Morning Call For Oct. 15, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.75%) this morning are down -0.20% and European stocks are down -0.87% on global economic concerns. China reported the smallest increase in consumer prices in 4-1/2 years last month and today's U.S. Sep retail sales data is expected to show the first decline since Jan. Asian stocks closed mostly higher: Japan +0.92%, Hong Kong +0.40%, China +0.71%, Taiwan -1.29%, Australia +0.73%, Singapore +0.14%, South Korea -0.25%, India closed for holiday. China's Shanghai Stock Index closed higher after weaker-than-expected inflation data fueled speculation the government may introduce additional stimulus measures, and Japanese stocks closed higher, led by strength in exporters, after the yen weakened against the dollar. Commodity prices are mostly lower. Nov crude oil (CLX14 -1.28%) is down -1.50% at a 2-1/3 year low after the IEA cut its 2014 global demand forecast along with speculation OPEC will refrain from cutting production to ease a supply glut. Nov gasoline (RBX14 -1.40%) is down -1.72% at a 3-3/4 year low. Dec gold (GCZ14 -0.55%) is down -0.80%. Dec copper (HGZ14 -0.86%) is down -0.65%. Agriculture and livestock prices are mostly lower. The dollar index (DXY00 +0.05%) is up +0.16% at a 1-week high. EUR/USD (^EURUSD) is down -0.09%. USD/JPY (^USDJPY) is up +0.14%. Dec T-note prices (ZNZ14 +0.33%) are up +0.5 of a tick on carry-over support from a rally in German bunds which climbed to a record high as the 10-year bund yield fell to an all-time low of 0.810%.

China Sep CPI rose +1.6% y/y, less than expectations of +1.7% y/y and the smallest pace of increase in 4-1/2 years. Sep PPI fell -1.8% y/y, a larger drop than expectations of -1.6% y/y and the fastest pace of decrease in 5 months.

UK Sep jobless claims fell -18,600, less than expectations of -35,000. The Sep claimant count rate dipped -0.1 to 2.8%, right on expectations and the lowest in 6 years.

The UK Aug ILO unemployment rate fell -0.2 to 6.0% for the 3-months through Aug, a bigger decline than expectations of -0.1 to 6.1% and the lowest in 5-3/4 years. Aug avg weekly earnings rose +0.7% 3-mo avg, right on expectations, and rose +0.9% ex-bonus 3-mo avg, higher than expectations of +0.8% 3-mo avg.

Japan Aug industrial production was revised downward to -1.9% m/m and -3.3% y/y from the originally reported -1.5% m/m and -2.9% y/y.

U.S. STOCK PREVIEW

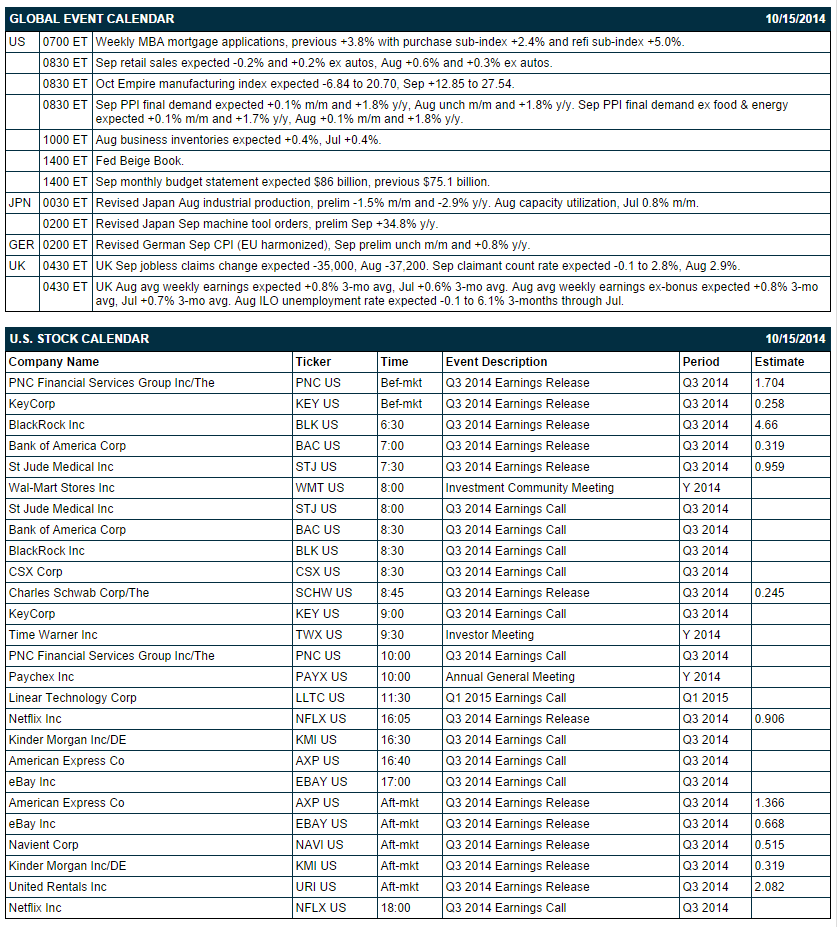

The market is expecting today’s Sep retail sales report to fall -0.2% m/m, giving back part of the sharp +0.6% increase seen in August. Retail sales are expected to much smoother excluding vehicle sales, rising +0.2% in Sep after the +0.3% gain in August. The market is expecting today’s Sep final demand PPI index to be unchanged from August’s level of +1.8% y/y. Meanwhile, the market is expecting today’s Sep core final-demand PPI to ease to +1.7% y/y from +1.8% in August, falling further from the 2-1/3 year high of +2.0% posted in May. The market is expecting today’s Oct Empire manufacturing index to show a -6.84 point decline to 20.70, reversing about one-half of the surge of +12.85 points to the 5-year high of 27.54 seen in September.

