Morning Call - 11/6/2014

OVERNIGHT MARKETS AND NEWS

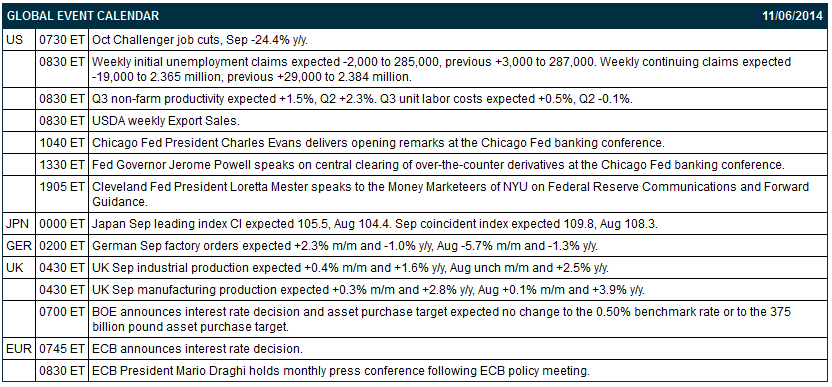

December E-mini S&Ps (ESZ14 -0.22%) this morning are down -0.12% and European stocks are up +0.02% ahead of the results of today's ECB meeting and press conference from ECB President Draghi shortly after. A smaller-than-expected increase in German Sep factory orders is limiting gains in European stock prices. As expected, the BOE kept its benchmark interest rate at 0.50% and maintained its 375 billion pound asset purchase target following the conclusion of its 2-day policy meeting. The Russian ruble weakened to a record 45.59 per dollar after the U.S. and Germany warned Russia of further sanctions as fighting intensified in rebel-held areas in east Ukraine and threatened to unravel a 2-month-old truce. Asian stocks closed mixed: Japan -0.86%, Hong Kong -0.20%, China +0.10%, Taiwan -0.80%, Australia -0.21%, Singapore +0.10%, South Korea +0.54%, India closed for holiday. Commodity prices are mostly lower. Dec crude oil (CLZ14 -0.18%) is down -0.27%. Dec gasoline (RBZ14 +0.12%) is up +0.13%. Dec gold (GCZ14 -0.10%) is down -0.07%. Dec copper (HGZ14 -0.25%) is down -0.17%. Agriculture prices are weaker. The dollar index (DXY00 -0.21%) is down-0.19%. EUR/USD (^EURUSD) is up +0.23%. USD/JPY (^USDJPY) is up +0.02% at a 7-year high. Dec T-note prices (ZNZ14 +0.07%) are up +2 ticks.

German Sep factory orders rose +0.8% m/m, less than expectations of +2.3% m/m. On an annual basis Sep factory orders fell -1.0% y/y, right on expectations.

UK Sep industrial production rose +0.6% m/m, stronger than expectations of +0.4% m/m and the most in 7 months. On an annual basis Sep industrial production rose +1.5% y/y, less than expectations of +1.6% y/y.

UK Sep manufacturing production rose +0.4% m/m and +2.9% y/y, stronger than expectations of +0.3% m/m and +2.8% y/y.

UK Oct Halifax house prices unexpectedly fell -0.4% m/m, weaker than expectations of +0.4% m/m. Halifax house prices rose +8.8% in the 3-months through Oct y/y, less than expectations of +9.1% 3-monhts y/y.

The Japan Sep leading index CI rose +1.2 to 105.6, slightly better than expectations of +1.1 to 105.5 and the highest in 5 months. The Sep coincident index rose +1.4 to 109.7, less than expectations of +1.5 to 109.8.

