Morning Call For Oct. 21, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.74%) this morning are up +0.67% at a 1-week high and European stocks are up +1.61% as Apple rose 2% in pre-market trading after it reported stronger-than-expected Q4 earnings results late yesterday. Another supportive factor for stocks was strength in the Chinese economy after Q3 China GDP grew more than expected. Asian stocks closed mixed: Japan -2.03%, Hong Kong +0.08%, China -0.87%, Taiwan -0.10%, Australia +0.11%, Singapore +0.68%, South Korea -0.99%, India +0.55%. Chinese stocks closed lower after the stronger-than-expected China Q3 GDP dampened speculation the government will boost economic stimulus measures. Commodity prices are mixed. Nov crude oil (CLX14+0.27%) is up +0.58%. Nov gasoline (RBX14 +0.52%) is up +0.57%. Dec gold (GCZ14 +0.38%) is up +0.32% at a 1-1/4 month high on expectations the Fed may push back interest rate increases. Dec copper (HGZ14 +0.64%) is up +0.30%. Agriculture and livestock prices are mostly higher. The dollar index (DXY00 +0.27%) is up +0.23%. EUR/USD (^EURUSD) is down -0.35%. USD/JPY (^USDJPY) is down -0.06%. Dec T-note prices (ZNZ14 -0.12%) are down -8.5 ticks.

China Q3 GDP rose +1.9% q/q and +7.3% y/y, stronger than expectations of +1.8% q/q and +7.2% y/y. Despite beating expectations, the +7.3% y/y increase was the slowest pace of expansion in 5-1/2 years.

China Sep industrial production rose +8.0% y/y, better than expectations of +7.5% y/y.

China Sep retail sales climbed +11.6% y/y, less than expectations of +11.7% y/y and the slowest pace of growth in 3-1/2 years.

China Sep fixed assets investment (ex-rural households) rose +16.1% year-to-date y/y, less than expectations of +16.3% year-to-date y/y and the slowest pace of increase in 12-3/4 years.

UK Sep public sector net borrowing rose +11.1 billion pounds, more than expectations of +10.1 billion pounds.

Japan Aug all-industry activity index fell -0.1% m/m, a smaller decline than expectations of -0.4% m/m, but still the third consecutive monthly drop.

U.S. STOCK PREVIEW

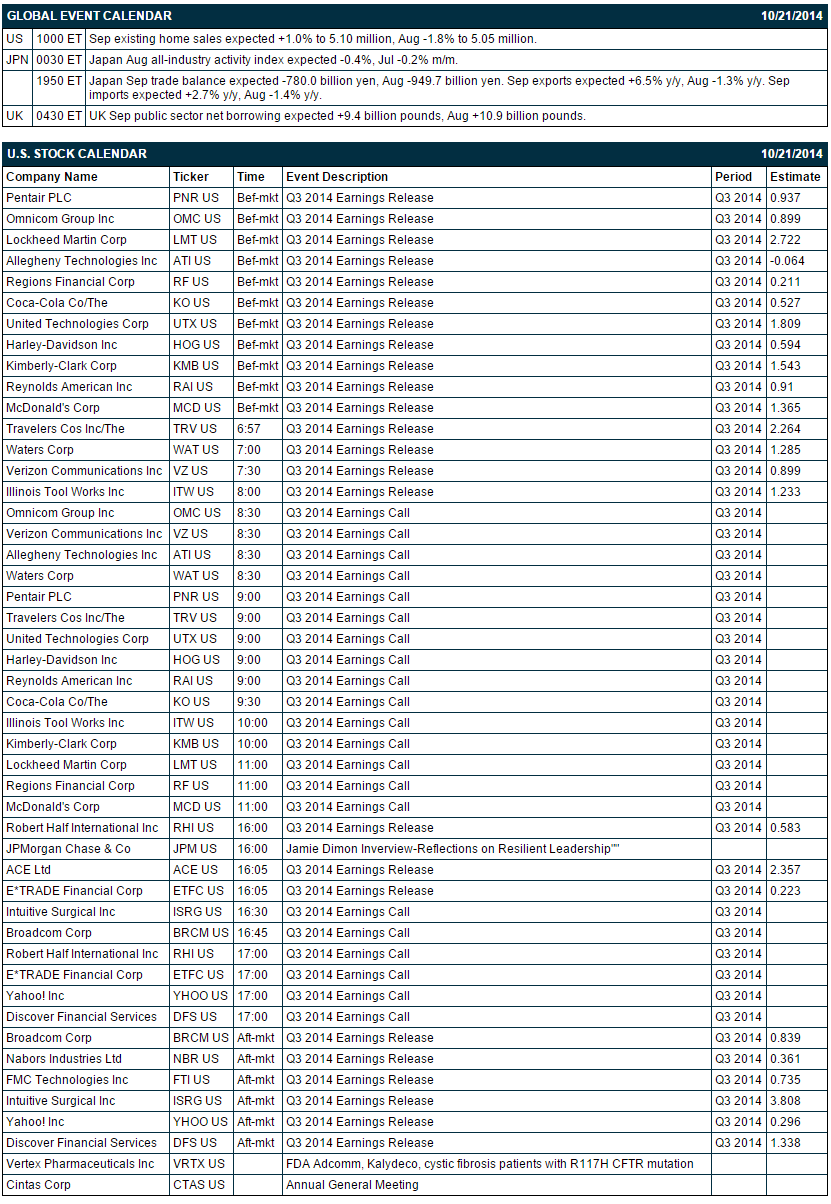

The market is expecting today’s Sep existing home sales report to show a +1.0% increase to 5.10 million, reversing some of the -1.8% decline to 5.05 million seen in August. There are 24 of the S&P 500 companies that report earnings today with notable reports including: Lockheed Martin (2.72), Coca-Cola (0.53), United Technologies (1.81), Kimberly-Clark (1.54), Harley-Davidson (0.59), McDonald's (1.37), E-Trade (0.22), Intuitive Surgical (3.81), Yahoo (0.30). Equity conferences during the remainder of this week include: Latin Markets Private Wealth Latin America and the Caribbean Forum on Thu.

