Morning Call For Wednesday, Nov. 8

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.11%) this morning are down -0.12% on concern about the progress on U.S. tax reform after the Washington Post reported that Senate Republican leaders were considering holding tax cuts back a year. European stocks are down -0.31% at a 1-1/2 week low, led by losses in banking stocks, as Credit Agricole slid 3% after it reported a slump in trading revenue. Mining stocks are weaker as well, as Dec COMEX copper (HGZ17 -0.24%) dropped -0.06% to a 4-week low on Chinese demand concerns after China Oct copper imports fell -30% m/m to 330,000 MT, the smallest amount in 6 months. Asian stocks settled mixed: Japan -0.10%, Hong Kong -0.30%, China +0.06%, Taiwan -0.20%, Australia +0.03%, Singapore +0.24%, South Korea +0.31%, India -0.46%. China's Shanghai Composite rallied to a 1-3/4 year high on signs of stronger domestic demand after China Oct imports rose more than expected, although stocks gave up most of their gains on economic growth concerns after China Oct exports rose less than expected.

The dollar index (DXY00 -0.01%) is down -0.08%. EUR/USD (^EURUSD) is up +0.06%. USD/JPY (^USDJPY) is down -0.34%.

Dec 10-year T-note prices (ZNZ17 -0.04%) are down -1 tick.

Philadelphia Fed President Harker said he has "not at this point" seen anything that would push him away from a Fed rate hike at next month's FOMC meeting, but he wants to see signs of inflation moving higher before backing additional rate hikes next year.

The China Oct trade balance widened to a surplus of $38.17 billion, smaller than expectations of $39.10 billion. Oct exports rose +6.9% y/y, weaker than expectations of +7.1% y/y. Oct imports rose +17.2% y/y, stronger than expectations of +17.0% y/y.