U.S. STOCK PREVIEW

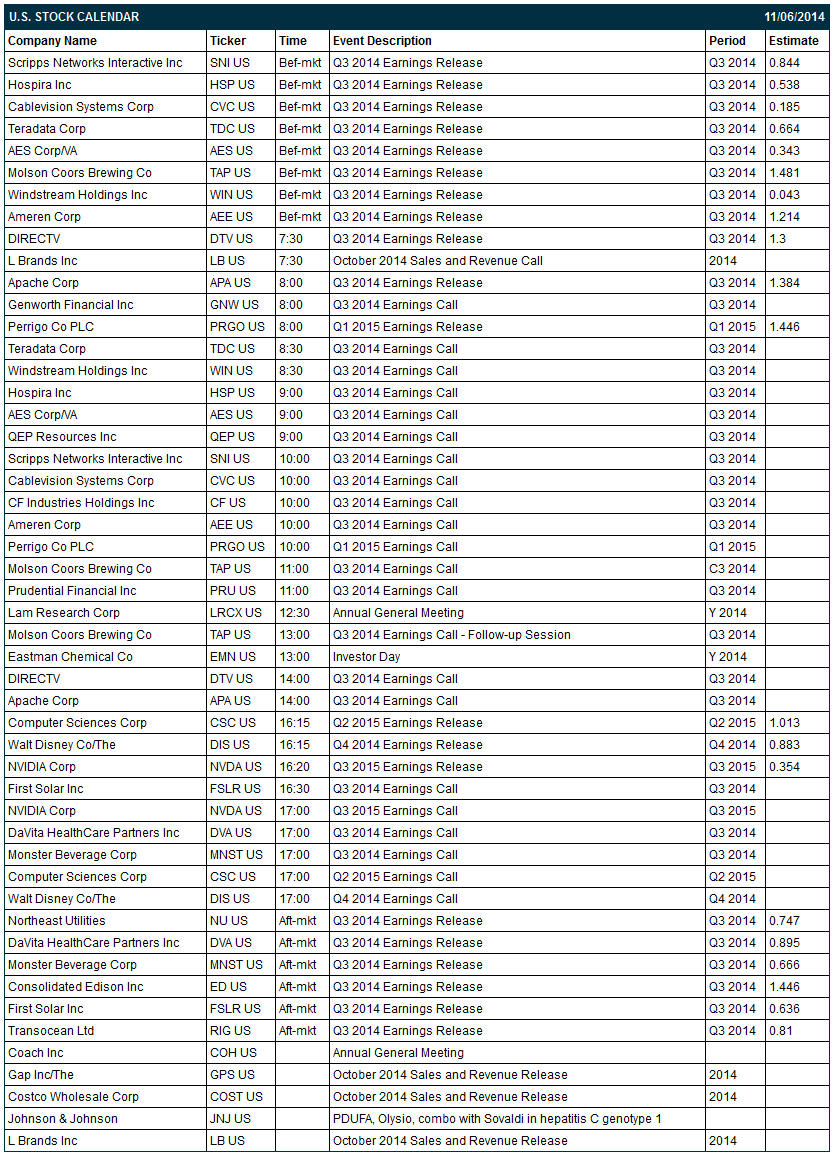

Today’s weekly initial unemployment claims report is expected to show a small -2,000 decline to 285,000 following last week’s small +3,000 increase to 287,000. Today’s Q3 non-farm productivity report is expected to ease to +1.5% from +2.3% in Q2. There are 20 of the S&P 500 companies that report earnings today with notable reports including: Walt Disney (consensus $0.88), Molson Coors (1.48), Apache (1.38), NVIDIA (0.35), Monster Beverage (0.67), First Solar (0.64), Transocean (0.81). Equity conferences this week include: Raymond James Global Airline Transportation Conference on Thu, BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Perrigo PLC (PRGO -0.84%) reported Q1 EPS of $1.40, below consensus of $1.45.

Sunoco Logistics (SXL -0.70%) reported Q3 EPS of 50 cents, well above consensus of 36 cents.

CenturyLink (CTL +0.05%) reported Q3 adjusted EPS of 63 cents, above consensus of 62 cents.

News Corp. (NWSA +0.99%) reported Q1 adjusted EPS of 9 cents, three times above consensus of 3 cents.

CF Industries (CF +0.46%) slid over 5% in after-hours trading after it reported Q3 adjusted EPS of $2.62, well below consensus of $3.47.

Tutor Perini (TPC +0.72%) reported Q3 EPS of 73 cents, stronger than consensus of 69 cents

DryShips (DRYS +5.80%) gained over 6% in after-hours trading after it reported Q3 EPS ex-items of 7 cents, better than consensus of 5 cents.

