Morning Call For Wednesday, Sept. 6

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.04%) this morning are little changed, down -0.03% as a Category 5 Hurricane Irma races through the Caribbean toward Florida. European stocks are down -0.16% at a 1-week low after German Jul factory orders unexpectedly declined. North Korean tensions continue to simmer with a lack of consensus among the U.S., Russia and China on how to pressure North Korea to give up its nuclear ambitions as Russia and China both oppose calls from the U.S. for additional sanctions against the North Korean regime. A +0.39% rally in Oct WTI crude oil (CLV17 +0.86%) to a 3-week high is limiting losses in stock indexes as energy stocks move higher. Asian stocks settled mostly lower: Japan -0.14%, Hong Kong -0.46%, China +0.03%, Taiwan -0.66%, Australia -0.29%, Singapore -0.58%, South Korea -0.29%, India -0.46%. A rally in commodity and energy producing stocks helped China's Shanghai Composite eke out a slight gain and post a new 1-1/2 year high, while a slide in USD/JPY to a 1-week low undercut Japanese exporter stocks and helped drag the Nikkei Stock Index down to a fresh 4-month low.

The dollar index (DXY00 +0.04%) is up +0.01%, although the upside was muted after Dallas Fed President Kaplan said the Fed should be "patient" on raising interest rates for a third time this year due to slow inflation. EUR/USD (^EURUSD) is up +0.11%. USD/JPY (^USDJPY) is up +0.06% as it recovers from a 1-week low in overnight trade.

Dec 10-year T-note prices (ZNZ17 -0.04%) are down -1 tick.

Dallas Fed President Kaplan said the Fed should be "patient" on raising interest rates for a third time this year as inflation has been slow to respond to a labor market that's nearing full employment.

German Jul factory orders unexpectedly fell -0.7% m/m, weaker than expectations of +0.2% m/m.

U.S. STOCK PREVIEW

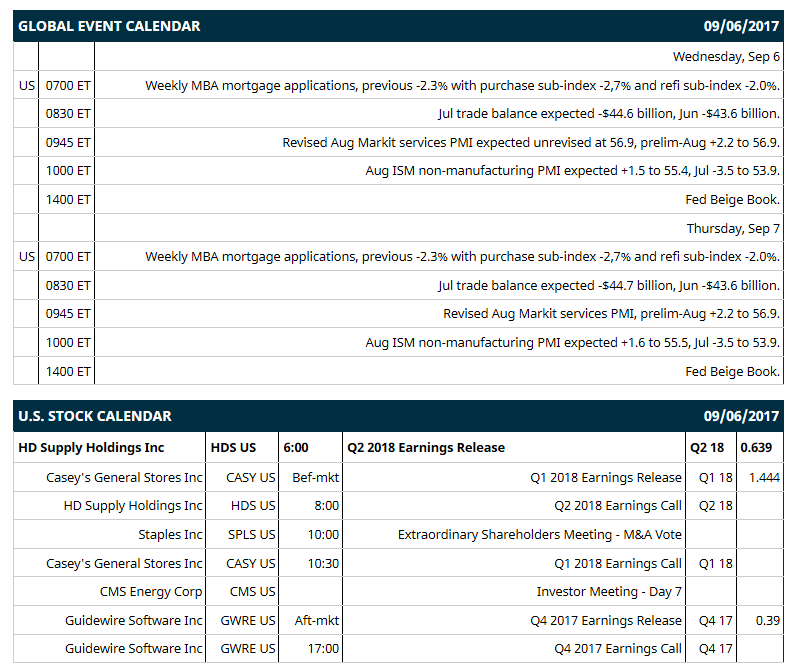

Key U.S. news today includes: (1) Weekly MBA mortgage applications, (2) Jul trade balance (expected -$44.7 billion), (3) Revised Aug Markit services PMI (prelim-Aug +2.2 to 56.9), (4) Aug ISM non-manufacturing PMI (expected +1.6 to 55.5), (5) Fed Beige Book.

Notable Russell 1000 earnings reports today include: HD Supply Holdings (consensus $0.64), Casey's General Stores $1.44, Guidewire Software $0.39..

U.S. IPO's scheduled to price today: Matlin and Partners Acquisition Corp. and Presidio.

Equity conferences this week: Barclays CEO Energy-Power Conference on Tue-Thu, Barclays Global Consumer Staples Conference on Tue-Thu, Baird Global Health Care Conference on Wed, Citi Biotech Conference on Wed, Drexel Hamilton TMT Conference on Wed, Goldman Sachs European Medtech and Healthcare Services Conference on Wed, Piper Jaffray Tech Select Conference on Wed, Raymond James U.S. Bank Conference on Wed, Simmons European Energy Conference on Wed, UBS Global Chemicals & Paper and Packaging Conference on Wed, Citigroup Biotech Conference on Wed-Thu, Cowen & Co. Global Transportation Conference on Wed-Thu, Goldman Sachs Global Retailing Conference on Wed-Thu, Keefe, Bruyette, & Woods Insurance Conference on Wed-Thu, Robert W. Baird Global Health Care Conference on Wed-Thu, Wells Fargo Securities Health Care Conference on Wed-Thu, Citi Global Technology Conference on Wed-Fri, Vertical Research Partners Global Industrials Conference on Wed-Fri, Barclays Back-to-School Consumer Conference on Thu, Gabelli & Company Aerospace & Defense Conference on Thu, Goldman Sachs Financial Technology Conference on Thu, KBW Insurance Conference on Thu, UBS Best of Americas Conference on Thu, Bank of America Merrill Lynch Media, Communications & Entertainment Conference on Thu-Fri, European Society for Medical Oncology Meeting on Fri, MUFG Securities Oil & Gas Corporate Access Day on Fri.