U.S. STOCK PREVIEW

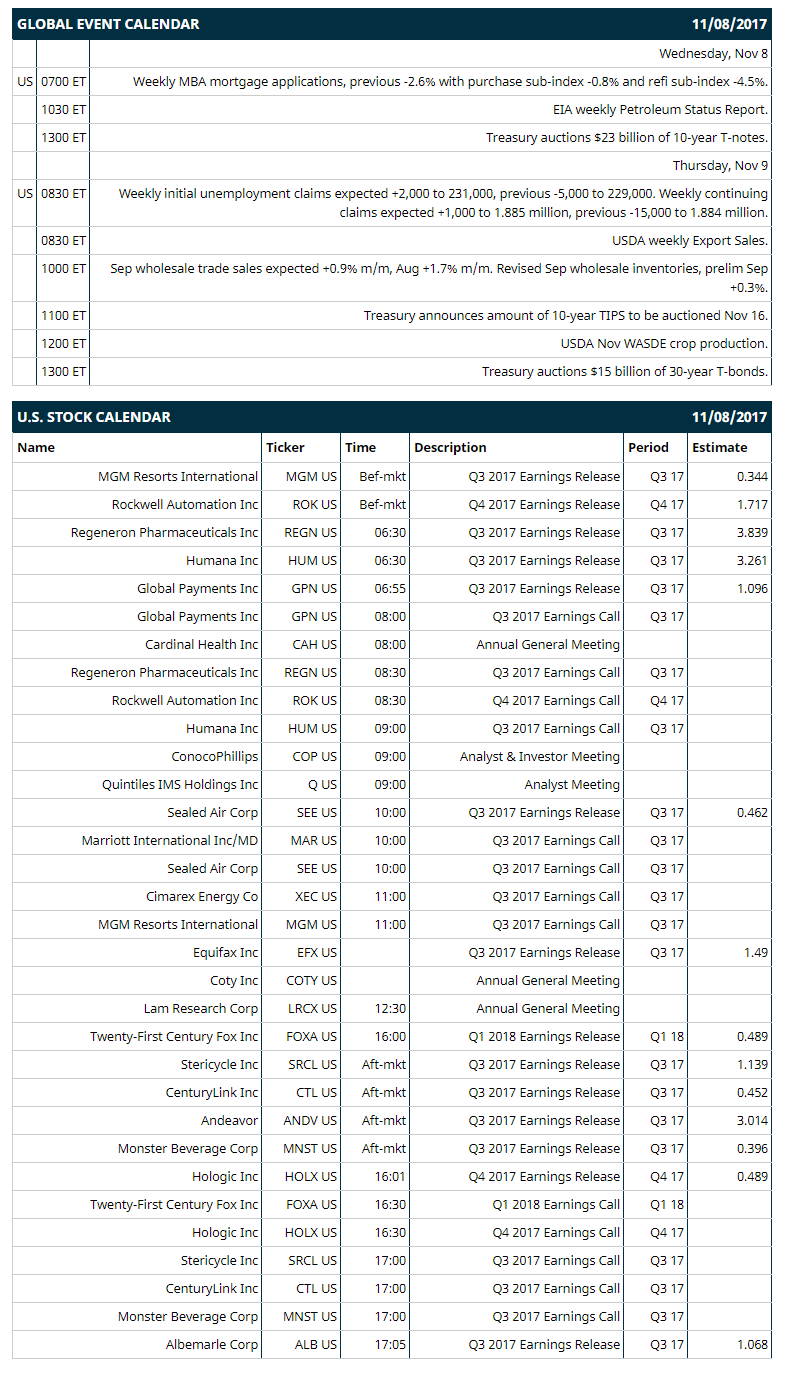

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -2.6% with purchase sub-index -0.8% and refi sub-index -4.5%), (2) Treasury auctions $23 billion of 10-year T-notes, (3) EIA weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: Humana (consensus $3.26), Regeneron Pharma (3.84), Rockwell Automation (1.72), Equifax (1.49), Twenty-First Century Fox (0.49), MGM Resorts (0.34), Monster Beverage (0.40).

U.S. IPO's scheduled to price today: LiveXLive Media (LIVXD), Apellis Pharmaceuticals (APLS).

Equity conferences this week: Credit Suisse Health Care Conference on Tue-Wed, Bernstein Technology Innovation Summit on Tue-Wed, Stephens Fall Investment Conference on Tue-Wed, RBC Capital Markets Technology, Internet, Media and Telecommunications Conference on Tue-Wed, Robert W. Baird Global Industrial Conference on Tue-Wed, Wells Fargo Technology, Media & Telecom Conference on Tue-Wed, Deutsche Bank Gaming, Lodging & Leisure Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Brown & Brown (BRO -0.61%) was downgraded to 'Sell' from 'Neutral' at Citigroup with a price target of $47.

Take-Two Interactive Software (TTWO -0.57%) rallied 8% in after-hours trading after it reported Q2 EPS of $1.09, higher than consensus 74 cents, and then raised guidance on fiscal 2018 adjusted EPS to $2.81-$3.00 from an Aug 2 estimate of $1.95-$2.16, well above consensus of $2.22.

DXC Technology (DXC -0.53%) rose 5% in after-hours trading after it reported Q2 adjusted EPS of $1.93, well ahead of consensus of $1.53.

Coherent (COHR -0.25%) jumped 8% in after-hours trading after it reported Q4 net sales of $490.3 million, better than consensus of $475.4 million.

DaVita (DVA -0.76%) lost 5% in after-hours trading after it reported Q3 adjusted EPS of 81 cents, well below consensus of 94 cents.

Match Group (MTCH -3.06%) climbed 5% in after-hours trading after it reported Q3 total revenue of $343.4 million, higher than consensus of $329.3 million.

ACADIA Pharmaceuticals (ACAD -0.28%) gained nearly 3% in after-hours trading after it reported Q3 revenue of $35.6 million, better than consensus of $32 million.

Carvana (CVNA -7.40%) lost over 5% in after-hours trading after it cut the upper end of its full-year revenue estimate to $850 million-$880 million from a prior view of $850 million-$910 million.

Glaukos (GKOS -10.94%) rose 5% in after-hours trading after it reported an unexpected Q3 profit of 4 cents a share, better than consensus for a -2 cents a share loss.

Extreme Networks (EXTR +0.17%) lost more than 2% in after-hours trading after it said it sees Q2 adjusted EPS of 10 cents to 14 cents, weaker than consensus of 18 cents.

