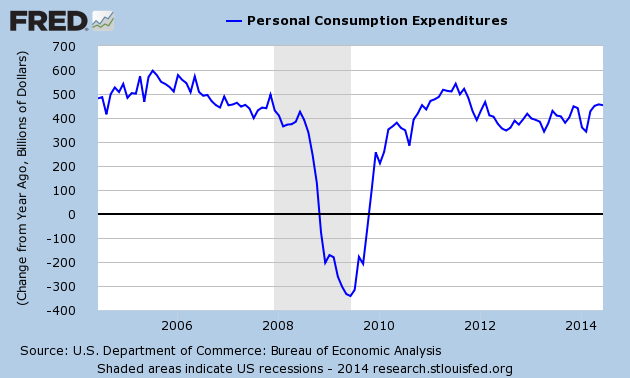

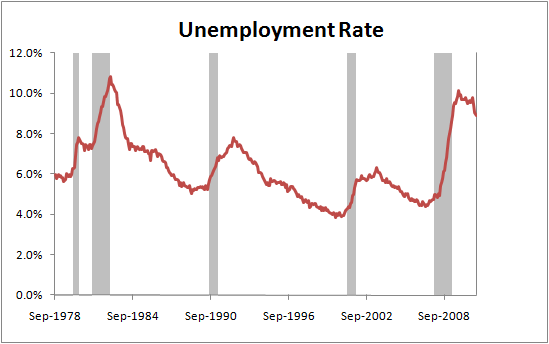

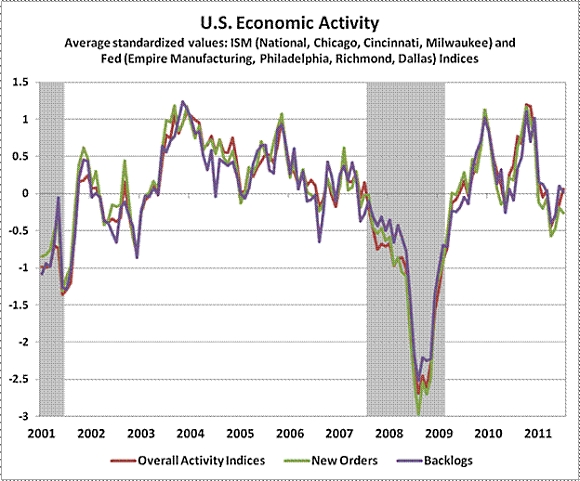

Of course they use other calls as well such as personal consumption expenditures, unemployment rates, New Orders, Backlogs, total US economic activity, etc. which are also equally lagging not leading indicators.

As you can see, the news is clearly after the fact. And that is assuming you know the facts at the time they become available rather than days, or weeks after the fact like you actually hear them. It’s like asking the coroner to tell you to predict when the patient is going to die. Thus the economic news you are bombarded with is more noise than anything viable you can use to make wise decisions about exiting the market. Of course, one may be a skeptic and realize that it serves none of these financial firms to get clients out of investments with them anyways.

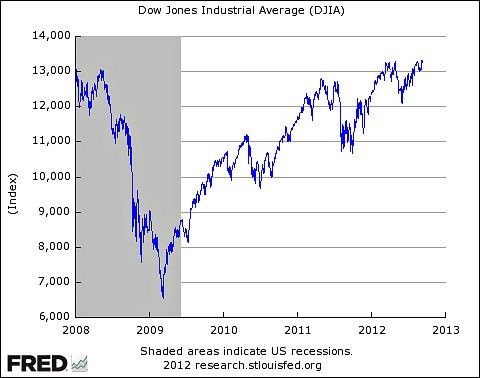

This is why looking at the stock market as an indicator is even worse for a few reasons. First it often reacts to when the economic reports get issued which makes its response late. Second, when it reacts it’s already too late for you to get out given prices are already reacting to the news. The best you can do here is to get out before the full downturn is revealed, however, if you want long term investment, you will then need to find a way to get back in before it recovers and you must make up the gains that you lost paying capital gains taxes if you sold for a profit.

