My Best Guess Is…

To be sure, it has been a long slog in the stock market for the past three months. In essence, stocks rallied hard on expectations of further monetary stimulus from the folks at the Bank of England, the European Central Bank, and the Bank of Japan after the BREXIT vote. However, after the three-week long, post-BREXIT blast, the major indices have gone nowhere.

Obviously, we can’t know exactly why this is happening. Some will argue that it’s the election. Some suggest it’s just the traditional seasonal swoon. Others contend that fears over the German banks are to blame. Another camp, which includes some big-names in the business say valuations are keeping a lid on stock prices. Still others pound the table that the Fed is the problem. And finally there is the dynamic duo of the economic outlook and corporate earnings.

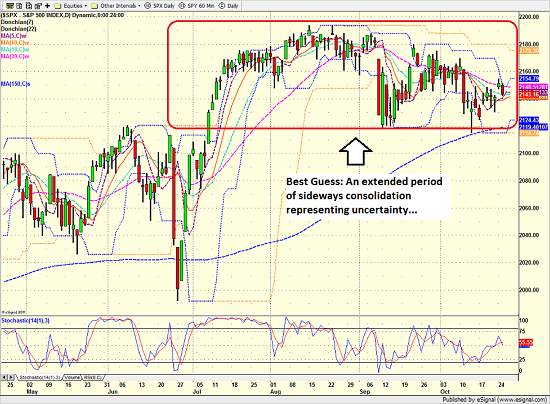

Cutting to the chase, my best guess is that we’re seeing an extended period of sideways consolidation that is being driven by uncertainty. Uncertainty over, well, fill in the blank with your favorite worry here.

The bottom line is that investors simply don’t have a reason to take a stand here. As such, money that needs to be invested is put to work, and then the fast-money types take profits early and often whenever stocks rally for a few days. With the end result being an up and down, back and forth market that winds up frustrating both teams.

S&P 500 – Daily

The good news is that while stocks have been technically in a downtrend since mid-August, the indices really have not declined much. For example, as of yesterday’s close, the S&P 500 is off just 2.15% from the recent high. The point being that while the action certainly hasn’t been fun to watch and it’s been tough to make any money, I’ve can’t really call this market negative either. No, from my seat, things have just been sloppy.

When does it end, you ask? Clearly nobody knows for sure. However, from a technical standpoint, the key lines in the sand are 2120 on the downside ant 2160 on the upside. And until one of the teams is able to make a run for the border, the sloppiness is likely to continues.

Turning to this morning, sloppy is clearly in play as Apple’s (NASDAQ: AAPL) earnings underwhelmed, a new poll shows Trump leading in Florida, there has been talk of the Fed moving up their schedule if the new President gets aggressive with fiscal policy, and there is fresh bad news on the BREXIT front. So, despite the fact that Coca-Cola (NYSE: KO) and Boeing (NYSE: BA) beat estimates and are up nicely in the early going, it looks like we’ll see a weak opening on Wall Street.