OVERNIGHT U.S. STOCK MOVERS

Lockheed Martin (LMT -0.40%) reported Q3 EPS of $2.76, higher than consensus of $2.72.

Harley-Davidson (HOG -0.43%) reported Q3 EPS of 69 bents, better than consensus of 59 cents.

The Travelers Cos. (TRV -0.04%) reported Q3 EPS of $2.61, well above consensus of $2.26.

Verizon (VZ +0.85%) reported Q3 EPS of 89 cents, less than consensus of 90 cents.

Brown & Brown (BRO +0.75%) reported Q3 EPS of 47 cents, right on consensus, although Q3 revenue of $421.3 million was slightly less than consensus of $425.4 million.

SAB Capital Advisors reported a 5.1% passive stake in Men's Wearhouse (MW +0.65%) .

Celanese (CE +2.13%) reported Q3 adjusted EPS of $1.61, much better than consensus $1.44, and then raised guiadance on fiscal 2014 adjusted EPS view to $5.55-$5.65, well above consensus of $5.33.

Texas Instruments (TXN +1.69%) gained 3% in after-hours trading ater it reported Q3 EPS of 76 cents, better than consensus of 71 cents.

Apple (AAPL +2.14%) climbed more than 2% in after-hours trading after it reported Q4 EPS of $1.42, well ahead of consensus of $1.31.

Rent-A-Center (RCII +0.25%) reported Q3 EPS of 48 cents, higher than consensus of 47 cents, although Q3 revenue of $769.5 million was below consensus of $773.32 million.

Illumina (ILMN -0.27%) rose more than 7% in after-hours trading after it reported Q3 adjusted EPS of 77 cents, much higher than consensus of 56 cents, and then raised guidance on fiscal 2014 EPS view to $2.63-$2.65, well ahead of consensus of $2.30.

Cadence Design (CDNS +0.73%) reported Q3 adjusted EPS of 26 cents, better than consensus of 24 cents.

Werner (WERN +1.22%) reported Q3 EPS of 36 cents, right on consensus, although Q3 revenue of $551.96 million was higher than consensus of $542.95 million.

Chipotle (CMG +1.76%) reported Q3 EPS of $4.15, well above consensus of $3.84.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.74%) this morning are up +12.75 points (+0.67%) at a 1-week high. The S&P 500 index on Monday closed higher: S&P 500 +0.91%, Dow Jones +0.12%, Nasdaq +1.43%. Bullish factors included (1) expectations for strong Q3 company earnings results as the estimate for Q3 S&P 500 company profits has been raised over the past 1-1/2 weeks, and (2) a rally in Apple that lifted technology stocks on expectations that increased iPhone 6 sales lifted Apple’s fiscal Q4 profit by +10%.

Dec 10-year T-notes (ZNZ14 -0.12%) this morning are down -8.5 ticks. Dec 10-year T-note futures prices on Monday closed higher. Closes: TYZ4 +5.50, FVZ4 +4.50. Bullish factors included (1) carry-over support from a rally in European government bonds after German Sep PPI fell -1.0% y/y, the largest year-over-year decline in 8 months, which may prompt he ECB to expand stimulus and (2) comments from Dallas Fed President Fisher suggesting the Fed may wait before raising interest rates when he said he wants to see how things proceed in the U.S. economy before raising interest rates.

The dollar index (DXY00 +0.27%) this morning is up +0.194 (+0.23%). EUR/USD (^EURUSD) is down -0.0045 (-0.35%). USD/JPY ^USDJPY) is down-0.06 (-0.06%). The dollar index on Monday closed lower after Dallas Fed President Fisher said that he wants to see how the things proceed in the U.S. economy before raising interest rates. Closes: Dollar index -0.157 (-0.18%), EUR/USD +0.00409 (+0.32%), USD/JPY +0.04 (+0.04%). USD/JPY moved higher as the yen weakened after the Nikkei newspaper reported that Japan’s $1.2 trillion Government Pension Investment Fund will increase its holdings of foreign stocks and bonds at the expense of Japanese assets, which is yen-negative.

Nov WTI crude oil (CLX14 +0.27%) this morning is up +48 cents (+0.58%) and Nov gasoline (RBX14 +0.52%) is up +0.0126 (+0.57%). Nov crude and Nov gasoline on Monday closed lower. Closes: CLX4 -0.04 (-0.06%), RBXX4 -0.0327 (-1.46%). Bearish factors included (1) speculation that OPEC won’t take any action to cut production and bolster crude prices before its next scheduled meeting late next month, and (2) expectations for Wednesday’s weekly EIA crude inventories to increase by +3.0 million bbl.

Disclosure: None