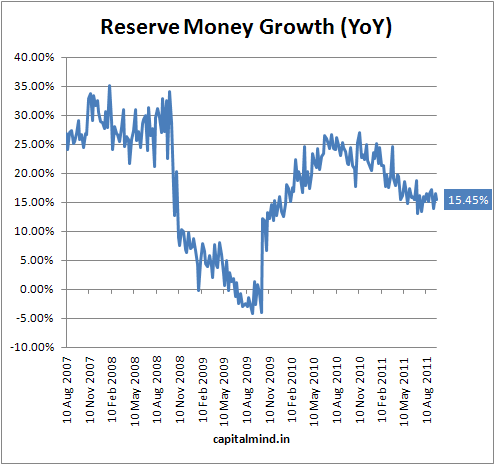

Strangely enough following Federal Reserve data doesn’t do you any better with things like reserve money growth also showing lagging not leading news and being issued even later than the period you care most about which is always now not a month later.

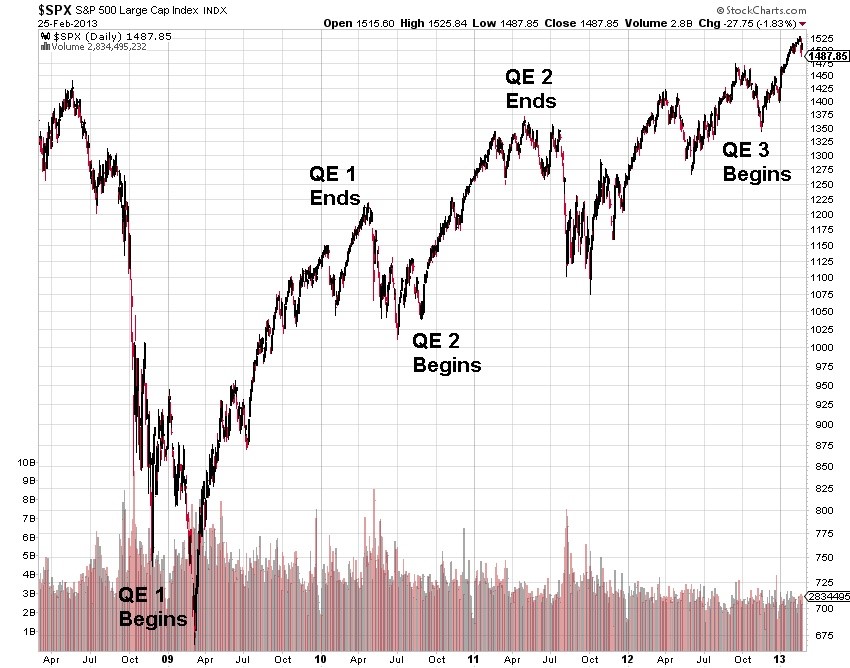

Even worse using the stock market or Federal Reserve as a gage is downright dangerous. That’s because the Federal Reserves (central bank) job has been to muddy the waters so you can’t tell what’s going on. Their ability to muddy the market and confuse the economy has been increased with their ability to threaten and create new money. As you can see, with the introduction of QE they have been able to create market bounces as well as use the threat of ending or cutting off liquidity as a way to create fake dips.

By doing this multiple times they have created a Pavlov effect with making the market believe every time the market drops or QE ends they will magically infuse the market with another iteration of QE liquidity. This is a dangerous precedent to make for a multitude of reasons including the fact there is a limit to how much the Federal Reserve can do this before they put the whole value of US bonds at risk since they are using QE mainly to buy up excess US debt issues at lower rates than market rates. This is increasingly being seen by foreign purchasers as artificial market fixing bordering on cheating that reduces just returns for loaning money. Needless to say, this has already caused China and others to abandon buying long term treasuries for fear of the loss they would absorb should the US fail to keep the artificially low rates for the full period of the bond.