Chubb (CB +0.40%) was upgraded to 'Overweight' from 'Neutral' at JP Morgan Chase with a target price of $175.

Applied Optoelectronics (AAOI +0.24%) gained 3% in after-hours trading after it said it sees "solid" datacenter demand for its 100G CWDM transceivers, and revenue for its CATV products reached a new record.

LendingClub (LC -6.67%) tumbled 17% in after-hours trading after it reported Q3 net revenue of $154 million, below consensus of $156.3 million, and then said it sees Q4 net revenue of $158 million to $163 million, weaker than consensus of $171.7 million.

Fossil Group (FOSL -1.86%) dropped 13% in after-hours trading after the company predicted bleak sales over the holiday season and says it sees Q4 net sales down -3.5% to -11%, well below consensus of down -1%.

Redhill Biopharma Ltd (RDHL -9.64%) plunged 20% in after-hours trading after it announced that it intends to offer $15 million in American Depository Shares, each representing ten of its ordinary shares, in an underwritten public offering.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.11%) this morning are down -3.00 points (-0.12%). Tuesday's closes: S&P 500 -0.02%, Dow Jones +0.04%, Nasdaq +0.11%. The S&P 500 on Tuesday posted a new record high, but fell back and closed little changed. Stocks were undercut by carry-over weakness from a slide in European stocks to a 1-week low and by weakness in energy stocks after crude oil prices fell -0.26%. Stocks were supported by the U.S. Sep JOLTS job openings report of +3,000 to 6.093 million (stronger than expectations of -7,000 to 6.075 million) and by the +$20.83 billion increase in U.S. Sep consumer credit (stronger than expectations of +$17.50 billion and the biggest increase in 10 months).

Dec 10-year T-note prices (ZNZ17 -0.04%) this morning are down -1 tick. Tuesday's closes: TYZ7 +2.00, FVZ7 +0.25. Dec 10-year T-notes on Tuesday rallied to a 2-1/2 week high and closed higher on carry-over support from a rally in 10-year German bunds to a 1-3/4 month high and by weakness in stocks, which boosted the safe-haven demand for T-notes.

The dollar index (DXY00 -0.01%) this morning is down -0..079 (-0.08%). EUR/USD (^EURUSD) is up +0.0007 (+0.06%) and USD/JPY (^USDJPY) is down -0.39 (-0.34%). Tuesday's closes: Dollar Index +0.156 (+0.16%), EUR/USD -0.0023 (-0.20%), USD/JPY +0.30 (+0.26%). The dollar index on Tuesday climbed to a 1-week high and settled higher on the unexpected increase in U.S. Sep JOLTS job openings, a sign of labor market strength that bolsters the case for additional Fed rate hikes. In addition, EUR/USD tumbled to a 3-1/2 month low after German Sep industrial production fell -1.6% m/m, the biggest decline in 9 months.

Dec crude oil (CLZ17 -0.42%) this morning is down -29 cents (-0.51%) and Dec gasoline (RBZ17 -0.74%) is -0.0148 (-0.82%). Tuesday's closes: Dec WTI crude -0.15 (-0.26%), Dec gasoline -0.0147 (-0.80%). Dec crude oil and gasoline on Tuesday closed lower on a stronger dollar and on profit-taking after OPEC in its World Oil Outlook report said it expects North American shale oil production to soar to 7.5 million bpd in 2021 from 5.1 million bpd in 2017. Losses were limited by expectations that Wednesday's EIA crude inventories will fall by -2.75 million bbl.

Metals prices this morning are mixed with Dec gold (GCZ17 +0.37%) +4.9 (+0.38%), Dec silver (SIZ17 +0.59%) +0.110 (+0.65%) and Dec copper (HGZ17 -0.24%) -0.002 (-0.06%) at a 4-week low. Tuesday's closes: Dec gold -5.8 (-0.45%), Dec silver -0.295 (-1.71%), Dec copper -0.0685 (-2.17%). Metals on Tuesday closed lower with Dec copper at a 1-week low. Metals prices were undercut by the rally in the dollar index to a 1-week high, and by the -1.6% m/m decline in German Sep industrial production, the biggest decline in 9 months and a sign of weaker industrial metals demand.

Disclosure: None.