Maiden Holdings (MHLD +1.99%) reported Q3 EPS of 38 cents, above consensus of 37 cents.

EnerSys (ENS +0.69%) reported Q2 adjusted EPS of $1.06, higher than consensus of $1.01.

Willis Group (WSH +1.42%) was upgraded to 'Hold' from 'Sell' at Deutsche Bank.

Tesla (TSLA -3.33%) rose over 5% in after-hours trading after it reported Q3 adjusted EPS of 2 cents, much better than consensus of a -1 cent loss.

Hologic (HOLX -2.14%) reported Q4 EPS ex-benefit of 38 cents, better than consensus of 37 cents.

Roundy's (RNDY +3.77%) reported a Q3 EPS loss of -7 cents, right on consensus, although Q3 revenue of $973.8 million was more than consensus of $965.6 million.

Symantec (SYMC +0.76%) reported Q2 EPS of 48 cents, above consensus of 43 cents.

Whole Foods (WFM +0.48%) jumped over 7% in after-hours trading after it reported Q4 EPS of 35 cents, higher than consensus of 32 cents.

Qualcomm (QCOM +0.12%) fell over 6% in after-hours trading after it reported Q4 EPS of $1.26, less than consensus of $1.31, and then lowered guidance on fiscal 2015 EPS to $5.05-$5.35, weaker than consensus of $5.58.

CBS (CBS +0.98%) was up over 2% in after-hours trading after it reported Q3 adjusted EPS of 74 cents, better than consensus of 73 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.22%) this morning are down -2.50 points (-0.12%). The S&P 500 index on Wednesday closed higher: S&P 500 +0.57%, Dow Jones +0.58%, Nasdaq -0.07%. Bullish factors included (1) speculation that the win by Republicans in the midterm elections to their first majority in the Senate in 8 years will boost economic growth as Republicans push ahead with their pro-business policies, (2) the +230,00 increase in the Sep ADP employment report, more than expectations of +220,000 and the most in 4 months, and (3) a stellar earnings season as 81% of reporting S&P 500 companies beat estimates, the most in 4 years.

Dec 10-year T-notes (ZNZ14 +0.07%) this morning are up +2 ticks. Dec 10-year T-note futures prices on Wednesday closed little changed: TYZ4 unch, FVZ4 +0.50. Negative factors included (1) the larger-than-expected increase in the Sep ADP employment report, which may prompt the Fed to raise interest rates sooner than expected, and (2) the rally in stocks which reduced the safe-haven demand for T-notes. T-notes recovered from losses after the Oct ISM non-manufacturing index fell more than expected.

The dollar index (DXY00 -0.21%) this morning is down -0.165 (-0.19%). EUR/USD (^EURUSD) is up +0.0029 (+0.23%). USD/JPY (^USDJPY) is up +0.02 (+0.02%). The dollar index on Wednesday climbed to a new 4-1/3 year high and closed higher. Closes: Dollar index +0.460 (+0.53%), EUR/USD-0.00605 (-0.48%), USD/JPY +1.044 (+0.92%). Bullish factors included (1) the larger-than-expected increase in the Sep ADP employment change, which bolsters the case for the Fed to raise interest rates next year, and (2) the rally in USD/JPY to a 6-3/4 year high after BOJ Governor Kuroda said there is “no limit for additional easing, including on bond purchases.”

Dec WTI crude oil (CLZ14 -0.18%) this morning is down -21 cents (-0.27%) and Dec gasoline (RBZ14 +0.12%) is up +0.0028 (+0.13%). Dec crude and Dec gasoline on Wednesday closed higher despite the rally in the dollar index to a 4-1/3 year high. Closes: CLZ4 +1.49 (+1.93%), RBZ4 +0.0210 (+1.01%). Supportive factors included (1) the +460,000 bbl increase in weekly EIA crude inventories, less than expectations of +2.0 million bbl, and (2) the -1.38 million bbl decline in EIA gasoline stockpiles to a 23-month low of 201.76 million bbl, a larger draw than expectations of -500,000 bbl.

Disclosure: None