Morning Call For Oct. 30, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.52%) this morning are down -0.43% ahead of U.S. Q3 GDP data that may show a slowdown in economic growth and European stocks are down -1.56% led by a slide in European bank stocks after the head of the Eurozone banking authority said that recent stress tests on banks weren't foolproof. European stocks fell even after Eurozone Oct economic confidence unexpectedly rose and after German Oct unemployment unexpectedly declined. Asian stocks closed mostly higher: Japan +0.67%, Hong Kong -0.49%, China +0.72%, Taiwan -0.18%, Australia +0.52%, Singapore +0.32%, South Korea +0.08%, India +0.92%. Japanese stocks closed higher, with the Nikkei Stock Index at a 3-week high, as exporters gained after the yen slipped to a 3-week low against the dollar, which boosts the earnings prospects of exporters. China's Shanghai Stock Index climbed to a 1-1/2 year high on speculation that the proposed trading link between the Hong Kong and Shanghai stock exchanges will spur foreign inflows into Chinese stocks. Commodity prices are mostly lower. Dec crude oil (CLZ14 -0.96%) is down -1.03%. Dec gasoline (RBZ14 -0.58%) is down-0.68%. Dec gold (GCZ14 -1.71%) is down -1.58%% at a 3-week low. Dec copper (HGZ14 -1.32%) is down -1.30%. Agriculture prices are higher. The dollar index (DXY00 +0.31%) is up +0.30% at a 3-week high. EUR/USD (^EURUSD) is down -0.32% at a 3-week low. USD/JPY (^USDJPY) is up +0.11% at a 3-week high. Dec T-note prices (ZNZ14 +0.09%) are up +2 ticks.

Eurozone Oct economic confidence unexpectedly rose +0.8 to 100.7, better than expectations of -0.2 to 99.7. The Oct business climate indicator rose +0.03 to 0.05 from a downward revised 0.02 in Sep, right on expectations.

German Oct unemployment unexpectedly fell -22,000, better than expectations of a +4,000 increase and the biggest decline in 6 months. The Oct unemployment rate remained unchanged at 6.7%, right on expectations and the lowest since data for a reunified Germany began in 1991.

UK Oct Lloyds business barometer fell -22 from Sep to 35, the lowest in 1-1/2 years.

UK Oct nationwide house prices rose +0.5% m/m and +9.0% y/y, better than expectations of +0.3% m/m and +8.5% y/y.

Japan Sep vehicle production fell -2.6% y/y, an improvement from the -6.7% y/y decline in Aug, but the third straight monthly decline.

U.S. STOCK PREVIEW

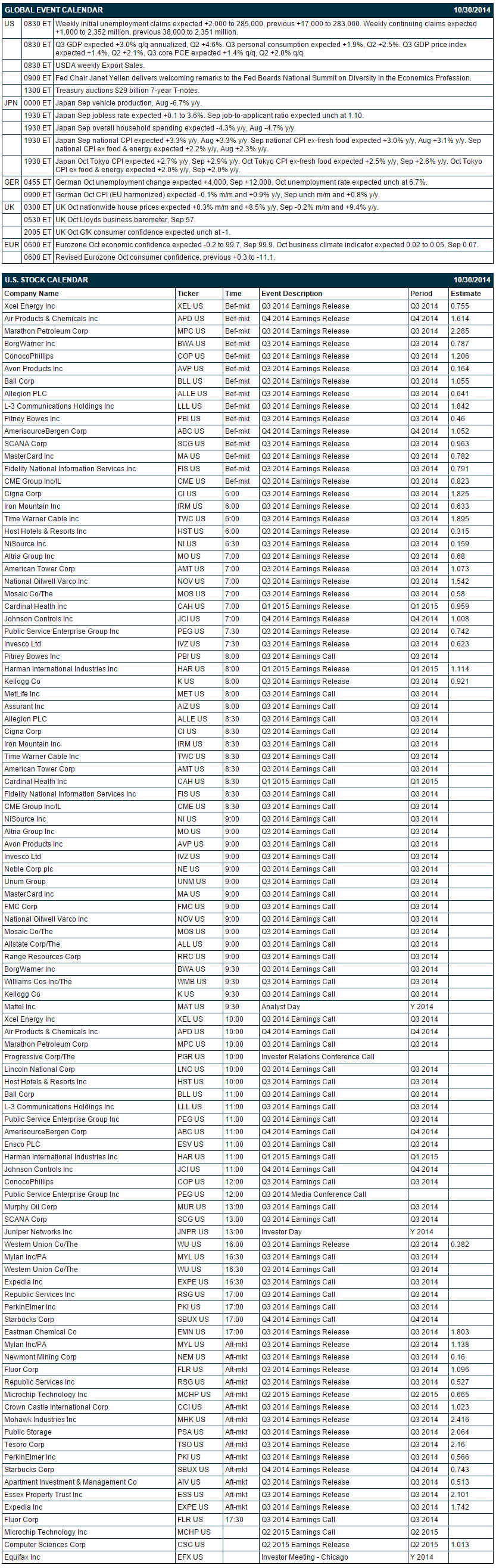

The market is expecting today’s weekly initial unemployment claims report to show a small +2,000 increase to 285,000 and for continuing claims to show a small +1,000 increase to 2.352 million. The market is expecting today’s first estimate for Q3 GDP growth to show an increase of +3.0% (q/q annualized). The Treasury today will sell $29 billion of 7-year T-notes, concluding this week’s $108 billion T-note package.