OVERNIGHT U.S. STOCK MOVERS

Rockwell Collins (COL +0.30%) was downgraded to 'Hold' from 'Buy' at Drexel Hamilton LLC.

Marathon Petroleum (MPC -4.59%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

Exxon Mobil (XOM +0.80%) was upgraded to 'Neutral' from 'Sell' at UBS.

Hewlett Packard Enterprise (HPE -1.89%) rose 5% in after-hours trading after it reported Q3 net revenue of $8.21 billion, higher than consensus of $7.50 billion.

Dave & Busters Entertainment (PLAY +0.52%) dropped 5% in after-hours trading after it reported Q2 comparable sales were up +1.1%, weaker than consensus of +2.6%.

Electronics for Imaging (EFII -1.01%) jumped 8% in after-hours trading after it said it sees Q3 adjusted EOS of 55 cents-60 cents, the midpoint above consensus of 56 cents.

Microchip Technology (MCHP -1.55%) lost 1% in after-hours trading after it reaffirmed its Q2 financial outlook.

Portola Pharmaceuticals (PTLA -5.47%) slipped nearly 3% in after-hours trading as a disagreement with the FDA on relevance of a 2nd polymorph in its Bevyxxa drug may delay the launch of the drug until Nov 2017 and possibly Q1 of 2018.

Monster Beverage (MNST +0.48%) rose 2% in after-hours trading after the Deal.com speculated Cocoa-Cola may acquire MNST as it already has a 16.7% stake in the company.

HealthEquity (HQY -0.43%) rallied 7% in after-hours trading after it said it sees full-year revenue of $223 million-$228 million, the midpoint above consensus of $224.8 million.

Coupa Software (COUP -2.41%) climbed 8% in after-hours trading after it reported Q2 revenue of $44.6 million, higher than consensus of $41.6 million, and said it sees full-year revenue of $177 million-$179 million, better than consensus of $174.3 million.

GoDaddy (GDDY +0.51%) slid -0.5% in after-hours trading after it announced that it intends to offer 20.5 million shares of its common stock in an underwritten public offering.

Duluth Holdings ({=DLTH jumped nearly 8% in after-hours trading after it reported Q2 EPS of 13 cents, better than consensus of 10 cents.

At Home Group (HOME +0.99%) gained over 1% in after-hours trading after it reported Q2 adjusted proforma EPS of 18 cents, above consensus of 17 cents.

Kratos Defense & Security Solutions (KTOS +3.14%) dropped over 5% in after-hours trading after it announced that it intends to offer 12.5 million shares of its common stock in an underwritten public offering.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.04%) this morning are down -0.75 points (-0.03%). Tuesday's closes: S&P 500 -0.76%, Dow Jones -1.07%, Nasdaq -0.92%. The S&P 500 on Tuesday closed lower on an escalation of North Korean tensions after the Asia Business Daily reported that North Korea was preparing to launch an intercontinental ballistic missile after President Trump said he agreed to support billions of dollars of new weapons sales to South Korea. Stocks also fell on concern that Hurricane Irma will hit the U.S. and curb economic activity, which will undercut U.S. GDP.

Dec 10-year T-note prices (ZNZ17 -0.04%) this morning are down -1 tick. Tuesday's closes: TYZ7 +24.00, FVZ7 +14.50. Dec 10-year T-notes on Tuesday rallied to a new contract high and the 10-year T-note yield fell to a 9-3/4 month low on increased safe-haven demand for T-notes after stock prices slumped on escalation of North Korean tensions. T-notes extended their gains on comments from Fed Governor Brainard who said, "we should be cautious about tightening policy further until we are confident inflation is on track to achieve our target."

The dollar index (DXY00 +0.04%) this morning is up +0.008 (+0.01%). EUR/USD (^EURUSD) is up +0.0013 (+0.11%) and USD/JPY (^USDJPY) is up +0.06 (+0.06%). Tuesday's closes: Dollar Index -0.383 (-0.41%), EUR/USD +0.0018 (+0.15%), USD/JPY -0.91 (-0.83%). The dollar index on Tuesday closed lower as escalation of North Korean tensions boosted safe-haven demand for the yen, and on dovish comments from Fed Governor Brainard who said the Fed should be "cautious" about tightening monetary policy further with a lack of inflation pressures.

Oct crude oil (CLV17 +0.86%) this morning is up +19 cents (+0.39%) at a new 3-week high and Oct gasoline (RBV17 -1.12%) is -0.0230 (-1.35%). Tuesday's closes: Oct WTI crude +1.37 (+2.90%), Oct gasoline -0.0488 (-2.79%). Oct crude oil and gasoline on Tuesday settled mixed with Oct crude at a 3-week high. Crude rallied on a weaker dollar and on the restarting of oil refineries along the Gulf Coast that were closed due to Tropical Storm Harvey, which will boost refinery demand for crude oil. Gasoline prices closed sharply lower as the sooner-than-expected restarting of refineries along the Gulf Coast will boost gasoline production.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.06%) -0.6 (-0.04%), Dec silver (SIZ17 +0.52%) +0.094 (+0.52%) and Dec copper (HGZ17 +0.42%) +0.014 (+0.45%). Tuesday's closes: Dec gold +14.1 (+1.06%), Dec silver +0.125 (+0.70%), Dec copper +0.0100 (+0.32%). Metals prices on Tuesday closed higher with gold at an 11-month nearest-futures high and copper prices at a 3-year high due to a weaker dollar and ramped up tensions with North Korea, which boosted safe-haven demand for precious metals. Copper also found support on signs of tighter copper supplies as LME copper inventories fell -3,325 MT to 217,550 MT, a 6-month low.

(Click on image to enlarge)

Disclosure: None.