Given all this cold facts one may get the feeling like its useless calling an economic downturn. Certainly the financial industry would like you to feel this way. Yet even given the prior data the clear fact is that looking at the period between economic cycles should give you room to think twice before buying into the market right now and would be a clearer sign to start moving investments out of the market than into the market. Sure you miss some of the toppy price action, but making economic cycle judgments based on usual length is more useful and predictive than most of the other garbage thrown at you daily which are a accumulation of lagging not leading indicators used by industry to get you to follow them right into the downturn time after time since the market was created.

But if you doubt my advice that the economy is topping off, you can consider these candid facts. Although the market is reaching new highs, residential investment in the economy is drastically lower than in 2008, non-residential equipment and software as a percent of GDP is lower, and non-residential capital equipment and structures is lower as well. This clearly makes you wonder how the economy and the stock market can be above 2008. The clear answer is, it is due to government overspending and Federal Reserve QE and easy money policies.

In terms of capital investment and expenditure in the US market, there remains very little to be enthused about. Almost all positives come from increased government debt, increased consumer debt, and companies hoarding cash, buying back shares, or increasing sales without increasing headcount or spending capital by letting it all happen overseas. This is not a prudent or sustainable way to grow an economy and does little for those in the country.

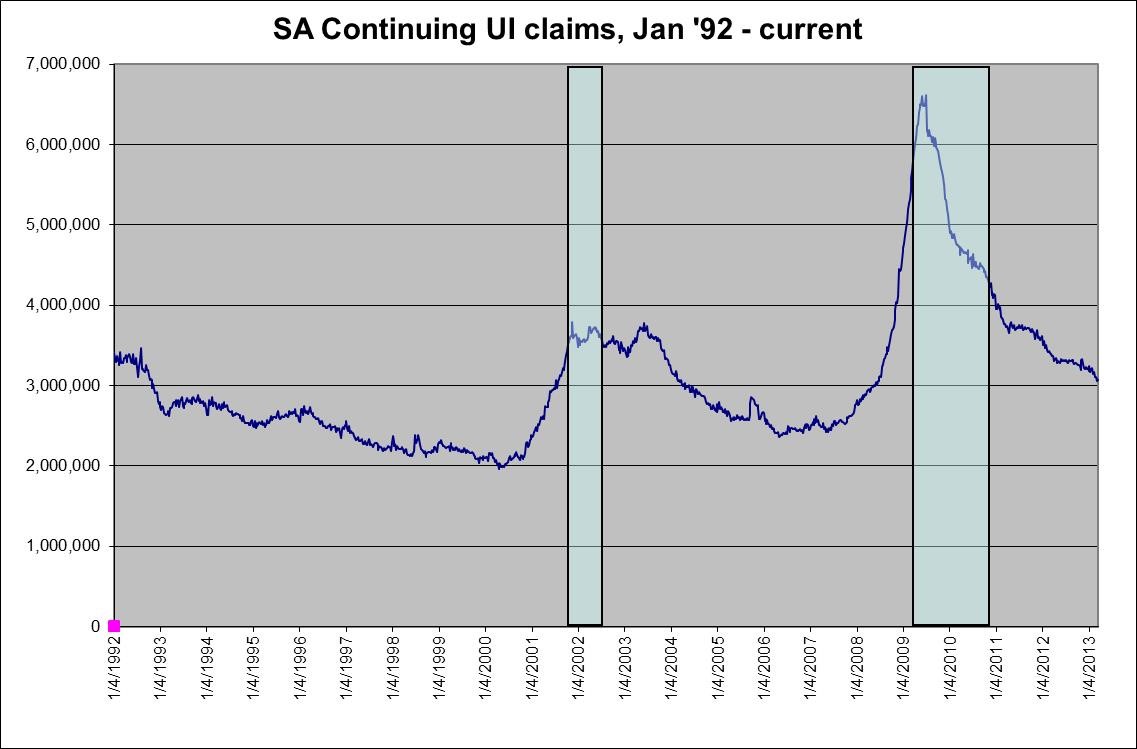

An argument for a clear recession indicator is continuing unemployment claims which worked correctly for the past 2 recessions. However, with the extension of continuing claims as part of the stimulus package and the cancellation of those extensions, it artificially lowers the claims. Furthermore, with the longevity of the weak economy those falling off the rolls ads to the unemployed but not the claims for unemployment.

