Morning Call For Wednesday, May 31

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.13%) this morning are up +0.11%% and European stocks are up +0.36% on signs of strength in the global economy. China's May manufacturing PMI was unchanged at 51.2, stronger-than-expected, and Eurozone Apr unemployment fell to an 8-year low of 9.3%. Gains were limited on weakness in energy producing stocks at Jul WTI crude oil (CLN17 -2.56%) falls -2.01%. Fund selling is pushing crude prices lower on concern that cuts in OPEC oil production will not be enough to counter rising U.S. shale oil output. Asian stocks settled mixed: Japan -0.14%, Hong Kong -0.16%, China +0.23%, Taiwan -0.61%, Australia +0.12%, Singapore +0.19%, South Korea +0.03%, India -0.04%. China's Shanghai Composite rose to a 3-week high after official data on May manufacturing and service activity came in stronger than expected. The Chinese yuan jumped to a 6-1/2 month high against the dollar on speculation the PBOC is intervening in currency markets to support the yuan.

The dollar index (DXY00 -0.15%) is down -0.12%. EUR/USD (^EURUSD) is up +0.26%. USD/JPY (^USDJPY) is down -0.07%. GBP/USD is down -0.18% at a 1-1/4 month low after polls show UK Prime Minister May's Conservative Party may fall short of a majority in next week's general election, which raises the risk of a hung parliament.

Jun 10-year T-note prices (ZNM17 -0.07%) are down -2.5 ticks.

The China May manufacturing PMI was unch at 51.2, stronger than expectations of -0.2 to 51.0. The May non-manufacturing PMI rose +0.5 to 54.5.

The Eurozone May CPI estimate rose +1.4% y/y, weaker than expectations of +1.5% y/y and the slowest pace of increase in 5 months. The May core CPI rose +0.9% y/y, weaker than expectations of +1.0% y/y.

The Eurozone Apr unemployment rate fell -0.1 to 9.3%, stronger than expectations of -0.1 to 9.4% and an 8-year low.

German May unemployment fell -9,000, less than expectations of -15,000. The May unemployment rate fell -0.1 to 5.7%, right on expectations and the lowest since German reunification in 1991.

