Most Markets Fell Last Week, Led By A Slide In US REITs

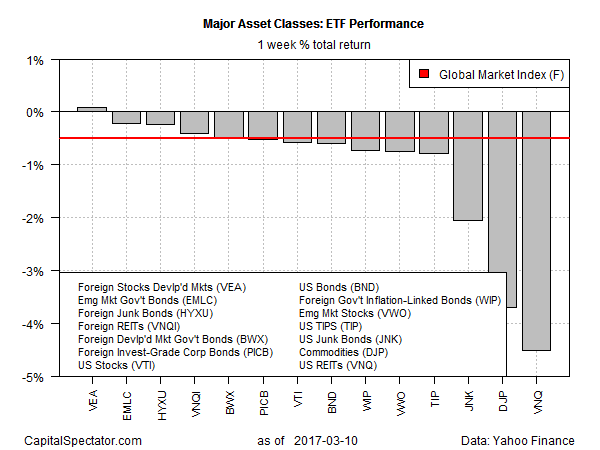

Red ink spilled across nearly every corner of the global markets last week, based on a set of exchange-traded products representing the major asset classes. The lone exception: foreign stocks in developed markets in US dollar terms. Otherwise, losses took a toll far and wide.

Vanguard FTSE Developed Markets (VEA) bucked the trend, posting a slight gain of 0.1% for the five trading days through Friday (Mar. 10). The advance pushed the fund near its highest close since the summer of 2015.

Last week’s biggest loser: real estate investment trusts (REITs) in the US. Vanguard REIT (VNQ) fell a hefty 4.5% last week. Weighed down by the expectations that the Federal Reserve will raise interest rates this week, the yield-sensitive REIT fund closed at its lowest price of the year so far.

Last week’s downside bias delivered a loss for an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights slid 0.5% last week — its first weekly decline since January.

(Click on image to enlarge)

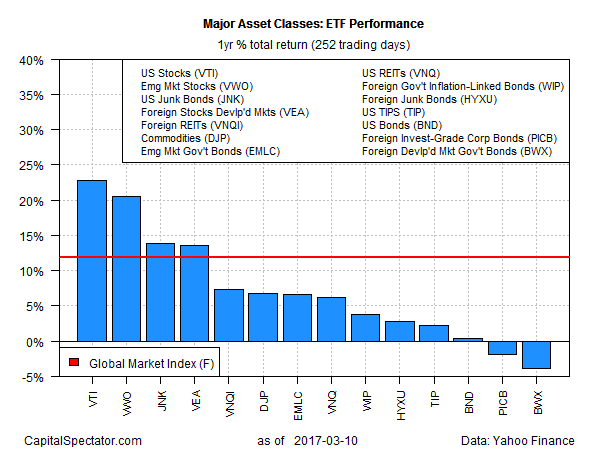

By contrast, one-year results are still mostly positive, but losses began creeping into this previously positive across-the-board profile.

Leading the field higher over the past 12 months: US equities. Vanguard Total Stock Market (VTI) is up 22.7% in total return terms for the year through Mar. 10.

The biggest loss among the major asset classes at the moment: government bonds in foreign developed markets in unhedged US dollar terms. SPDR Bloomberg Barclays International Treasury Bond (BWX) is off 3.8% for the trailing one-year window.

Meanwhile, GMI.F’s one-year trend remains solidly positive over the past year. The benchmark is ahead by 11.9% for the 12 months through Mar. 10.

(Click on image to enlarge)

Disclosure: None.

Other exceptions: Medical Devices (IHI), broad Healthcare (XLV), Big Tech (QQQ), etc. Some items hit with the ugly stick in the market's original Trump knee jerk did just fine. It's the 'Trump Trade' items that are leading the downside. That's a negative divergence to the mania.