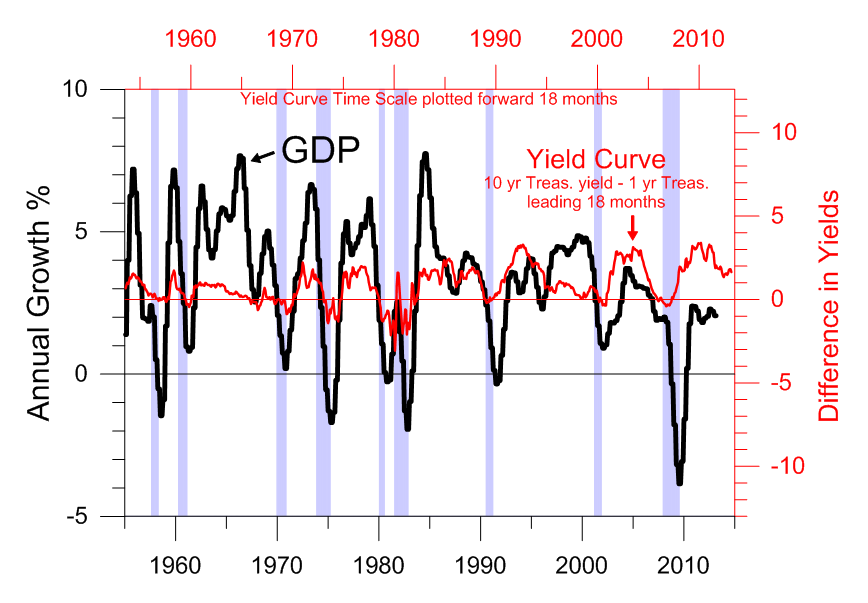

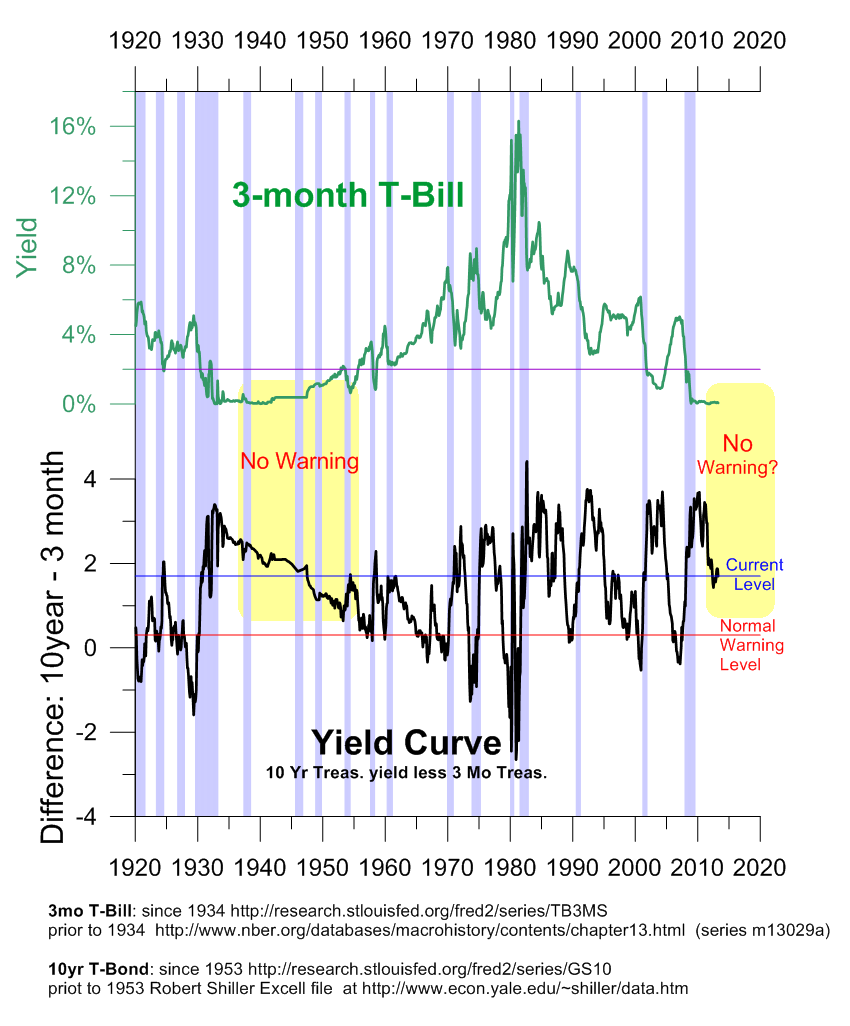

Another strong indicator is the inversion of the 1 year yield curve with the 10 year yield curve. When they get inverted a recession is a strong outcome. There are two strong reasons why this indicator will not work this time. As you can see, when the 3 month Treasury bill is near zero it has a history of not reflecting a recession. Likewise, the preponderance of short term treasuries issued by the Federal Reserve and their careful manipulation of rates gives then extraordinary abilities to prevent inversion from happening since it is a known recession trigger.

Needless to say, pointing out a recession before others see it and being fairly accurate is not a task done by part time brokers and central bank economists. For one thing, the economy changes, government and central bank policies and behaviors change, and people change. One must be more proactive to understand the mingling of all these forces. Sadly the US is becoming more and more socialistic making the economic signals less concise and less effective than in the past. One may be able to predict something that leads to a recession, however, if that lever is targeted by government of Federal Reserve action then the indicator no longer reads correctly. Likewise, that which closely correlated to past recessions may not do so because that indicator isn’t as valuable or is no longer a leading indicator, oftentimes because too many people follow it or the data is no longer broad enough or too broad to be a leading indicator. There are a multitude of lagging indicators and economists and bankers love to chat away about them because they are simple, they are fed to them, and they are no longer leading indicators thus tending to point out the conclusion they want, “Everything is fine so keep forking over money to us to invest”.