U.S. STOCK PREVIEW

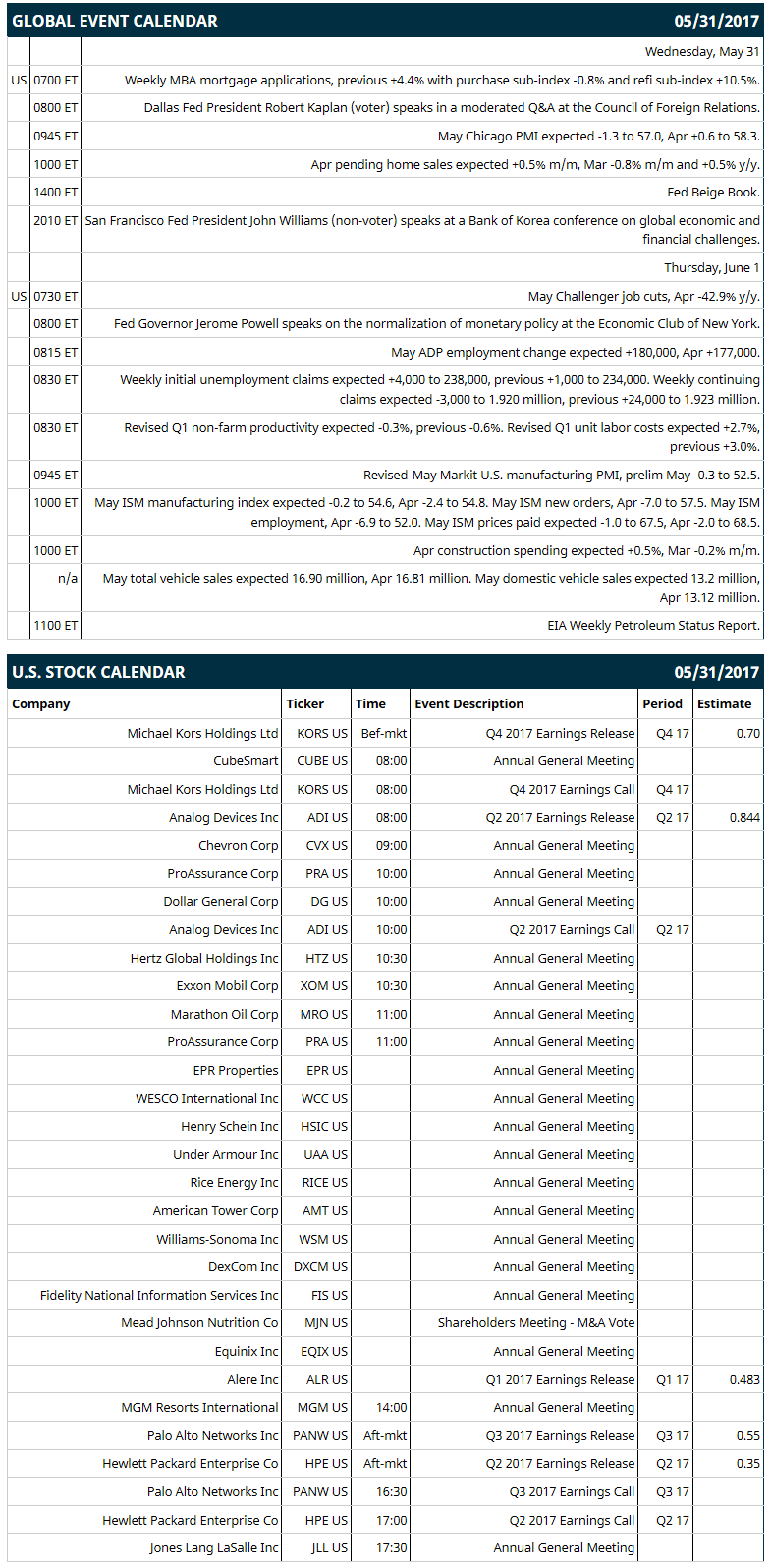

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +4.4% with purchase sub-index -0.8% and refi sub-index +10.5%), (2) Dallas Fed President Robert Kaplan (voter) speaks in a moderated Q&A at the Council of Foreign Relations, (3) May Chicago PMI (expected -1.3 to 57.0, Apr +0.6 to 58.3), (4) Apr pending home sales (expected +0.5% m/m, Mar -0.8% m/m and +0.5% y/y), (5) Fed Beige Book, and (6) San Francisco Fed President John Williams (non-voter) speaks at a Bank of Korea conference on global economic and financial challenges.

Notable Russell 2000 earnings reports today include: HP Enterprises (consensus $0.35), Palo Alto Networks (0.55), Alere (0.48), Michael Kors (0.70), Analog Devices (0.84).

U.S. IPO's scheduled to price today: none.

Equity conferences: Stifel Dental & Veterinary Conference on Wed, Cowen & Co Technology, Media & Telecom Conference on Wed-Thu, RBC Capital Markets Consumer and Retail Conference on Wed-Thu, KeyBanc Capital Markets Industrial, Automotive & Transportation Conference on Wed-Thu, Sanford C. Bernstein & Co. Strategic Decision Conference on Wed-Fri, American Society of Clinical Oncology Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

VMware (VMW -0.07%) ws upgraded to 'Outperform' from 'Neutral' at Baird with a price target of $115.

Irobot (IRBT +2.76%) was downgraded to 'Hold' from 'Buy' at Canaccord Genuity with a price target of $90.

Gogo (GOGO -0.47%) was initiated with a recommendation pf 'Outperform' at Raymond James with a 12-month target price of $15.

Intuitive Surgical (ISRG +0.45%) gained almost 1% in after-hours trading after its da Vinci X Surgical System received FDA clearance in the U.S.

Exact Sciences (EXAS -2.01%) jumped 7% in after-hours trading after UnitedHealth expanded colonography coverage using CT colonography and other preventative care related to colonoscopies.

Mallinckrodt PLC (MNK +0.90%) rose nearly 2% in after-hours trading after Reuters reported that the company is exploring the sale of its generic drug unit.

James River Group Holdings Ltd (JRVR -1.31%) lost over 1% in after-hours trading after it announced a secondary offering of 4.25 million shares by "significant" shareholders.

Apollo Commercial Real Estate Finance (ARI -0.05% slipped 3% in after-hours trading after it announced that it had commenced an underwritten public offering of 12.0 million shares of common stock.

Quanex Building Products (NX -0.26%) rose 5% in after-hours trading after it reported Q2 sales of $209.13 million, better than consensus of $205.5 million.

Extended Stay America (STAY -1.07%) lost almost 1% in after-hours trading after it announced a secondary offering of 25.0 million paired shares with each paired share consisting of a share of common stock of Extended Stay America and a share of Class B common stock of ESH Hospitality.

Hertz Global Holdings (HTZ -0.63%) climbed 3% in after-hours trading after it said it plans a $1 billion sale of secured bonds to refinance debt.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.13%) this morning are up +2.75 points (+0.11%). Tuesday's closes: S&P 500 -0.12%, Dow Jones -0.24%, Nasdaq +0.11%. The S&P 500 on Tuesday closed lower on carry-over weakness from a slide in European stocks on concern about a possible early Italian election and on a Reuters report that the ECB at its June 8 meeting will discuss dropping its reference to downside risks. Stocks were also undercut by the -1.5 point decline in the U.S. May consumer confidence (Conference Board) to 117.9 (weaker than expectations of -0.8 to 119.5) and by weakness in energy stocks after Jul WTI crude oil fell -0.28%.

Sep 10-year T-notes (ZNM17 -0.07%) this morning are down -2.5 ticks. Tuesday's closes: TYU7 +8.50, FVU7 +5.25. Sep 10-year T-notes on Tuesday closed higher on dovish comments from Fed Governor Brainard who said that if low inflation persists, the Fed would have to reassess its policy path. T-notes were also boosted by a lack of inflation pressures after the U.S. Apr core PCE deflator eased to a 16-month low of +1.5% y/y.

The dollar index (DXY00 -0.15%) this morning is down -0.118 (-0.12%). EUR/USD (^EURUSD) is up +0.0029 (+0.26%) and USD/JPY (^USDJPY) is down -0.08 (-0.07%). Tuesday's closes: Dollar index -0.162 (-0.17%), EUR/USD +0.0022 (+0.20%), USD/JPY -0.42 (-0.38%). The dollar index on Tuesday closed lower on strength in EUR/USD which recovered from a 1-week low and moved higher on the Reuters report that the ECB may drop its reference to downside risks at its June 8 meeting. The dollar was also undercut by the decline in T-note yields, which undercuts the dollar's interest rate differentials.

July WTI crude oil prices (CLN17 -2.56%) this morning are down -$1.00 a barrel (-2.01%) and July gasoline (RBN17 -2.06%) is -0.0298 (-1.83%). Tuesday's closes: Jul crude -0.14 (-0.28%), Jul gasoline -0.0018 (-0.11%). Jul crude oil and gasoline on Tuesday closed lower on continued disappointment that OPEC did not extend its production cuts longer than 9 months and on last Friday's Baker Hughes report showing that U.S. active oil rigs in the week ended May 26 rose by +2 rigs to a 2-year high of 722 rigs.

(Click on image to enlarge)

Disclosure: None.