Morning Call For Wednesday, Oct. 18

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 +0.15%) this morning are up +0.16% at a new record nearest-futures high and European stocks are up +0.45% at a 5-month high. Optimism that the Trump administration will pass a tax reform plan continues to underpin U.S. equity prices, while speculation that the ECB will remain accommodative for longer in lifting European stocks. An introductory speech by ECB President Draghi today at a conference in Frankfort shed no light on ECB plans, while the markets speculate that President Trump will insert a hawk to be the next Fed Chair. A person familiar with the process said that President Trump will name his choice for the next Fed Chair before he leaves Nov 3 on an 11-day trip to Asia and Hawaii. Asian stocks settled mostly higher: Japan +0.13%, Hong Kong +0.05%, China +0.29%, Taiwan -0.03%, Australia +0.01%, Singapore closed for holiday, South Korea -0.03%, India -0.08%. Chinese stocks gained ahead of data tomorrow on China GDP, industrial production and retail sales. Japan's Nikkei Stock Index rose to a new 20-3/4 year high as polls suggest Prime Minister Abe's ruling party may show its best election result in more than three decades after this Sunday's elections in Japan. Abe's Liberal Democratic Party is projected to win as many as 303 seats, close to 2/3 of the 465 seats up for election. That would be the strongest showing since 304 seats were won in the 1986 election.

The dollar index (DXY00 +0.21%) is up +0.20% at a 1-week high on hawkish comments from San Francisco Fed President Williams and Philadelphia Fed President Harker who both look for Fed rate hike at the Dec FOMC meeting. EUR/USD (^EURUSD) is down -0.13% at a 1-week low. USD/JPY (^USDJPY) is up +0.52% at a 1-week high.

Dec 10-year T-note prices (ZNZ17 -0.22%) are down -10 ticks.

San Francisco Fed President Williams said the U.S. economy is stronger than in looks and that inflation softness in overstated. He said the Fed should aim to raise interest rates at the Dec FOMC meeting and three more times next year.

Philadelphia Fed President Harker said he sees one more rate increase in 2017 and notes that high prices for equities and other assets could be an argument for continued, steady pace for rate increases and "that's why I would like to prudently move up to the neutral real rate as quickly as possible."

