Morning Call For Oct. 22, 2014

OVERNIGHT MARKETS AND NEWS

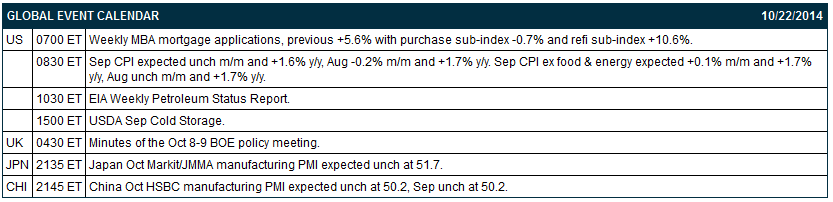

December E-mini S&Ps (ESZ14 -0.21%) this morning fell back from a 1-week high in overnight trade and are down -0.15% and European stocks slipped-0.09% after ECB Governing Council member Luc Coene told the L'Echo newspaper that the ECB has "no concrete proposal" on corporate bond buying and that "it's too early to say if we'll adopt additional stimulus measures." European stocks had rallied on Tuesday after Reuters reported that the ECB is considering corporate-bond purchases to fight the threat of deflation in the Eurozone. Asian stocks closed mostly higher: Japan +2.64%, Hong Kong +1.37%, China -0.61%, Taiwan +1.09%, Australia +1.14%, Singapore closed for holiday, South Korea +1.09%, India +0.80%. Japan's Nikkei Stock Index rose to a 1-week high on signs of a rebound in the Japanese economy after Japan Sep exports rose more than expected by the most in 7 months. Commodity prices are mixed. Dec crude oil (CLZ14 +0.25%) is up +0.27%. Dec gasoline (RBZ14 +0.58%) is up +0.65%. Dec gold (GCZ14 -0.25%) is down -0.46%. Dec copper (HGZ14 +0.36%) is up +0.33%. Agriculture and livestock prices are mostly higher. The dollar index (DXY00 +0.13%) is up +0.24%. EUR/USD (^EURUSD) is down -0.15%. USD/JPY (^USDJPY) is down -0.01%. GBP/USD is down -0.37% after the minutes of the Oct 8-9 BOE policy meeting showed a majority of policy makers saw increased risks to the UK economy from a slump in the Eurozone. Dec T-note prices (ZNZ14+0.09%) are up +0.5 of a tick.

The Japan Sep trade balance unexpectedly widened to a deficit of -958.3 billion yen from a revised -949.7 billion yen deficit in Aug, when expectations were for the deficit to shrink to -780.0 billion yen. Sep exports rose +6.9% y/y, more than expectations of +6.5% y/y and the most in 7 months. Sep imports climbed +6.2% y/y, over double expectations of +2.7% y/y.

The minutes of the Oct 8-9 BOE policy meeting showed members voted 7-2 to keep the policy rate unchanged at 0.50% and 9-0 to maintain the asset purchase target at 375 billion pounds. Most BOE members expressed concern over risks to the UK recovery from slowing global economic growth and weaker Eurozone economy, with a majority of the members saying the CPI outlook doesn't justify a rate increase.