I am always open to various indicators people propose to me. The less tracked by other and the less open to manipulation tend to be the better indicator from road traffic to Internet traffic between countries. For instance, the last recession had US Latin America peak utilization rates drop dramatically leading up to the fall. This primarily probably had to do with US corporations cutting orders from Mexico because it was the fastest way to cut flexible production at the time. It may be the case for the next recession as well.

Needless to say, few want to publish their leading indicators because if they are followed by too many people they will no longer be leading and various actors in the market may act to try to get it to send incorrect information from governments and agencies to market manipulators as I suspect happens with precious metals, copper, and oil already.

I am open to anyone who wishes to prove those who say you can’t time the market and call a market decline by providing a leading indicator. As I stated at the beginning there is an easy market timing system already. Don’t invest more in a market after 4 years and try to exit some of your position by the sixth year. It is not a guarantee a recession is around the corner, but what is, is that there will be a recession sooner or later as long as the market is a free one. We can only hope the free market carries on, because recessions are a small price to pay for the growth a truly free market offers. I am ashamed to see current central bankers and the government turn their backs on it. To do so makes it impossible for the economy to weather economic slowdowns and spells long term disaster for the economy with low to no growth to show for the “protection” which is a kind word for smothering the economic flame.

The fortunate news is that 2014 looks pretty safe until the end of the year. Good luck in 2015. We certainly are headed towards a bumpy ride with the Federal Reserve and government still way overextended to deal with any economic downturn that is fast approaching.