U.S. STOCK PREVIEW

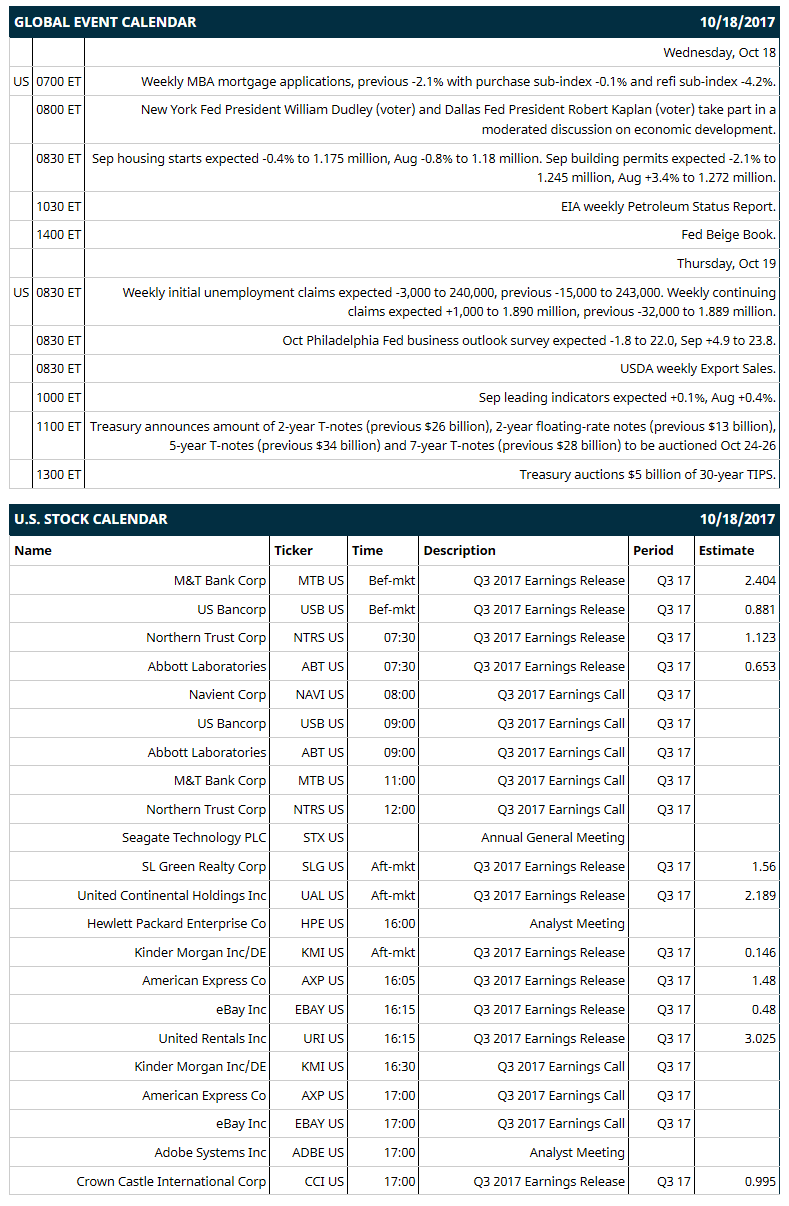

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -2.1% with purchase sub-index -0.1% and refi sub-index -4.2%), (2) New York Fed President William Dudley (voter) and Dallas Fed President Robert Kaplan (voter) take part in a moderated discussion on economic development, (3) Sep housing starts (expected -0.4% to 1.175 million, Aug -0.8% to 1.18 million), (4) Fed Beige Book, (5) EIA weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: American Express (consensus $1.48), United Rentals (3.03), M&T Bank (2.04), United Continental (2.19), SL Green Realty (1.56), Northern Trust (1.12), Crown Castle (1.00), US Bancorp (0.88), Abbott Labs (0.65), EBay (0.48), Kinder Morgan (0.15).

U.S. IPO's scheduled to price today: MongoDB (MDB), RumbleOn (RMBL)

Equity conferences this week: International Association for the Study of Lung Cancer World Conference - Abstra on Mon-Wed, BIO Investor Forum on Tue, METALCON Conference on Thu, SAP Retail Executive Forum on Thu, American Association for the Study of Liver Diseases Liver Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

Expedia (EXPE +0.44%) was upgraded to 'Buy' from 'Neutral' at Redburn.

Grainger (GWW +12.65%) was upgraded to 'Outperform' from 'Market Perform' at Oppenheimer with an 18-month target price of $245.

Chipotle Mexican Grill (CMG +2.78%) fell nearly 3% in pre-market trading after it was downgraded to 'Underperform' from 'Neutral' at Bank of America/Merrill Lynch.

WP Carey (WPC -0.43%) was initiated as an 'Outperform' at Baird with a 12-month target price of $77.

Allergan (AGN -0.32%) was downgraded to 'Hold' from 'Buy' at Edward Jones,

International Business Machines (IBM -0.20%) jumped nearly 5% in after-hours trading after it reported Q3 operating EPS of $3.30, better than consensus of $3.28, and said it sees a $2.8 billion to $2.9 billion increase in Q4 sales from Q3.

Cree (CREE +0.20%) lost nearly 3% in after-hours trading after it forecast Q2 revenue of $340 million-$360 million, below consensus of $369 million.

Select Comfort (SCSS -0.56%) fell over 4% in after-hours trading after it reported Q3 EPS of 62 cents, weaker than consensus of 68 cents, and then said it sees full-year EPS of $1.30-$1.45, the midpoint below consensus of $1.39.

Hi-Crush Partners LP (HCLP +2.87%) jumped nearly 12% in after-hours trading when it announced that it will resume a quarterly cash distribution of 15 cents per share and its board said it authorized a stock buyback program of up to $100 million.

Inovio Pharmaceuticals (INO +0.48%) rose nearly 3% in after-hours trading after it was initiated as an 'Outperform' at RBC Capital Markets with a 12-month target price of $11.