U.S. STOCK PREVIEW

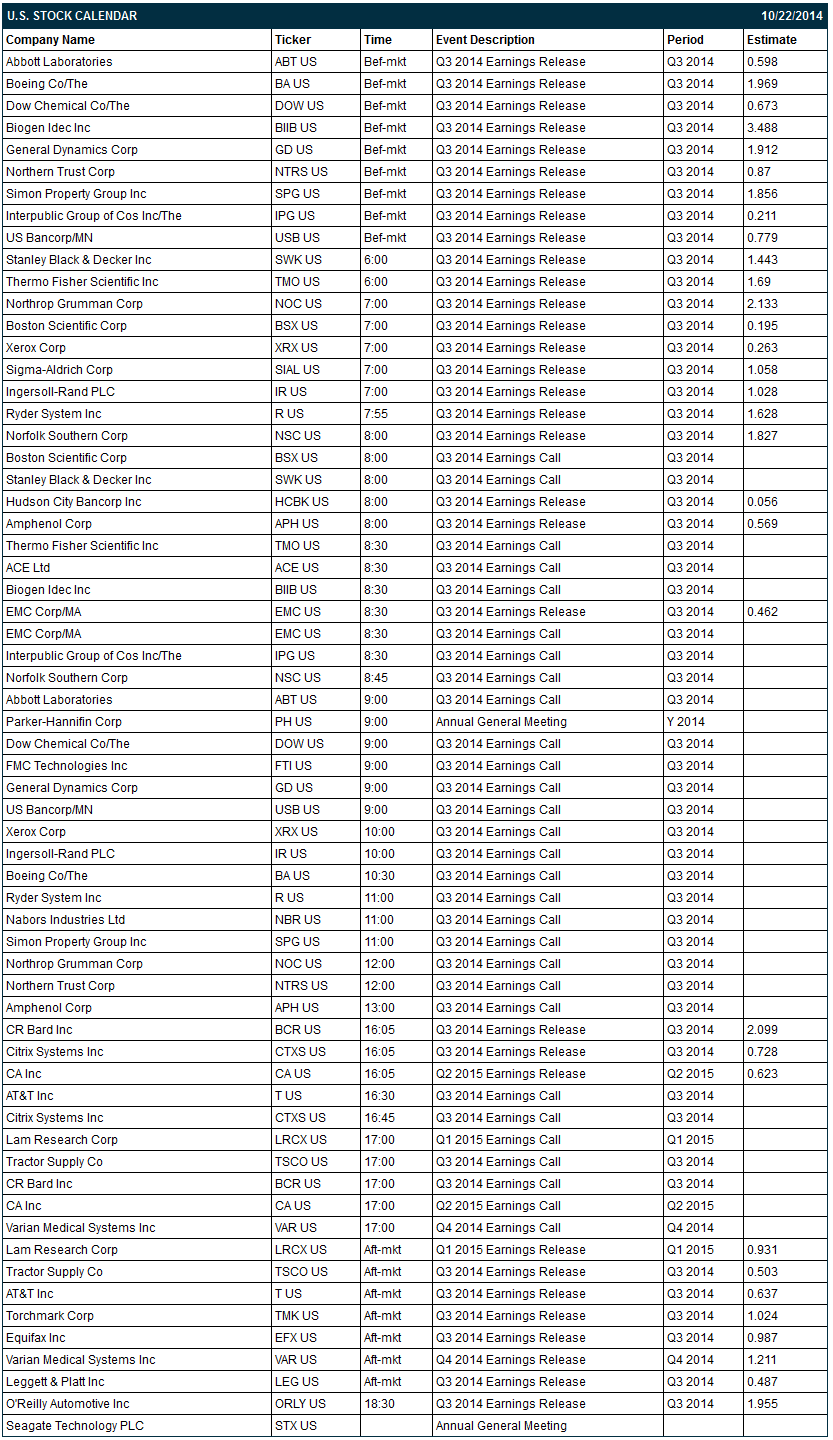

The market is expecting today’s Sep CPI report to ease to a 6-month low of +1.6% y/y from +1.7% in August. Meanwhile, the market is expecting today’s Sep core CPI to remain unchanged from August’s 6-month low of +1.7% y/y. There are 32 of the S&P 500 companies that report earnings today with notable reports including: AT&T (consensus $0.64), Abbott Labs (0.60), Boeing (1.97), Dow Chemical (0.67), General Dynamics (1.91), Northern Trust (0.87), US Bancorp (0.78), Northrup Grumman (2.13), Ingersoll-Rand (1.03), Citrix (0.73). Equity conferences during the remainder of this week include: Latin Markets Private Wealth Latin America and the Caribbean Forum on Thu.

OVERNIGHT U.S. STOCK MOVERS

VMware (VMW +0.60%) dropped nearly 2% in pre-market trading after reported Q3 EPS of 87 cents, higher than consensus of 83 cents, but then lowered guidance for Q4 sales to $1.67 billion to $1.171 billion, below consensus of $1.71 billion.