There are 12 of the S&P 500 companies that report earnings today: Bank of America (consensus $0.32), Blackrock (4.66), American Express (1.37), PNC Financial (1.70), KeyCorp (0.26), Schwab (0.25), eBay (0.67), United Rentals (2.08), Kinder Morgan (0.32), Navient (0.52), Netflix (0.91), St Jude Medical (0.96). Equity conferences during the remainder of this week include: Bio Japan 2014 on Wed, Bloomberg Next Big Thing Summit: East on Thu, and 5th Annual Global Automotive Forum on Thu.

OVERNIGHT U.S. STOCK MOVERS

Intel (INTC +2.13%) was downgraded to 'Underweight' from 'Equal Weight' at Morgan Stanley.

JPMorgan Chase (JPM -0.29%) was upgraded to 'Buy' from 'Hold' at Argus with a price target of $65.

CBS (CBS +2.09%) was upgraded to 'Buy' from 'Neutral' at Citigroup.

Sanofi (SNY -0.10%) was upgraded to 'Outperform' from 'Neutral' at Credit Suisse.

BlackRock (BLK +0.93%) reported Q3 EPS of $5.21, well ahead of consensus of $4.66.

PNC Financial Services Group (PNC +0.67%) reported Q3 EPS of $1.72, higher than consensus of $1.70.

Bank of America (BAC +0.73%) reported Q3 EPS of 40 cents, higher than consensus of 32 cents.

St. Jude Medical (STJ -1.17%) reported Q3 EPS of 97 cents, better than consensus of 96 cents.

Shannon River reported a 5.2% passive stake in WebMD (WBMD +2.35%) .

Heineken (HEINY -0.95%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Point72 Asset Management reported a 5.2% passive stake in Aegerion (AEGR -1.10%) .

CSX (CSX +2.87%) rose over 2% in after-hours trading after it reported Q3 EPS of 51 cents, better than consensus of 48 cents.

Intel (INTC +2.13%) climbed nearly 3% in after-hours trading after it reported Q3 EPS of 66 cents, higher than consensus of 65 cents, and said it sees Q4 revenue of $14.7 billion, plus or minus $500 million, which is better than consensus of $14.49 billion.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.75%) this morning are down -3.75 points (-0.20%). The S&P 500 index on Tuesday closed higher. S&P 500 +0.16%, Dow Jones -0.04%, Nasdaq +0.06%. Supportive factors for stocks included (1) strength in bank stocks led by a rally in Citigroup after its bond-trading revenue climbed and lending improved, (2) a rally in airline stocks after the price of crude tumbled to a 2-1/4 year low, and (3) reduced interest rate concerns after the 10-year T-note yield fell to a 1-1/4 year low. Gains were limited on European economic concerns after the German Economy Ministry cut its German 2014 GDP forecast to 1.2% from an earlier estimate of 1.8% and after Eurozone Aug industrial production fell -1.8% m/m, a bigger drop than expectations of -1.6% m/m and the largest monthly decline in 2 years.

Dec 10-year T-notes (ZNZ14 +0.33%) this morning are up +0.5 of a tick. Dec 10-year T-note futures prices on Tuesday climbed to a new contract high and the 10-year T-note yield fell to a 1-1/4 year low of 2.17%w. Closes: TYZ4 +9.00, FVZ4 +3.75. Bullish factors include (1) carry-over support from a rally in German bunds to a record high as the 10-year German bund yield tumbled to an all-time low of 0.835%, and (2) expectations for delayed Fed tightening due to slower global economic growth.

The dollar index (DXY00 +0.05%) this morning is up +0.134 (+0.16%) at a 1-week high. EUR/USD (^EURUSD) is down -0.0012 (-0.09%). USD/JPY (^USDJPY) is up +0.15 (+0.14%). The dollar index on Tuesday closed higher. Closes: Dollar index +0.29 (+0.34%), EUR/USD -0.0947 (-0.74%), USD/JPY +0.215 (+0.20%). The main bullish factor for the dollar was weakness in EUR/USD on European economic concerns after (1) the German Oct ZEW expectations of economic growth survey fell more than expected to a 23-month low, (2) Eurozone Aug industrial production dropped -1.8% m/m, the most in 2 years, and (3) the German Economy Ministry cut its German 2014 GDP forecast to 1.2% from an Apr estimate of 1.8% and cut its German 2015 GDP forecast to 1.3% from 2.0%.

Nov WTI crude oil (CLX14 -1.28%) this morning is down -$1.23 a barrel (-1.50%) at a fresh 2-1/3 year low and Nov gasoline (RBX14 -1.40%) is down-0.0375 (-1.72%) at a 3-3/4 year low. Nov crude and Nov gasoline prices on Tuesday closed sharply lower with Nov crude at a 2-1/4 year low and Nov gasoline at 3-3/4 year low. Closes: CLX4 -3.90 (-4.55%), RBXX4 -0.0751 (-2.33%). Bearish factors included (1) a stronger dollar, (2) the action by the IEA to cut its global 2014 crude demand forecast for the fourth consecutive month as it cut its 2014 global crude demand estimate by -250,000 bpd to 650,000 bpd, the slowest pace of growth in 5 years, and (3) expectations for Thursday's weekly EIA data will show crude inventories increased +2.5 million bbl.

Disclosure: None