Akari Therapeutics LLC (AKTX -1.23%) plunged 15% in after-hours trading after it was said to offer $17 million in company shares at $5.00-$5.25 each, a 17.97%-21.88% discount to Tuesday's close.

MobileIron (MOBL -2.56%) slumped 10% in after-hours trading after it announced that CEO Barry Mainz will step down effective immediately amid a "mutual decision," and after the company reported preliminary Q3 revenue of $42 million-$43 million, below a July 27 forecast of $44 million-$46 million.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 +0.15%) this morning are up +4.00 points (+0.16%) at a fresh record nearest-futures high. Tuesday's closes: S&P 500 +0.07%, Dow Jones +0.18%, Nasdaq +0.13%. The S&P 500 on Tuesday eked out a new record high and closed slightly higher on the unexpected +4 point increase in the U.S. Oct NAHB housing market index to 68, stronger than expectations of unchanged at 64 and a 5-month high. There was also strength in health-care stocks after Republican Senator Alexander and Democratic Senator Murray said they have the "basic outlines" of a bipartisan deal to resume federal subsidies to health insurers for 2 years. Stocks were undercut by news that U.S. Sep import prices rose +0.7% m/m, stronger than expectations of +0.6% m/m and the fastest pace of increase in 15 months, which bolsters the case for a Fed rate hike in Dec.

Dec 10-year T-note prices (ZNZ17 -0.22%) this morning are down -10 ticks. Tuesday's closes: TYZ7 +0.50, FVZ7 unch. Dec 10-year T-notes on Tuesday closed little changed. T-note prices were supported by the the weaker-than-expected U.S. Sep manufacturing production report and by the decline in the 10-year T-note breakeven inflation expectations rate to a 3-week low. T-note prices were undercut by the stronger-than expected U.S. Sep import price report of +0.7% m/m, the most in 15 months, and by the unexpected 4-point increase in the U.S. Oct NAHB housing market index to a 5-month high.

The dollar index (DXY00 +0.21%) this morning is up +0.183 (+0.20%) at a 1-week high. EUR/USD (^EURUSD) is down -0.0015 (-0.13%) at a 1-week low and USD/JPY (^USDJPY) is up +0.58 (+0.52%) at a 1-week high. Tuesday's closes: Dollar Index +0.174 (+0.19%), EUR/USD -0.0030 (-0.25%), USD/JPY +0.01 (+0.01%). The dollar index on Tuesday closed higher on speculation that President Trump may be leaning toward John Taylor as the next Fed chair, who is thought to be hawkish. There was also weakness in EUR/USD which fell to a 1-week low after the German Oct ZEW came in lower than expected and after Spain cut its 2018 GDP estimates.

Nov crude oil (CLX17 +0.31%) this morning is up +20 cents (+0.39%) and Nov gasoline (RBX17 +0.50%) is +0.0083 (+0.51%). Tuesday's closes: Nov WTI crude +0.01 (+0.02%), Nov gasoline +0.0132 (+0.82%). Nov crude oil and gasoline on Tuesday closed higher on expectations for Wednesday's EIA crude inventories to fall -3.0 million bbl and the increase in the crack spread to a 1-week high, which gives incentive for refineries to purchase more crude to refine into gasoline. Crude oil prices were undercut by a stronger dollar and by reduced tensions between Iraq and Kurdistan after Sky News reported that the Kurdish Peshmerga agreed to return to Iraq's 2003 border demarcations, which reduces the likelihood of disruptions of crude supplies from Iraq.

Metals prices this morning are lower with Dec gold (GCZ17 -0.35%) -5.5 (-0.43%) at a 1-week low, Dec silver (SIZ17 -0.36%) -0.081 (-0.48%) at a 1-week low and Dec copper (HGZ17 -0.25%) -0.007 (-0.20%). Tuesday's closes: Dec gold -16.8 (-1.29%), Dec silver -0.328 (-1.89%), Dec copper -0.0435 (-1.34%). Metals on Tuesday closed lower with Dec gold and Dec silver at 1-week lows. Metals prices were undercut by a stronger dollar and by speculation that President Trump is leaning toward John Taylor as the next Fed chair, who is thought to be a monetary policy hawk.

(Click on image to enlarge)

Disclosure: None.