Boeing (BA +2.26%) reported Q3 EPS of $2.14, well ahead of consensus of $1.97.

Ingersoll-Rand PLC (IR +2.08%) reported Q3 EPS of $1.10, stronger than consensus of $1.03.

Stanley Black & Decker (SWK +1.93%) reported Q3 EPS of $1.55, better than consensus of $1.44.

Northrop Grumman (NOC +1.17%) reported Q3 EPS of $2.26, higher than consensus of $2.13.

Nabors Industries (NBR +4.36%) reported Q3 ex-items EPS of 39 cents, better than consensus of 36 cents.

Unisys (UIS +1.41%) reported Q3 adjusted EPS of $1.30, more than twice consensus of 60 cents.

Six Flags (SIX +3.92%) reported Q3 EPS ex-items of $1.56, higher than consensus of $1.50.

E-Trade (EFTC) reported Q3 EPS of 29 cents, better than consensus of 22 cents.

FMC Technologies (FTI +3.56%) reported Q3 EPS of 72 cents, less than consensus of 74 cents.

Intuitive Surgical (ISRG +2.17%) gained over 2% in after-hours trading after it reported adjusted Q3 EPS of $3.92, stronger than consensus of $3.80.

Discover (DFS +2.68%) reported Q3 EPS of $1.37, higher than consensus of $1.34.

Yahoo (YHOO +2.29%) climbed over 2% in after-hours trading after it reported Q3 EPS of 52 cents, much better than consensus of 30 cents.

Broadcom (BRCM +2.84%) jumped 6% in after-hours trading after it reported Q3 adjusted EPS of 91 cents, well above consensus of 84 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.21%) this morning are down -3.00 points (-0.15%). The S&P 500 index on Tuesday rallied up to a 1-1/2 week high and closed sharply higher: S&P 500 +1.96%, Dow Jones +1.31%, Nasdaq +2.62%. Bullish factors included (1) signs of U.S. economic strength after Sep existing home sales rose +2.4% to 5.17 million, better than expectations of +1.0% to 5.10 million and the most in a year, (2) strength in technology stocks after Apple gained more than 2% when it reported stronger-than-expected Q4 earnings results, and (3) reduced Chinese economic concerns after China Q3 GDP rose +7.3% y/y, a faster pace of expansion than expectations of +7.2% y/y.

Dec 10-year T-notes (ZNZ14 +0.09%) this morning are up +0.5 of a tick. Dec 10-year T-note futures prices on Tuesday closed lower. Closes: TYZ4 -5.00, FVZ4 -1.25. Negative factors included (1) the larger-than-expected increase in Sep existing home sales by the most in a year, and (2) reduced safe-haven demand for T-notes after the S&P 500 rallied up to a 1-1/2 week high.

The dollar index (DXY00 +0.13%) this morning is up +0.208 (+0.24%). EUR/USD (^EURUSD) is down -0.0019 (-0.15%). USD/JPY ^USDJPY) is down-0.02 (-0.02%). The dollar index on Tuesday closed higher on signs of U.S. economic strength after Sep existing home sales rose more than expected by the most in a year. Closes: Dollar index +0.397 (+0.47%), EUR/USD -0.00837 (-0.65%), USD/JPY +0.05 (+0.05%). EUR/USD retreated after Reuters reported that unidentified sources familiar with the situation said the ECB could make a decision on adding corporate bond purchases to its easing measures as soon as December.

Dec WTI crude oil (CLZ14 +0.25%) this morning is up +22 cents (+0.27%) and Dec gasoline (RBZ14 +0.58%) is up +0.0141 (+0.65%). Dec crude and Dec gasoline on Tuesday closed higher. Closes: CLZ4 +0.58 (+0.71%), RBZ4 +0.0145 (+0.68%). Bullish factors included (1) signs of stronger Chinese oil demand after China Q3 GDP grew at a faster than expected pace and after China Sep crude processing rose +9.1% y/y to 10.3 million bpd, the most in 15 months, and (2) the stronger-than-expected U.S. Sep existing home sales that boosted stocks and bolstered the economic outlook.

Disclosure: None