There are 47 of the S&P 500 companies that report earnings today with notable reports including: MasterCard (0.78), Xcel Energy (0.76), Marathon (2.29), CME Group (0.82), Time Warner (1.90), Johnson Controls (1.01), Kellog (0.92), Newmont Mining (0.16), Fluor (1.10), Starbucks (0.74), Expedia (1.74). Equity conferences during the remainder of this week include: GTEC (Government Technology Exhibition & Conference) 2014 on Tue-Thu.

OVERNIGHT U.S. STOCK MOVERS

Time Warner Cable (TWC +0.81%) reported Q3 EPS of $1.86, weaker than consensus of $1.90.

Level 3 (LVLT -0.93%) will replace Jabil Circuit (JBL -0.30%) in the S&P 500 as of the close of trading on November 4.

CME Group (CME +0.61%) reported Q3 EPS of 84 cents, higher than consensus of 82 cents.

Avis Budget (CAR -0.23%) reported Q3 EPS of $1.91, better than consensus of $1.80.

Baidu (BIDU -1.93%) reported Q3 EPS ex-items of $1.90, well above consensus of $1.69.

Williams (WMB +3.07%) reported Q3 EPS of 15 cents, weaker than consensus of 19 cents.

Con-way (CNW -0.53%) reported Q3 EPS of 78 cents, above consensus of 75 cents.

Norwegian Cruise Line (NCLH +1.19%) reported Q3 adjusted EPS of $1.11, better than consensus of $1.08, and then raised guidance on fiscal 2014 adjusted EPS to $2.28-$2.32, better than consensus of $2.26.

Kraft Foods (KRFT -0.59%) reported Q3 EPS ex-items of 78 cents, higher than consensus of 74 cents.

Fortune Brands (FBHS -0.52%) reported Q3 ex-items EPS of 55 cents, less than consensus of 56 cents.

Hanesbrands (HBI -0.15%) reported Q3 adjusted EPS of $1.73, above consensus of $1.68.

Allstate (ALL -0.40%) reported Q3 EPS of $1.39, higher than consensus of $1.33.

F5 Networks (FFIV -2.60%) reported Q4 EPS of $1.57, better than consensus of $1.48.

MetLife (MET +0.33%) reported Q3 operating EPS of $1.60, well above consensus of $1.38.

Visa (V -0.95%) rose 3% in after-hours trading after it reported Q4 adjusted EPS of $2.18, stronger than consensus of $2.10.

Century Aluminum (CENX -0.22%) reported Q3 EPS of 52 cents, right on consensus, although Q3 revenue of $500.6 million was better than consensus of $488.64 million.

Akamai (AKAM -1.64%) reported Q3 EPS of 62 cents, higher than consensus of 57 cents.

Whiting Petroleum (WLL +1.21%) reported Q3 adjusted EPS of $1.24, better than consensus of $1.22.

Unum Group (UNM -0.20%) reported Q3 adjusted EPS of 87 cents, weaker than consensus of 90 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.52%) this morning are down -8.50 points (-0.43%). The S&P 500 index on Wednesday fell back from a 1-month high and closed lower: S&P 500 -0.14%, Dow Jones -0.18%, Nasdaq -0.39%. The main bearish factor for stocks was the mildly hawkish FOMC post-meeting statement where the FOMC mentioned “solid job gains” with lower unemployment and that risks to the economy and the job outlook are “nearly balanced.” Bullish factors included (1) strength in energy producers as crude oil rallied and (3) strong Q3 stock earnings results with about 80% of reporting S&P 500 companies having beaten earnings estimates.

Dec 10-year T-notes (ZNZ14 +0.09%) this morning are up +2 ticks. Dec 10-year T-note futures prices on Wednesday slid to a 2-week low and closed lower: TYZ4 -16.00, FVZ4 -15.50. Bearish factors included (1) supply pressures as the Treasury auctions $108 billion of T-notes this week, and (2) the mildly hawkish post-FOMC statement where the FOMC said it sees “solid job gains” with lower unemployment and that underutilization of labor resources is gradually diminishing.

The dollar index (DXY00 +0.31%) this morning is up +0.254 (+0.30%) at a 3-week high. EUR/USD (^EURUSD) is down -0.0041 (-0.32%) at a 3-week low. USD/JPY (^USDJPY) is up +0.12 (+0.11%) at a 3-week high. The dollar index on Wednesday rallied to a 3-week high and closed higher. Closes: Dollar index +0.544 (+0.64%), EUR/USD -0.0102 (-0.80%), USD/JPY +0.735 (+0.68%). The main bullish factor was mildly hawkish FOMC statement where the FOMC said it sees “solid job gains” with lower unemployment, which increases the chances that the Fed will raise interest rates sooner rather than later.

Dec WTI crude oil (CLZ14 -0.96%) this morning is down -85 cents (-1.03%) and Dec gasoline (RBZ14 -0.58%) is down -0.0148 (-0.68%). Dec crude and Dec gasoline on Wednesday closed higher with Dec gasoline at a 2-week high. Closes: CLZ4 +0.78 (+0.96%), RBZ4 +0.0258 (+1.20%). Bullish factors included (1) the +2.06 million bbl increase in weekly EIA crude supplies, less than expectations of +3.8 million bbl, and (2) the -1.24 million bbl decline in weekly EIA gasoline inventories to a 23-month low of 203.14 million bbl, nearly double expectations of a -650,000 bbl draw.

Disclosure: None